PHOTO

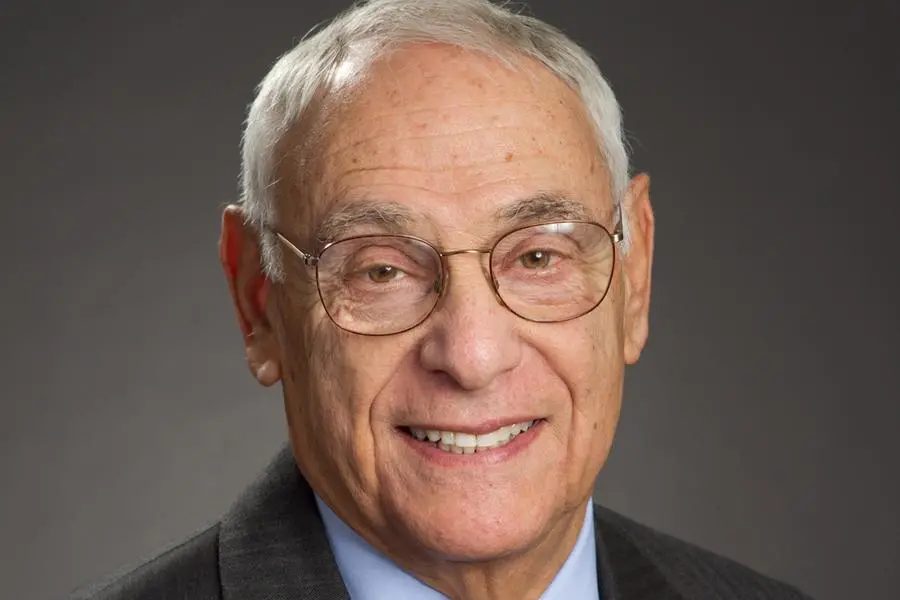

With nearly a decade of private equity support in Egypt under its belt, the Egyptian American Enterprise Fund’s chairman James Harmon remains confident that it can still attract more foreign capital despite the global economic downturn.

“This is a particularly difficult year in the world and in Egypt as well, but I think the success that we have had in Egypt over the last 10 years, both financial and development, is very important for the future.”

The Egyptian-American Enterprise Fund (EAEF) was created by the US Congress in 2011 following the mass revolt that forced Mohamed Hosni Mubarak to step down from office. The fund was aimed at helping to rebuild the country’s private sector in the midst of highly turbulent times marked by a decline in foreign direct investments and tourism revenues.

“When I first got here, there was revolution and so much violence in the streets. Nobody wanted to invest in Egypt,” Harmon recounted. “If we could attract capital with that background, what I can do now should be easy compared to what we faced 10 years ago.”

The fund has so far invested the $300 million originally earmarked by Congress in nearly 100 companies. The EAEF takes pride in also having attracted another $657 million in FDIs to its own portfolio from other investors.

Attractive Returns

“Our goal is to continue to bring significant capital into Egypt and to help the Egyptian private sector to grow,” he said. “Some of that will come from US investors who perhaps have not invested in Egypt but have seen our successful returns, so they are now interested in joining us.”

Harmon explained that EAEF investments have secured average annual returns of nearly 20 percent. “It is a significant return, but we are also very focused on the development success, which is job creation, gender balance and the improvement of the quality of life of Egyptians,” he added.

Since its inception, the EAEF has helped seed five first-time equity funds including Lorax, Tanmiya Capital Ventures (TCV), Algebra Ventures, Ezdehar Management and Flat6Labs. The fund’s portfolio includes two of Egypt’s most successful enterprises, namely Fawry, the e-payment giant, and Sarwa (now known as Contact Financial), the country’s largest non-banking financial services provider.

Harmon went on to say that the recent investments pledged by GCC countries would entice more investors around the globe to come to Egypt. “These are very important indications of the success that Egypt has and the talent that exists in Egypt. It is a very significant confirmation of the opportunities in Egypt,” he said.

In April this year, Saudi Arabia, Qatar and the UAE pledged a total of $22 billion to help Egypt amid the economic crisis spawned by the Russian invasion of Ukraine. The Saudi government deposited $5 billion in the Central Bank of Egypt to replenish foreign reserves; the remaining $17 billion is expected as FDIs. The Emirati holding company ADQ has already channelled $1.8 billion into Egypt through five different acquisition deals signed in April.

The Fund’s Near-Future Plans

Looking ahead, the EAEF plans to commit another $100 million to Egyptian equity funds this year. Harmon added that he would recommend committing up to $50 million of that amount to the under-creation TCV2 fund, which describes itself as a top-tier fund aimed at professionalizing family businesses. “We firmly believe that TCV will be one of the MENA region’s top private equity funds in the coming years,” he said.

The EAEF is also exploring the possibility of seeding first-time funds with smaller ticket sizes. “There is not a lot of support to small funds because most people want to invest in successful stories and larger companies in Egypt,” he said. “There is some risk factor in supporting new funds that have a smaller amount [of capital]. We may not succeed, but we are prepared to take that risk.”

The EAEF has so far invested in a range of sectors including fintech, healthcare, education and agriculture. “We are quite open to new sectors,” he said. “In a perfect world, we are determined to try to do something more in the agriculture area, and to find something that would help with the production, distribution and delivery of food.”

Harmon is also hoping to find more climate-related businesses that his fund could back. The fund has recently hired local consultancies to measure the carbon emissions of its investment portfolio in advance of the UN climate summit, which will be held in the Red Sea resort of Sharm El-Sheikh in November. Through this move, said Harmon, the fund hopes to set new eco-friendly standards for Egyptian companies and help Egypt meet its climate priorities.

“Investors will become impressed with Egypt when they see [Egyptians] are measuring emissions,” said Harmon, who also serves as co-chairman of the World Resources Institute. “People are going to say carbon footprint reporting in Egypt is timely and sophisticated.”

(Reporting by Noha El Hennawy; editing by Seban Scaria seban.scaria@lseg.com )