PHOTO

Key Highlights

- Board of Directors recommends 20% (AED 0.20 per share) cash dividend subject to approval of the shareholders of the Bank

- Operating profit of AED 2,496 million higher by 6% for 2017 compared to the prior year

- Operating income up by 4% in 2017 to AED 3,631 million

- Loans and advances as at 31 December 2017 of AED 71.1 billion, slightly lower compared to prior year-end due to loan repayments and the Group’s selective approach to booking new business

- Continuing strong liquidity position with loan to deposit ratio at 90.4% and advances to stable resources of around 80% as at 31 December 2017

- Disciplined management of expenses with a cost to income ratio of 31.3% for 2017

- Asset quality being prudently managed with NPLs to gross loans ratio of 4.3% and loan loss coverage of 97.1% as at 31 December 2017

- Solid capital position with overall and Tier 1 capital adequacy ratios as per Basel III of 19.4% and 18.3% respectively as at 31 December 2017

Financial Review

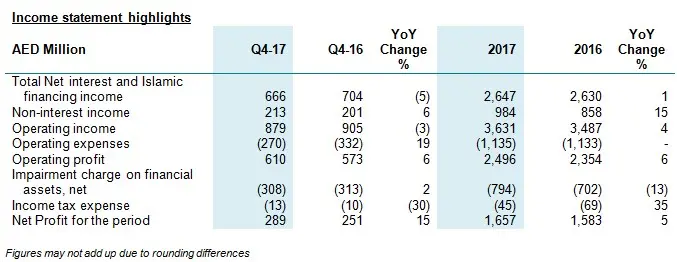

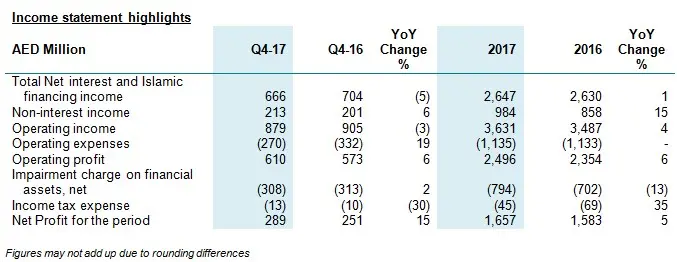

Union National Bank (UNB), one of the leading banks based in the United Arab Emirates, recorded a net profit of AED 1,657 million for the year 2017, up by 5% compared to the prior year. The net profit for the fourth quarter of the year was AED 289 million, higher by 15% as compared to the same quarter of 2016.

Commenting on the results, Mr. Mohammad Nasr Abdeen, Chief Executive Officer, Union National Bank said “The UNB Group has recorded another year of satisfactory financial performance as the global economic outlook continues to improve. The Group’s focus has been to further expand its franchise, selectively pursue growth with emphasis on fee related business and prudent risk management.” He further added that “The Group expanded its presence both domestically and internationally, with the opening of new branches in the UAE and Egypt as also establishing a commercial branch in the People’s Republic of China, the first ever from a UAE based bank.”

The operating profit for the year ended 31 December 2017 was AED 2,496 million, up by 6% compared to the preceding year mainly due to an increase in operating income for the year 2017, an increase of 4% to AED 3,631 million.

The growth in operating income was driven by an increase in non-interest income while net interest income increased modestly by 1%. The increase in net interest income was led by a growth in the average loan book partly offset by a reduction in net interest margin on account of increase in funding cost; the net interest margin for 2017 was 2.57%, lower by 8 basis points compared to the last year. The non-interest income in 2017 increased by 15%, to AED 984 million, over the last year mainly due to an increase in fees and commission income driven by higher business volumes in Retail Banking business and gain on dealing in foreign currencies and derivatives. This increase was partially offset by recognition of a fair value loss on investment properties of AED 27 million in 2017.

Balance sheet

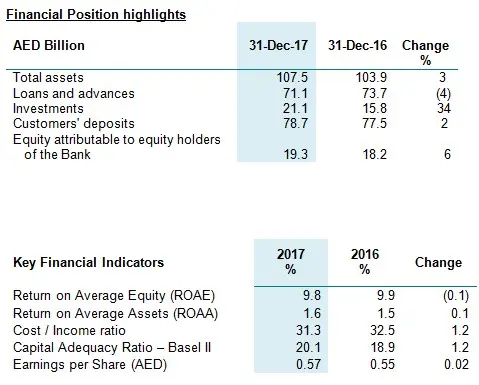

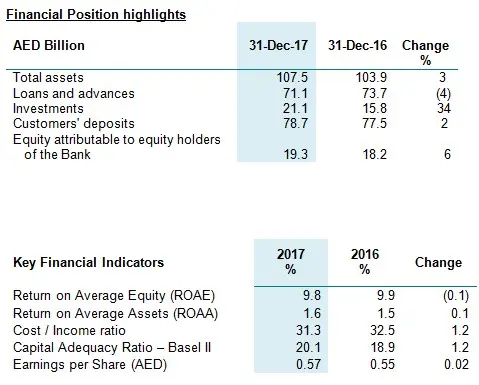

Net loans and advances were AED 71.1 billion as at 31 December 2017, lower by 4% year-on-year due to certain loan repayments in wholesale banking segment and overall softer credit demand. As part of active balance sheet management, the investment portfolio of the Group increased by 34% in 2017 to AED 21.1 billion as at 31 December 2017. The total assets of the Group were AED 107.5 billion as at 31 December 2017, higher by 3% as compared to previous year end.

Customers’ deposits increased by 2% to AED 78.7 billion as at 31 December 2017 compared to the previous year-end. The liquidity position of the Group remained strong with the liquid assets, including investments constituting

29.8% of the total assets as at 31 December 2017. Other key Liquidity measures remained sound with the loan to deposit ratio being 90.4% and the advances to stable resources ratio being circa 80% as at 31 December 2017. Also, the Liquidity Coverage ratio and the Eligible Liquid Assets ratio were significantly above the required thresholds set by the Central Bank of the UAE.

Operating expenses

Consistent with the prior year trends, the Group continued to efficiently manage its cost base with the operating expenses for 2017 at AED 1,135 million being broadly unchanged as compared to the prior year. As a socially responsible corporate entity, the Group made a contribution of AED 30 million in 2017 to Sandooq Al Watan, as UAE marked 2017 as the Year of Giving.

The cost to income ratio of the Group for 2017 was 31.3% (2016: 32.5%) continuing to be amongst the best in UAE banking industry.

Credit quality

The Group has been prudently managing its asset quality, proactively identifying problem loans and taking necessary measures to protect the interests of the Group. The ratio of non-performing loans and advances to gross loans and advances was 4.3% as at 31 December 2017 (31 December 2016: 3.4%) due to an increase in the impaired portfolio in certain segments. The overall loan loss coverage was 97.1% as at 31 December 2017 (31 December 2016: 108.3%).

Additional provisions of AED 308 million were recognized during the fourth quarter, resulting in an overall impairment charge on financial assets during 2017 of AED 794 million (2016: AED 702 million).

Profitability measures and Capital strength

The annualized return on average equity, excluding Tier 1 capital notes, for the year ended 31 December 2017 was 9.8% (2016: 9.9%) and the annualized return on average assets was 1.6% (2016: 1.5%). The earnings per share for the year ended 31 December 2017 was AED 0.57 (2016: AED 0.55).

The increase in the regulatory capital base, along with a reduction in risk weighted assets led to further strengthening in the Group’s already solid capital position. The Basel III capital adequacy ratio for the UNB Group computed in accordance with the Central Bank of the UAE guidelines was 19.4% as at 31 December 2017 with the Tier I capital adequacy ratio being 18.3% as at 31 December 2017. The Group is well prepared for the adoption of IFRS 9: Financial Instruments standard that would be implemented effective 1 January 2018.

Dividend Proposal

The Board of Directors has recommended a dividend distribution of 20% (AED 0.20 per share) of cash dividend subject to necessary approvals.

Ratings

During 2017, Fitch Ratings, Moody’s Investor Service and Capital Intelligence affirmed the ratings of the Bank with stable outlook. The existing ratings of the Bank are:

Moody’s: Bank deposits: A1 / P-1;

Fitch Ratings: A+ Long-term IDR and F1 Short-term IDR;

Capital Intelligence: A+ Foreign Currency Long-term and A1 Foreign Currency Short-term

Awards and Accolades

Some key accolades won during 2017 are:

- Global Finance, the international financial magazine, has ranked UNB among the Top 10 Safest Banks in the Middle East and the 50 Safest Banks in the Emerging markets. UNB came 5th in the Middle East and 17th in the Emerging Markets for the 2017 edition.

- UNB won the prestigious Mohammad Bin Rashid Al Maktoum Business Award for 2016 in the finance category for the fourth consecutive time.

- UNB CEO was honoured with the prestigious ‘GCC Banker of the Year 2017’ while UNB has been honoured with the ‘GCC Retail Bank of the Year 2017’ by World Finance magazine.

- UNB CEO received the distinguished “Al Nisr Al Arabi” (Arab Eagle) Award for UNB’s great achievements in the world of Banking and Finance from the Arab Organization for social responsibility and Tatweej Academy for Excellence and Quality in the Arab World.

- UNB CEO and Al Wifaq Finance Company Managing Director was conferred with the ‘Islamic Banker of the Year’ Award while Al Wifaq Finance Company was honoured with the “Most Innovative Islamic Finance Solutions Award” at the World Finance Islamic Banking Awards announced in the Spring 2017 issue of World finance.

- UNB became the first organization from the Private Sector and the first Bank to have undertaken the Global Star Rating System for Services. The Bank’s Salam branch was rated 4 star, thereby becoming the first organization from the private sector to achieve this recognition.

- UNB was awarded the “Shariah Compliant Fund Manager of the year 2017” by Global Investor Group at the 2017 MENA Capital Markets Summit and Awards 2017.

- UNB has been recognized with the HR Excellence Award at the annual Middle East HR Summit and Expo 2017.

- UNB won the GCC Best Employer Brand Award for the fourth consecutive year. In addition, UNB has also won the HR Leadership Award for the first time.

- Union National Bank won the acclaimed Super brand award 2017. This is the 7th consecutive year that UNB has achieved this distinction.

- UNB won eight Stevie Awards under the various categories including the 'People's Choice Stevie Awards for Favourite Companies'; Company of the year- Financial Services large- Gold; Human Resource Department of the year- Gold; Executive of the year- Silver; Human Resource Executive of the year-Silver; Customer Service team of the year- Silver; Health, Safety and Environment Program of the year- Silver and Product development/management team of the year-Bronze.

- UNB won the “Business Excellence” Award at the BIZZ Americas 2017 held in US Virgin Island.

- UNB won four product awards under the categories, Best Customer Deposit Scheme, Best Call Center, Best New SME Product and Best Current Account Product at the 2017 Banker Middle East Product Awards.

- UNB won the Quality Achievements Award 2017 in the Diamond Category presented by the European Society for Quality Research in recognition of its outstanding commitment, support and efforts to endorse and improve achievements in Quality Management.

- UNB received the Dubai Chamber CSR Label 2016. This is the 2nd consecutive year that UNB has achieved this distinction.

- UNB won the Swiss International Quality Standard Award from the Europe Business Assembly. In addition, the Bank's CEO received the Swiss International Quality Certificate as recognition of UNB's innovative initiatives towards the improvement and advancement of quality developments.

-Ends-

© Press Release 2018