- Solid improvement in gross profit and net profit

- Strategic partnership with Tyson Foods to unlock significant synergies across the board

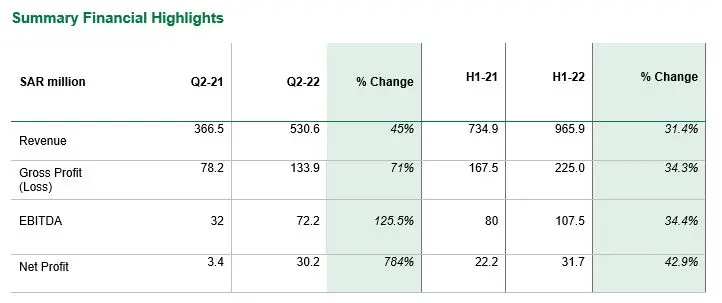

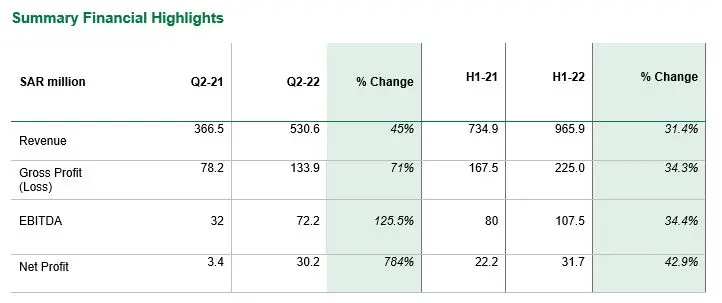

Riyadh -Tanmiah Food Company (“Tanmiah” or the “Company”, 2281 on the Saudi Exchange), a market leading provider of fresh and processed poultry and other meat products, animal feed and health products, and a foods brand franchise operator, today announced its results for the first half ended 30 June 2022, with a 31% year-on-year (YoY) growth in revenues to SAR 965.9 million. Gross margin improved to 23.3% from 22.8% in H1-2021, while EBITDA of SAR 107.5 million (+30% YoY), yielded a margin of 11.1%. Net income increased 43% YoY from SAR 22.2 million to SAR 31.7 million, on the back of the robust topline performance and gradual price increases in the fresh chicken category.

Zulfiqar Hamadani CEO of Tanmiah, commented:

“We have continued to successfully execute our capacity expansion program, resulting in solid topline performance as Tanmiah’s products continued to grow in popularity during the first half of the year as we drive innovation across all our product lines. The recent completion of refurbishment projects at our Majmah facility to reach a capacity of 420,500 birds per day (net of rental capacity) will further boost revenues and profitability in the upcoming quarters and is a major milestone in our goal to reach a production capacity of 1.2 million birds per day by 2025.

Despite the volatility in global commodity prices, our strong market positioning, and the increasing preference by customers for our diversified product offerings has enabled us to mitigate this impact by carefully managing pricing, thus resulting in margin improvement during the period.

As we embark on a new phase in Tanmiah’s journey through the landmark partnership with Tyson Foods, we expect to unlock substantial long-term value for our shareholders by enhancing all stages of the value chain, along with diversifying our product offerings, and expanding our global footprint. Collectively, we will continue to significantly invest in our business to raise production capacity further and meet the expected rising demand that could be captured through the potential launch of a new Global Halal brand with Tyson, which may be marketed worldwide.”

Ahmed Osilan, Executive Board Member & Managing Director of Tanmiah said:

“We are proud to have achieved major milestones since the start of the year, including the strategic partnership with Tyson Foods. Our sustained investments in ramping up production capacity and strengthening our long-standing relationships with our key business partners, have rewarded us with a robust performance during the period, whereby we have successfully attained a remarkable growth in profitability.

We are delighted to be taking our company to a whole new level, by advancing our technical expertise and tapping new opportunities for realizing wide-ranging synergies across the group, whilst accelerating our pace of growth.

Further supporting our strategic growth plans is the SAR 150 million financing facility recently secured by our subsidiary, ADC, from the Agriculture Development Fund. This forms part of a comprehensive bundle of loans that are aligned to the Government’s ongoing initiatives to boost food production. We remain committed to our pioneering role in reinforcing Saudi Arabia’s food security and self-sufficiency goals, through enriching the domestic ecosystem by bringing world-class sector expertise to the Kingdom and creating a number of job opportunities in the local market, which will emerge as a result of our significant partnership with Tyson Foods.”

Revenue Analysis

Tanmiah reported first half revenues of SAR 965.9 million, up 31% YoY from SAR 734.9 million. Top-line growth was driven by strong performance across all segments, in particular fresh poultry and further processed products, reflecting a combination of both price and volume effect.

Fresh Poultry sales, comprising 69% of total revenues, increased 31% YoY to SAR 666.2 million from SAR 510.7 million in the similar period of last year. Fresh poultry revenue growth was driven by a continued expansion of capacity, leading to sustained volume growth, in line with the rising popularity of Tanmiah’s products, as well as a gradual increase in prices across the fresh chicken category. The Group had ended 2021 with daily capacity of 370,000 birds and increased it to 420,500 birds per day (net of rental capacity), marking a 13.6% growth, following the upgrade of Tanmiah’s facility in Majmah, north of Riyadh.

Further Processed Products revenues grew by 31% YoY to SAR 199.0 million during H1-2022. This increase in sales comes on the back of growth in demand from the food service channel, and a gradual revision of prices for key food service customers during contract renewals.

Feed and animal health revenues grew by 26% to SAR 91 million in the H1-2022, predominantly due to the increasing demand for animal health products and equipment.

Food franchise operator revenues amounted to SAR 9.8 million in H1-2022, with Q2 reflecting the second full quarter since the launch of the food franchise vertical. During the period, Tanmiah opened a total of 6 POPEYES® stores in KSA, bringing the total to 10 operational outlets as of 30 June 2022.

Income Statement Analysis

Cost of Sales rose 37.6% YoY to SAR 396.6 million in Q2-2022, up from SAR 288.3 million. The main drivers for this include a continued expansion of Tanmiah’s production capacity, in addition to higher feed costs. Despite this, gross margin improved to 25.2% from 21.3% in Q2-2021, as the improvement in the top line has outpaced the rise in Cost of Sales during the period. For H1-2022, cost of sales increased 31% YoY to SAR 740.9 million, up from SAR 567.4 million during the similar period last year. This was essentially due to the global rise in the cost of the Company’s primary raw materials, in addition to an increase in volumes and the sustained expansion program that Tanmiah is undertaking to raise production capacity. Nevertheless, gross margin improved to 23.3% from 22.8% in H1-2021, primarily due to product price increases.

EBITDA amounted to SAR 72.2 million, compared to SAR 32 million in Q2-2021. For H1-2022, EBITDA came in at SAR 107.5 million, compared to SAR 80 million in the same period last year, despite the 35.1% YoY rise in selling, general and admin expenses.

Net Income surged to SAR 30.2 million in Q2-2022, from SAR 3.4 million in Q2-2021. Meanwhile net income increased 42.9% YoY to SAR 31.7 million from SAR 22.2 million in H1-2021, which is primarily the result of sustained performance across all segments, which is driving the topline growth.

Balance Sheet Analysis

Tanmiah ended the period with SAR 125 million in total cash and cash equivalents. Total borrowings increased to SAR 321 million during the quarter from SAR 302 million at the end of March 2022.

Capex increased from SAR 30 million in H1-2021 to SAR 41 million in H1-2022, which included hatchery expansion, and expansion of feed storage capacity, in line with Tanmiah’s expansion plans. The planned capital expenditure in the next five years will focus on increasing feed milling, primary processing, and further processing capacities.

Growth Strategy

Tanmiah’s strategy to further reinforce its market positioning hinges on both organic and inorganic growth. In order to capture lucrative opportunities from rising demand for poultry, coupled with the Kingdom’s strategic goal of attaining 80% self-sufficiency in the poultry sector by 2025, Tanmiah continues to invest substantially on capacity expansion and continues to make good progress in this regard. The Company has increased its local sales of fresh chicken by 9% YoY from 49.2 million chickens in H1-2021 to 53.5 million chickens in H1-2022, as a result of sustained investments in its assets and operations. Tanmiah has recently completed the refurbishment of its facility in Majmah, which has resulted in increasing its total production capacity to 420,500 birds per day (net of rental capacity), from 370,000 birds per day at the end of 2021.

Tanmiah has continued to capitalize other strategic initiatives by the government to reinforce the domestic food sector, whereby the Company has obtained a short-term financing facility of SAR 150 million from Agricultural Development Fund (ADF) to finance the import of grains. Moreover, Tanmiah has recently secured a EUR 48.2 million long term Shariah compliant facility from Rabobank to further support its expansion program.

Another key event for Tanmiah is the strategic partnership with Tyson Foods, whereby the latter will acquire 15% of Agriculture Development Company (ADC) and 60% of Supreme Foods (SFPC) for a total consideration of USD 70 million. Tanmiah considers this partnership an important milestone in its 60-year journey, demonstrating its commitment to its pioneering role in reinforcing the Saudi Arabia's food security and self-sufficiency goals. The partnership will also enable Tanmiah to gain exposure to global industry know-how and could lead to emerging opportunities in the fast-growing Halal market. By capitalizing on this significant collaboration, Tanmiah will be well-positioned to enhance its product, customer, and geographical diversification, and deliver substantial value through advancing its operational processes, which will enable the Company to realize material operational efficiencies and improve its revenues and profitability going forward.

Market Overview

Global supply chain disruptions have continued to exert inflationary pressures on margins during the period. However, global grain prices have started to ease from their peaks during the latter half of the quarter although they still remained elevated relative to their 5-year historical average. As a result, international poultry prices have been steadily increasing since the second half of 2020 but domestically produced fresh poultry remain competitively priced in comparison to frozen imported poultry.

The global Halal food market is expected to achieve unprecedented growth over the long term, with industry reports pointing to a Compound Annual Growth Rate of nearly 10% by 2032. Such trends are conducive to Tanmiah’s growth, particularly in light of the strategic partnership with Tyson Foods.

On the domestic front, a variety of government supported projects, both direct and indirect, as part of Saudi Vision 2030 are expected to have a positive impact on Tanmiah’s share of the market due to increased investment in capacity, production and distribution across Saudi Arabia and the MENA region. The Company’s wide range of products, coupled with its solid sector experience and fully integrated and highly efficient business model will strongly position it to capture market growth and deliver sustainable long-term value to shareholders.

ESG Commitments

Tanmiah applies a strategic and integrated approach to sustainability through the Company’s Giving, Earning and Sustaining model. Tanmiah’s sustainability framework aims to formulate a net positive approach towards its activities with initiatives in areas including community and environment, workplace, innovation, and animal welfare. Tanmiah’s environmental credentials are strong by industry standards and the Company is committed to continuously working on improving them.

In March, Tanmiah announced the winner of the $1 million omnipreneurship award which aims to incentivize scientists and innovators to find ways to convert food production waste to valuable products. The winner of the grand prize was Polymeron from King Abdullah University of Science and Technology.

In Q1-22 Tanmiah achieved the NSF International Global Animal Wellness Standard Certification, which provides assurance that a strong, consistent animal wellness system is in place along the entire protein supply chain. Tanmiah was also recognized by the Saudi Ministry of Environment, Water and Agriculture with the GAP Certificate for good agricultural practices.

About Tanmiah Food Company

Tanmiah Food Company, established in 1962, is one of the Middle East’s leading providers of fresh poultry, processed poultry, and other processed meat products, as well as animal feed and health products. It is a publicly listed company on the Saudi stock market. It is worth noting that Al-Dabbagh Holding Group is a partner and founding shareholder of Tanmiah Food Company. Tanmiah’s fully integrated and highly efficient business model includes production, further processing, and distribution with products sold in Saudi Arabia, the UAE, Bahrain, Oman, Jordan, and Kuwait. As of 30 June 2022, Tanmiah operates 102 farms as well as six hatcheries, two feed mills, four slaughterhouses, three food processing plants, and 13 dry and cold storage facilities located in Saudi Arabia, Bahrain, and the UAE. Tanmiah distributes its products through a network of wholesalers, retailers, and food service outlets, as well as online direct to consumers. Sustainability is a core principle at Tanmiah, with initiatives including planting a million trees by the end of 2025, using wastewater from its facilities, and turning waste products into fertilizer. For more information, visit www.tanmiah.com

Forward-Looking Statements

This communication contains certain forward-looking statements. A forward-looking statement is any statement that does not relate to historical facts and events, and can be identified by the use of such words and phrases as “according to estimates”, “anticipates”, “assumes”, “believes”, “could”, “estimates”, “expects”, “intends”, “is of the opinion”, “may”, “plans”, “potential”, “predicts”, “projects”, “should”, “to the knowledge of”, “will”, “would” or, in each case their negatives or other similar expressions, which are intended to identify a statement as forward-looking. This applies, in particular, to statements containing information on future financial results, plans, or expectations regarding our business and management, our future growth or profitability and general economic and regulatory conditions and other matters affecting us.

Forward-looking statements reflect our management’s (“Management”) current views of future events, are based on Management’s assumptions, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. The occurrence or non-occurrence of an assumption could cause our actual financial condition and results of operations to differ materially from, or fail to meet expectations expressed or implied by, such forward-looking statements. Our business is subject to a number of risks and uncertainties that could also cause a forward-looking statement, estimate or prediction to become inaccurate. These risks include fluctuations prices, costs, ability to retain the services of certain key employees, ability to compete successfully, changes in political, social, legal, or economic conditions in Saudi Arabia, worldwide economic trends, the impact of war and terrorist activity, inflation, interest rate and exchange rate fluctuations and Management’s ability to timely and accurately identify future risks to our business and manage the risks mentioned above.

Investor Relations & Media Enquiries

Mr. Hussam Al Shareef, Investor Relations Manager

Tanmiah food Company

Email ir@tanmiah.com

P.O. Box 86909

Riyadh 11632, Kingdom of Saudi Arabia

www.tanmiah.com