PHOTO

The GCC insurance players avoided negative rating action due to strong capital buffers during the first wave of COVID-19. However, there could be some negative ratings in 2021, due to capital depletion triggered by a possible second wave of the pandemic, S&P Global Ratings said.

“The insurance sector has entered this crisis with a very robust level of capitalization,” Ali Karakuyu, Director & Lead Analyst, Insurance Ratings, at S&P said at a webinar hosted by the ratings agency.

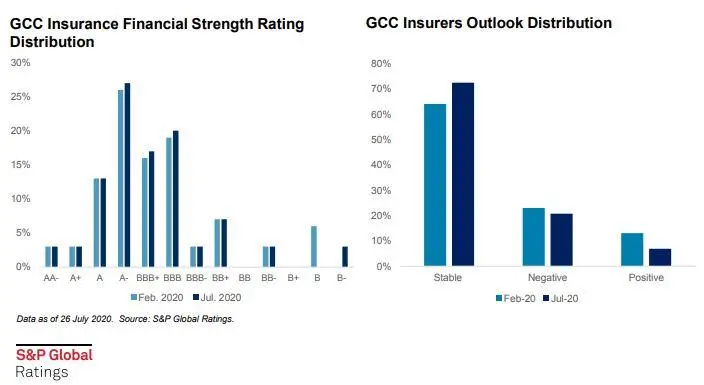

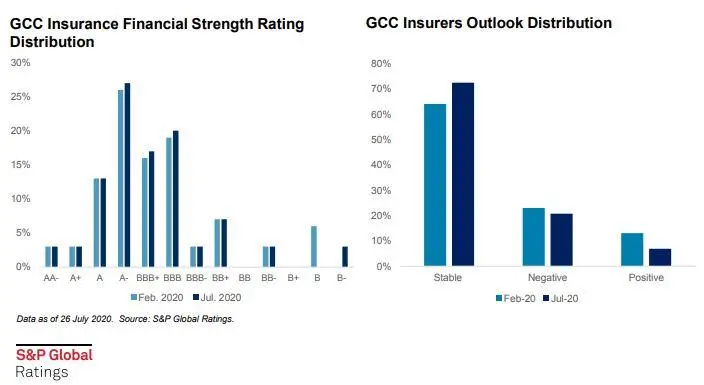

Average ratings on insurance companies in the GCC region are relatively strong according to S&P.

“Ratings on GCC insurers have been more resilient particularly when compared with other sectors in the region,” Emir Mujkic, Director & Lead Analyst, Insurance Ratings at S&P said.

Mujkic noted that 20 percent of the outlooks are still negative, suggesting that there could be some rating movements over the next year or two.

“The capital adequacy of many GCC insurance companies has weakened over the past couple of months,” he said.

According to S&P, a second wave of the COVID-19 pandemic could eat into GCC insurers’ capital and lead to some negative rating actions in 2020-2021, as well as some further consolidation in the sector.

Earnings risks

Relatively high exposure to equites and other high-risk assets put earnings and capital buffers of GCC insurers at risk, S&P noted.

The ratings agency anticipates that many insurers will report solid underwriting results in the first half of 2020, due to a sharp reduction in motor and medical claims offsetting some weaker investment returns.

However, asset volatility, an increase in claims to more normal levels and constrained economic conditions will likely have a negative effect on growth and earnings prospects in the second half of 2020, S&P said.

(Reporting by Gerard Aoun; editing by Seban Scaria)

#GCC #INSURANCE #FINANCIALSERVICES

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2020