PHOTO

Tensions in the Strait of Hormuz have heightened in the wake of Iran’s seizure of an oil tanker, and the number of British-flagged tankers crossing the region is expected to drop significantly as a result. However, Refinitiv ship tracking data suggests that the oil trade has remained unaffected.

Tensions in the Gulf escalated to new levels in July when the British-flagged Stena Impero, owned by Sweden’s Stena Bulk, was seized by Iran’s Revolutionary Guard. Ship-tracking data from Refinitiv shows that the British vessel had not deviated from its passage through the Strait of Hormuz, where a strict traffic separation scheme is in operation under the rules of International Maritime Organization.

Refinitiv’s data also shows that the first half of 2019 has recorded a total of 5,250 tankers (oil and LNG) compared to the total of 11,277 tankers sailing in the region over the whole of 2018. The drop in the number of ships in the region is partly due to a fall in exports from Iran and to the maintenance season in Asia during the first half of the year.

“We have assessed a total of 90 tankers that have exited the Gulf so far this year, and this is expected to drop at least till the time a resolution is found for the stand-off between the UK and Iran for their respective tankers,” Ranjith Raja, senior oil analyst, Refinitiv MENA, told Zawya.

“This kind of interception is not common in international waterways, especially in the Hormuz Strait, which channels more than a third of the global seaborne crude exports,” he continued. “Several major ship-owners have already decided to limit their assets’ exposure in the region, but almost all ships transiting the strait are currently maintaining their security level at MARSEC 3, which means an imminent threat is perceived, according to the International Ship and Port facilities Security (ISPS) code.”

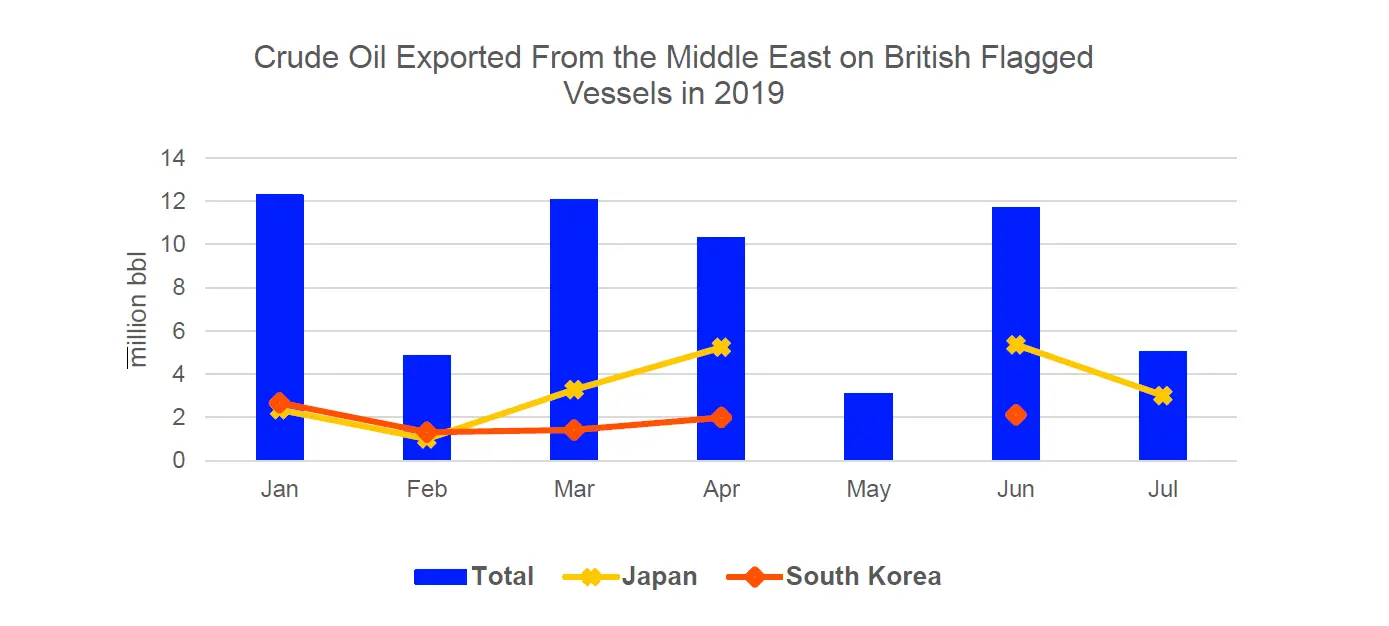

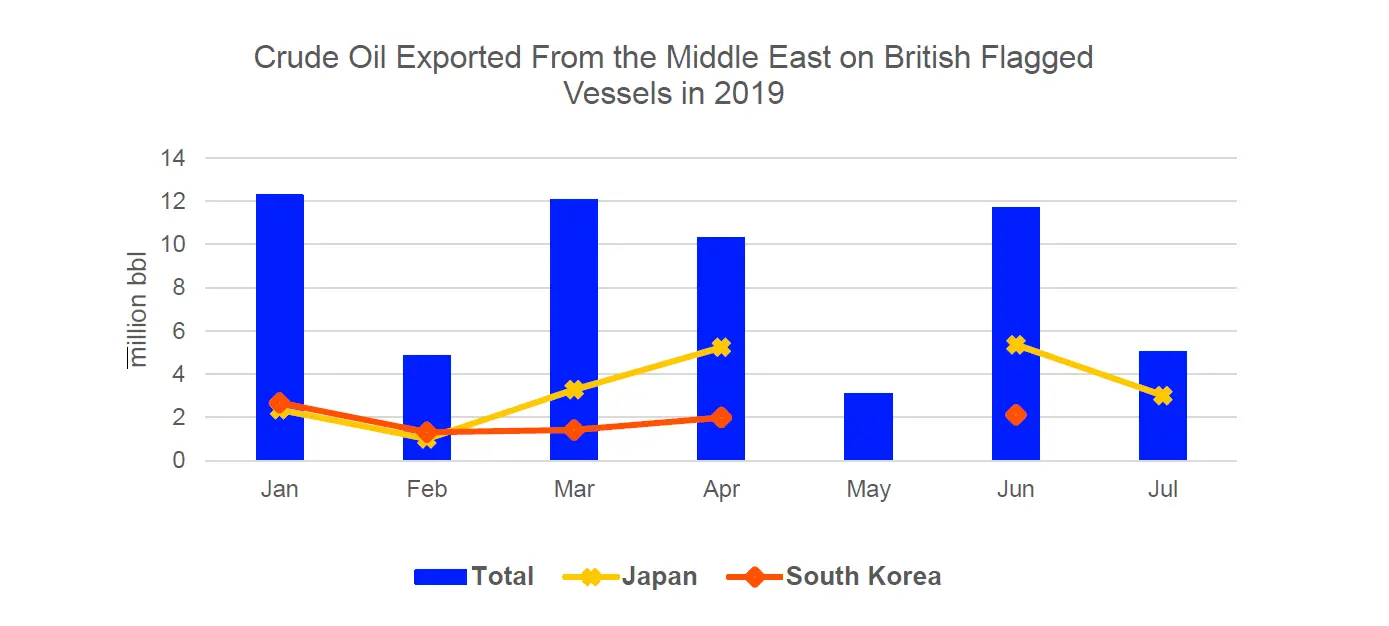

Source: Refinitiv

Refinitiv has also noted instances of ship owners or charters incurring additional premiums, quoted in the range of $100,000 for a seven-day passage in the region. “This has clearly had an impact on the freights and willingness of the operators to position their ship waiting for cargoes,” Raja noted. “However, with the shipping market in quite a downturn, not all operators have the luxury to turn down employment of their ships, and [they] will be willing to pick up the available cargoes.”

OIL TRADE UNAFFECTED

With regard to the oil trade, Refinitiv has not seen any decline in overall volumes being shipped from the region. “Iran’s drop in exports is more to do with the impact of US sanctions, while the rest of the country’s exports remain largely unchanged,” Raja said.

However, there has been a significant impact on the bunker market. “The bunker market in the region has seen a downturn both in terms of the volumes and the number of ships bunkering in Fujairah, which is the second largest bunkering hub in the world. Bunker fuels are being priced at a significant discount compared to Singapore, which were as high as $45 per metric tonnes following the incident.”

Source: Refinitiv

DISRUPTION IN STRAIT OF HORMUZ UNLIKELY

A Refinitiv special report on the Strait of Hormuz concluded that long-term disruption of the Strait of Hormuz is very unlikely, and the impact on the maritime sector is more about the perceived threat of such an incident being repeated than the authorities actually following through with multiple seizures or attacks.

With the naval forces in the region becoming more cautious and vigilant, “the strait is under intense scrutiny for any movements of both commercial and naval traffic,” Raja said. “Once the maritime industry regains its trust in the security that’s being made available, most of the operators are expected to send their ships back to the region for employment.”

(Written by Seban Scaria seban.scaria@refinitiv.com, edited by Daniel Luiz)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019