Sharjah, UAE: Bank of Sharjah P.J.S.C today announced the results of the period ended 31 March 2018

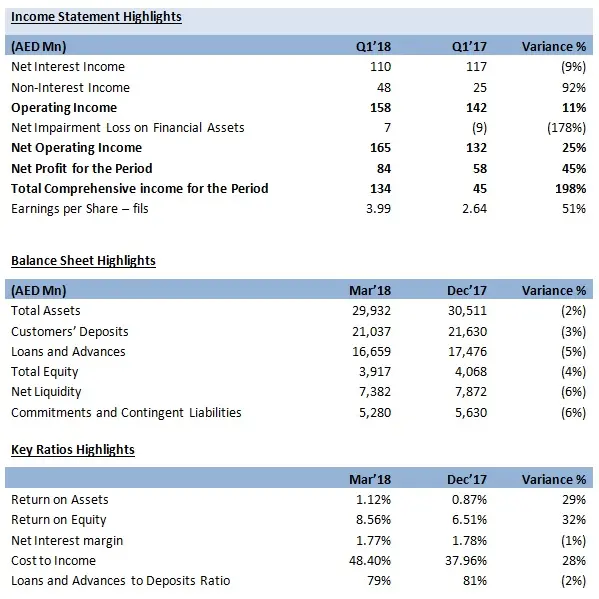

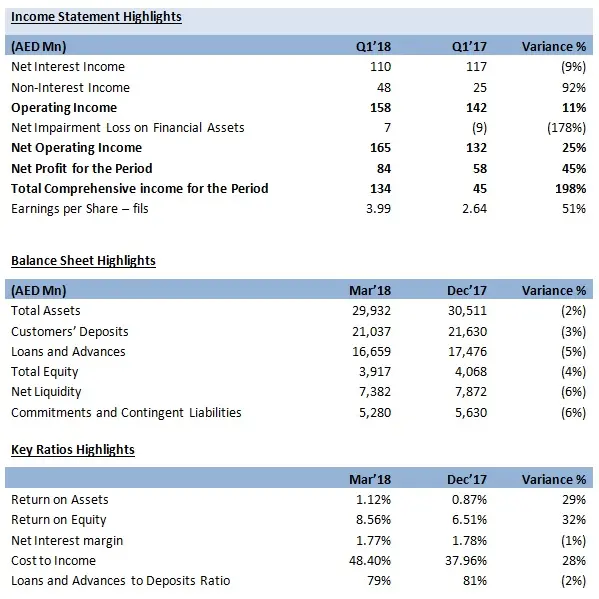

Financial Highlights

- Total Assets at AED 29,932 million, down by 2% compared to 31 December 2017

- Net Loans and Advances at AED 16,659 million, down by 5% compared to 31 December 2017

- Total Customers’ Deposits at AED 21,037 million, down by 3% compared to 31 December 2017

- Total Operating Income of AED 158 million, up by 11% compared to 31 March 2017

- Net Operating Income of AED 165 million, up by 25% compared to 31 March 2017

- Net Profit for the quarter of AED 84 million, up by 45% compared to 31 March 2017

- Total Comprehensive income for the quarter of AED 134 million, up by 198% compared to 31 March 2017

- Return on Assets at 1.12% and Return on Equity at 8.56%

- Basel III Common Equity Tier 1 ratio at 15.57% compared to a minimum required ratio of 8.5%

- Loans and Advances to Deposits Ratio at 79%

Financial year review

During the quarter, the Bank continued to maintain high levels of liquidity and a low loan to deposit ratio.

Results Review

Income

Net Interest Income decreased by 9% compared to the corresponding figure for the same period of 2017, Non-Interest Income increased by 92% due to better market performance and operating income increased by 11%. The net operating income reached AED 165 million for the period ended 31 March 2018 compared to AED 132 million for the same period of 2017, an increase of 25%.

Net profit for the period ended 31 March 2018 reached AED 84 million, against AED 58 million for the same period of 2017, up by 45%. Earnings per share for the period ended 31 March 2018 were up by 51% and reached 3.99 fils compared to 2.64 fils in 2017.

Total Comprehensive income for the period ended 31 March 2018 increased by 198% to total comprehensive income of AED 134 million versus a total comprehensive income of AED 45 million for the same period of 2017. This was due to an upturn in the market value of strategic investments and a positive effect from change in fair value of issued bonds.

Assets Growth

Total Assets reached AED 29,932 million, a decrease of 2% over the corresponding 31 December 2017 figure of AED 30,511 million. Loans and Advances reached AED 16,659 million, 5% below the corresponding figure of AED 17,476 million as at 31 December 2017.

Customer Deposits

Customers’ Deposits reached AED 21,037 million, a 3% decrease over the corresponding 31 December 2017 balance of AED 21,630 million.

Capital and Liquidity

Total Equity as at 31 March 2018 stood at AED 3,917 million, a decrease of 4% compared to AED 4,068 million for the corresponding year of 2017. This was mainly due to the adoption of IFRS 9 “Expected credit losses” impact on retained earnings.

Net Liquidity reached AED 7,382 million as at 31 March 2018, a decrease of 6% compared to 2017 year figure of AED 7,872 million.

-Ends-

For further information, please contact:

Erica Alkhfaji / Tarek Zahnan

ASDA’A Burson-Marsteller

Tel: 971-4-450-7600

Email: erica.alkhfaji@bm.com / tarek.zahnan@bm.com

© Press Release 2018