PHOTO

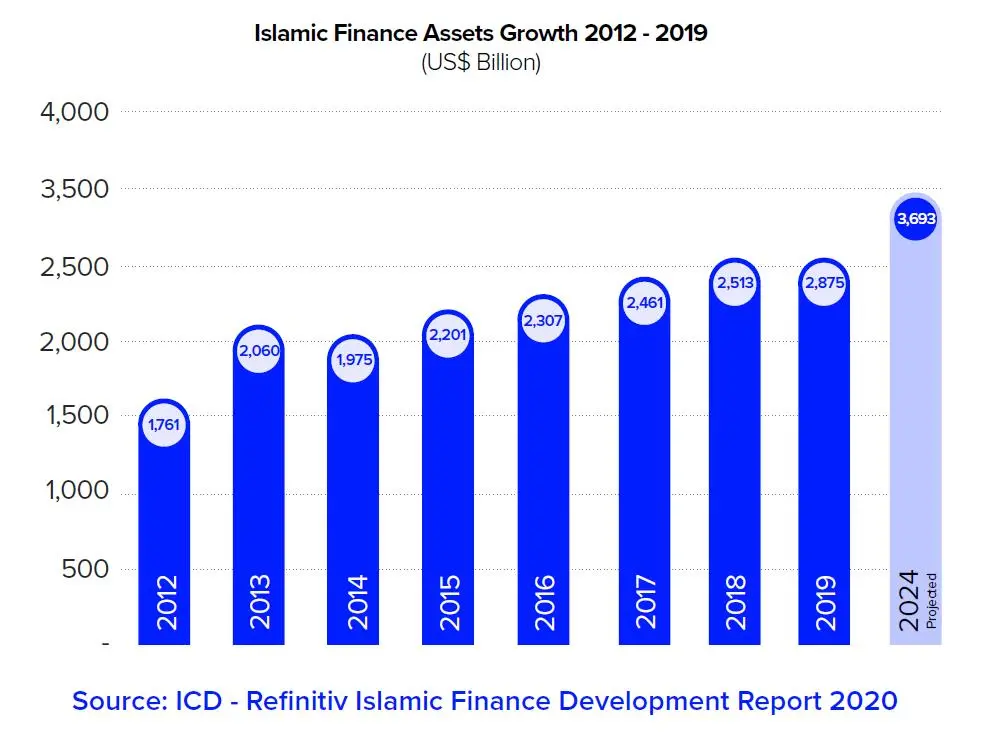

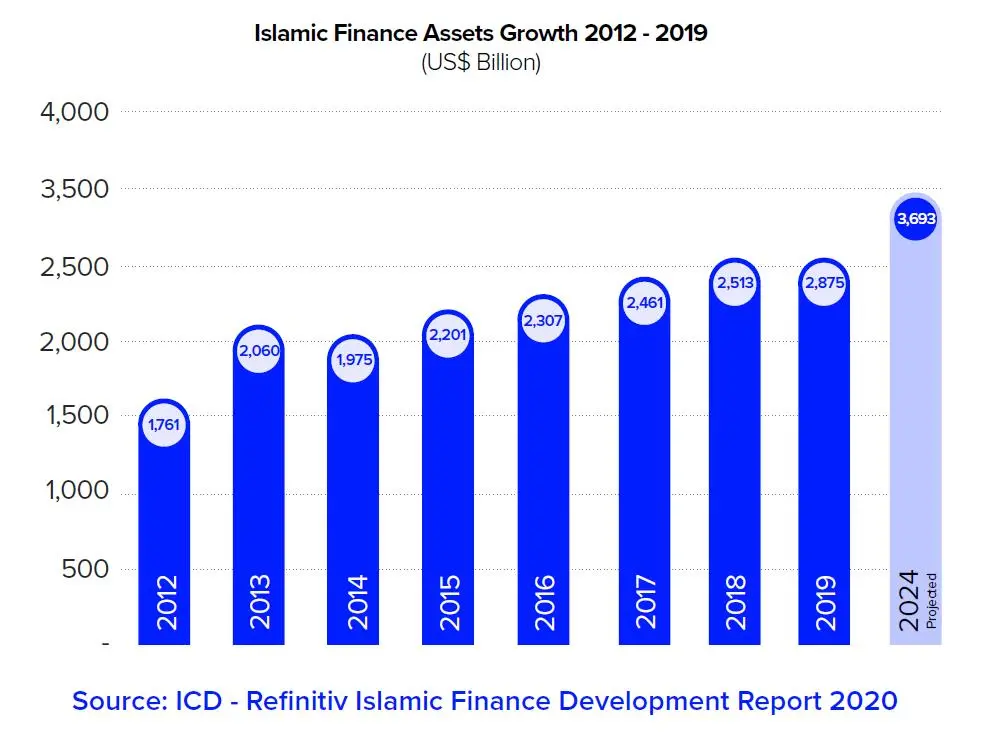

The Islamic finance industry saw double-digit growth of 14 percent in 2019 at $2.88 trillion in assets, and it is expected to reach $3.69 trillion by 2024, according to a report by Refinitiv and the Islamic Corporation for the Development of Private Sector (ICD).

The industry returned to strong growth after the slowdown in 2018, when the industry expanded by a more moderate 2 percent. This growth is despite the uncertainty felt across the largest Islamic finance markets over the past few years due to sustained low oil prices and subdued industry growth in previous years.

Islamic finance assets remain concentrated in Iran, Saudi Arabia and Malaysia and they accounted for 66 percent of global assets in 2019.

The 14 percent growth in global Islamic finance industry assets was partly due to elevated levels of sukuk issuance in the traditional markets in the GCC and Southeast Asia.

Green and SRI (socially responsible investment) sukuk grew in prominence in the UAE and South East Asia and have continued to grow in 2020 with the entrance of new issuers.

Another key growth driver was Islamic funds, which rose 30 percent in 2019, mainly in the GCC states, due to new launches of Islamic exchange traded funds (ETFs) and ESG-related investment assets, which was made available through digital media and appealed to millennials, the report said.

Islamic banking assets also surged by $248 billion to almost $2 trillion in 2019, particularly in the largest Islamic markets such as Saudi Arabia and Iran, the report said.

Yet, the fastest expansion was seen in the non-core markets such as Morocco, where ‘participatory banking’ was introduced in 2017. Other markets likely to see further expansion in Islamic banking include Turkey and the Philippines.

Global takaful assets grew 10 percent to $51 billion in 2019. Takaful operators in other GCC markets saw even higher growth in 2019, rising by 14% over the year. Growth was seen across several business lines and there was an improvement in profitability of investments.

The ‘other Islamic financial institutions’, or OIFI sector, saw a 6 percent increase in total assets in 2019, to $153 billion. This sector consists of financial institutions other than Islamic banks and takaful operators, such as financing, mortgage, leasing and factoring companies.

The fastest growing OIFI market in 2019 was the Maldives, with its total assets rising 62 percent to $44 million.

Outlook uncertain as COVID-19 lingers

Despite the strong expansion seen in 2019, a Refinitiv forecast said that the industry growth will fall to single digits, reaching $3.69 trillion by 2024, as the world attempts to deal with the Coronavirus pandemic that erupted on a global scale in the first quarter of 2020.

While the total impact of the pandemic on the industry cannot be measured quantitively before the end of 2020, several Islamic financial institutions including Islamic banks had reported losses or a fall in profits due to COVID-19-related increase in loan impairments.

In addition, consolidation among both Islamic banks and the conventional banking sector is showing no signs of easing, with a new wave set in motion by the economic impact of COVID-19.

This trend is likely to continue in the core Islamic finance markets, mainly in the GCC countries, Malaysia and Indonesia, as banks face shrinking lending demand, lower profit margins, and higher numbers of non-performing loans, the report said.

The pandemic has led to a growth in some areas of the industry. Some regulators have turned to Islamic finance to mitigate the economic impact. For instance, Algeria, uses it to attract local savers.

Sukuk is also being used to aid financial recovery for sovereigns and corporates. Quasi-sovereigns such as Islamic multilateral organizations have also stepped in to support countries reeling from the pandemic.

For instance, the Islamic Development Bank (IsDB) allocated $2.3 billion to member countries through its Strategic Preparedness and Response Programme in April 2020. As of September 2020, it had deployed an emergency support to 23 different member organizations in North and sub-Saharan Africa and in Central Asia totalling $687.1 million.

According to the report, sustainability has also become a more important consideration during the pandemic.

The pandemic has also been a game changer in that several Islamic financial institutions have moved to offer their products via digital platforms to better serve their locked-down customers, thereby speeding the advance of technology within Islamic finance.

(Reporting by Shereen Mohamed; editing by Seban Scaria)

(Shereen.mohamed@refinitiv.com)

For more insights, read the ICD-Refinitiv Islamic Finance Development Report 2020

Video: Key highlights of the Refinitiv Islamic Finance Development Report 2020

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2020