PHOTO

It was to reassure Muslim consumers, as well as to drive sales, that global candy manufacturers Haribo, Nestlé and Ferrero Rocher acquired halal certification.

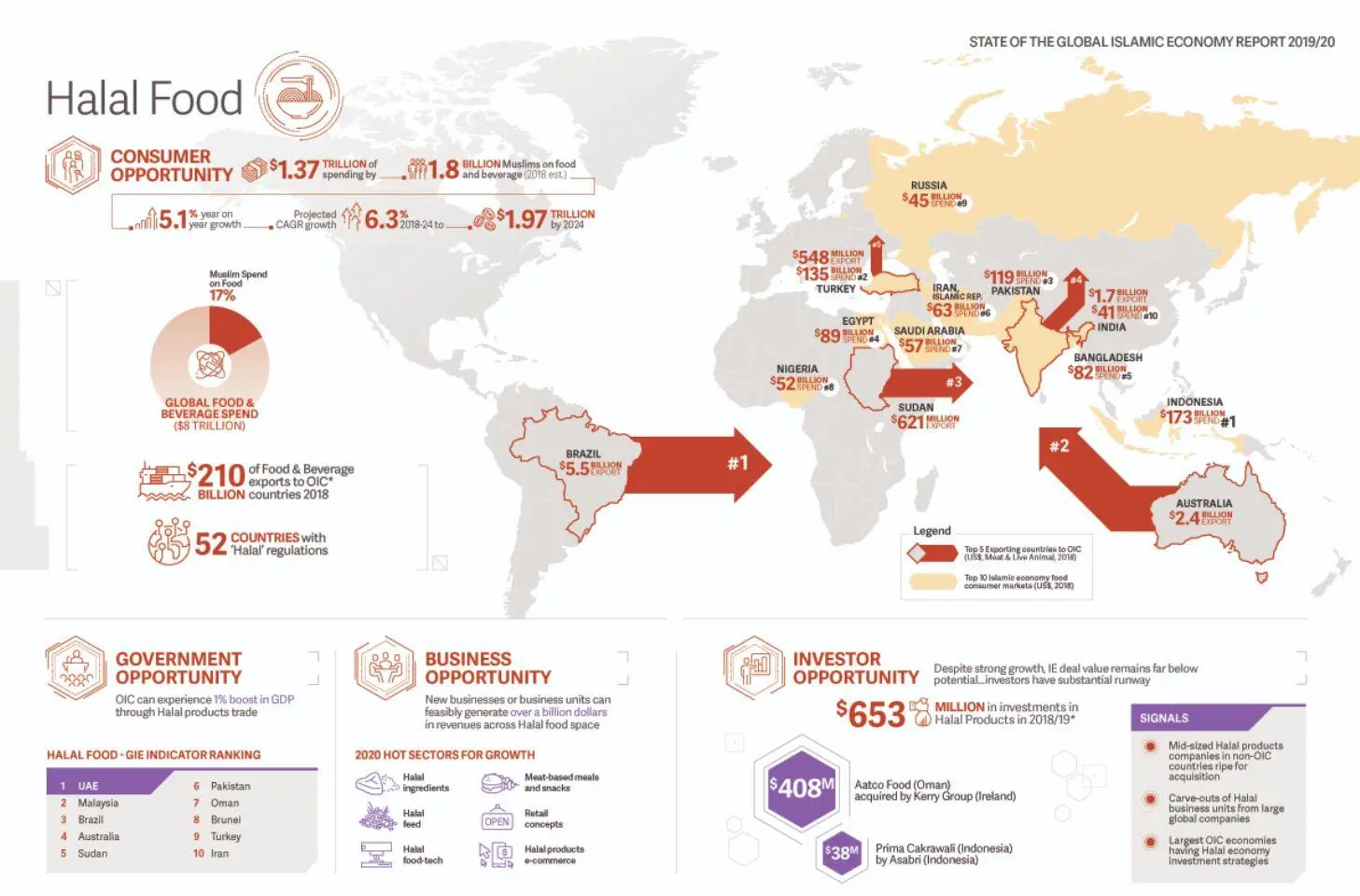

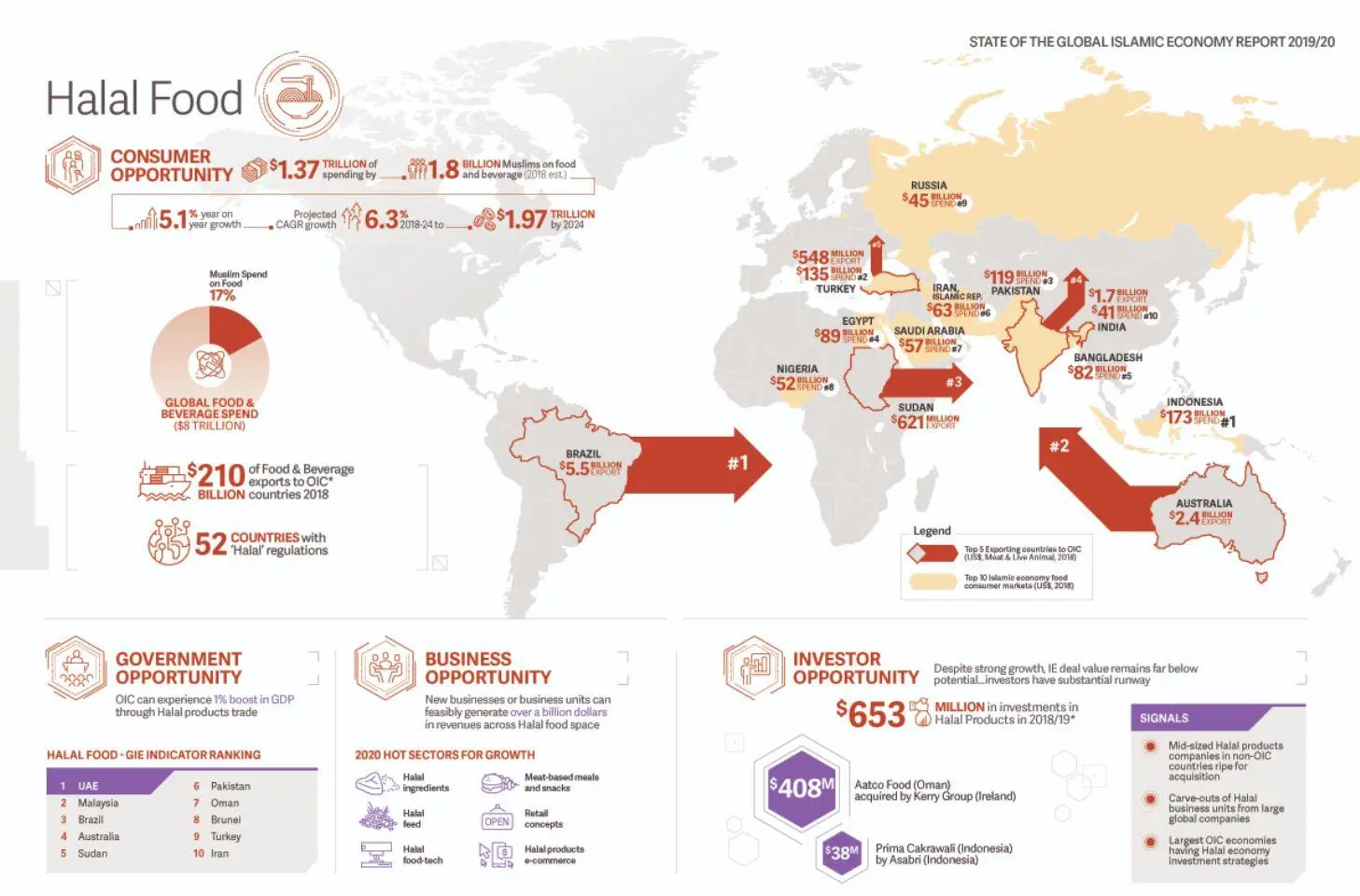

Such attention to labels and the origins of food products are increasing among Muslim and non-Muslim consumers alike. So much so that, the global Muslim spend on food is estimated at $1.37 trillion in 2018, growing at 5.1 percent from 2017.

The spend is forecast to grow by 6.3 percent per year to reach $2 trillion by 2024, according to the State of the Global Islamic Economy Report published by Dinar Standard.

Indonesia, Turkey and Pakistan are the top three countries that spend the most on the halal sector.

As far as investments on a macro level are concerned, the UAE and China have inked a $1 billion agreement for a food manufacturing and processing plant in Dubai, while Indonesia aims to launch an $18 million Halal Lifestyle District.

Halal food industry. Source: State of the Global Islamic Economy Report 2019/20

Investment roadmap

While investment activity remains constrained, modest activity signals a much larger pipeline to come, the report said, and cited a few examples: Japanese restaurant operator Zensho Holdings acquired Malaysia’s halal chain The Chicken Rice Shop (TCRS) for $53 million. Malaysian conglomerate Brahim’s is seeking to sell a majority stake in its airline catering arm and Salam Planet, with nearly 200,000 registered users across Denmark, Pakistan and the UK, acquired Halal Dining Club, a UK-based halal restaurant booking app.

“The halal food industry remains ripe for investment by both financial investors and corporates exploring avenues of growth, with entrepreneurs seeking to gain substantially,” the report said, while suggesting that (Organisation of Islamic Cooperation) OIC national governments can link halal food to their national growth and food security objectives.

Investments in halal food companies, according to the report, are gathering momentum and the creation of dedicated funds, such as TaqwaTech, as well as Muslim community funds discussed at the AMCC 2019 conference, will spark more investment interest in halal food, with select Sovereign Wealth Funds (SWFs) entertaining a halal proposition.

It highlighted the creation of new billion-dollar, publicly listed halal food companies as a potential outcome by 2030.

“While there have been increasing investments, there has also been a lack of clear verifiable investment success stories, which has limited the involvement of the larger venture and private equity investment firms in the industry to date,” the report said.

The report also made a case for halal food as ‘an important step for OIC countries to diversify their economies, boost food production and create jobs.

“Following the lead of Malaysia, UAE and Indonesia, it is imperative to develop comprehensive national strategies on how to address the global halal food trade opportunity, with an important development role for SWFs,” it said.

When it comes to businesses, the report argued, global food industry champions can generate substantial growth by creating dedicated halal propositions.

“Food conglomerates can emulate the successes of BRF by developing robust halal propositions, exploring setting up operations in OIC countries, and providing Muslim consumers with their global brands, particularly in large consumer markets such as Indonesia and Saudi Arabia,” it said.

However, the report also pointed out that there is a lack of dedicated support for halal entrepreneurs. Dedicated support from well-established incubators for halal entrepreneurs remains very limited, although exciting potential developments have been discussed and floated particularly in the US.

Signals of opportunity

Though the industry still lags in operations, regulation and ecosystem development, growth in consumer demand continues to present substantial opportunities for investors, governments and businesses. The Global Islamic Economy Report has identified few signals of opportunity.

Developing strong halal propositions: Several OIC governments, including the largest ones, Indonesia and Saudi Arabia, are seeking to develop robust halal propositions. A broader OIC-wide opportunity exists, however, to strengthen intra-OIC trade and for individual countries to invest in boosting food production and enhancing food security.

Ripe for consolidation: While consumer spend has shown impressive 5.1 percent growth, the industry remains fragmented and ripe for mergers and acquisitions. There is a substantial opportunity for an investor or well-capitalised business to acquire small and midsized independent halal food companies, notably in non-OIC markets, to develop a multi-billion-dollar revenue company.

Ethical linkages to SDGs: The halal sector is at the early stages of fulfilling a broader social role, with substantial halal food businesses primed to better address a global trend towards ethical consumption and establishing a favorable impact on society and on the environment.

Modest regulatory developments: Halal regulation remains disparate, with OIC importing countries differing on regulations. Developing regulations across OIC countries continues to affect the industry supply chain dynamic. Alignment and rationalising can unlock industry growth and establish halal standards and regulations as benchmarks for global ethical food production.

Adopting blockchain within operations: Blockchain can transform supply chains, but there remains little evidence of robust industry profitability. There are substantial opportunities for multinationals and investor-backed entities to scale operations globally and develop highly profitability halal propositions.

(Writing by Seban Scaria seban.scaria@refinitiv.com, editing by Anoop Menon)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019