PHOTO

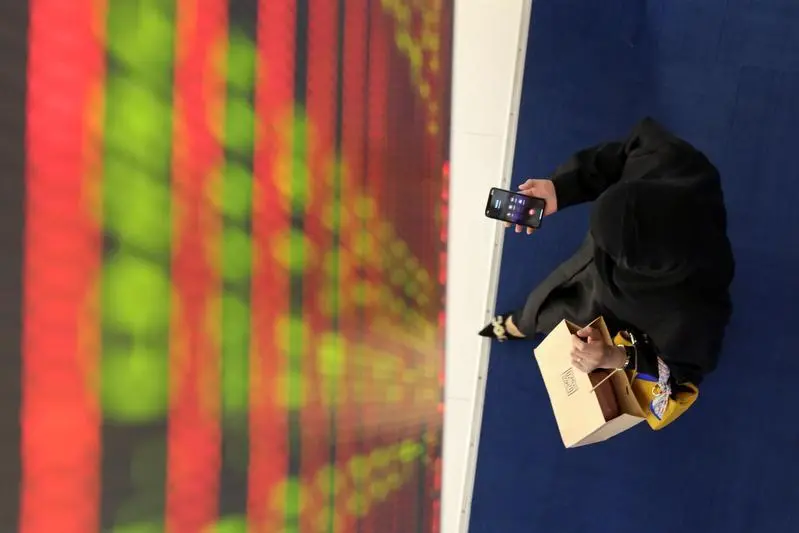

Dubai's stock market, in a choppy trade, ended higher on Friday ahead of the U.S. Federeal Reserve meeting next week, while the Abu Dhabi index extended losses for a fourth session on price corrections.

Fed policymakers meet next week and are likely to announce a 50 basis point hike in the U.S. central bank's lending rate, while indicating a slower pace of future rate hikes.

Most Gulf Cooperation Council countries, including Saudi Arabia, the United Arab Emirates and Qatar, have their currencies pegged to the U.S. dollar and follow the Fed's policy moves closely, exposing the region to a direct impact from monetary tightening in the world's largest economy.

The main share index in Dubai added in a volatile trade added 0.3%, ending three sessions of losses, helped by a 1.7% fall in utility firm Dubai Electricity and Water Authority.

The Dubai bourse remained volatile while traders remained cautious ahead of the Fed's meeting, Robert Woolfe, COO at Emporium Capital, said. "In the meantime, the main index could stay around current levels."

Separately, the United Arab Emirates issued a decree-law imposing a corporate tax at a 9% rate for taxable business income exceeding AED 375,000 ($102,000). The tax will apply to all firms from June. 1 next year, it added.

In Abu Dhabi, the index eased 0.2%, with the counrty's biggest lender First Abu Dhabi Bank losing 0.8%.

The index - which touched its record peak in mid-November - posted a second weekly loss of 6%. Oil prices - a key catalyst for the Gulf's financial markets - were stable but both benchmarks were headed for a weekly loss on worries over weak economic outlooks in China, Europe and the United States weighing on oil demand.

Brent crude futures contract was set for weekly loss of around 10%, its worst weekly drop in percentage terms since August.

- ABU DHABI fell 0.2% to 10,252

- DUBAI rose 0.3% to 3,325

(Reporting by Ateeq Shariff in Bengaluru)