PHOTO

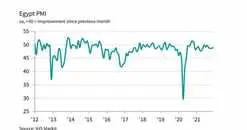

Price pressures eased across non-oil businesses and business activities were more stable in Egypt in December 2021, according to a latest business survey.

The seasonally adjusted IHS Markit Purchasing Managers' Index (PMI) rose to its highest level in four months in December. At 49.0, up from 48.7 in November, the index moved closer to the 50.0 neutral threshold and was above its long-run series average of 48.2 (since April 2011).

"The latest Egypt PMI gave increased confidence that inflationary pressures peaked earlier in the fourth quarter and are now beginning to soften. Input prices rose at the slowest rate since September, while the month-on-month drop in inflation was the quickest recorded for more than three years," David Owen, Economist at IHS Markit, said.

While input cost inflation was weakest in over three years due to reduced purchasing prices and weak increases in wages, new orders were stymied due to weak demand and rising prices, the IHS Markit survey noted.

"That said, higher selling prices continued to hinder new business volumes, which declined for the fourth month in a row. Output also fell, although the sub-index ticked closer to the 50.0 stabilisation mark and was above its long-run trend," Owen said.

Output and new orders in the non-oil sector continued to contract in December, although the rates of decline were the softest recorded in three months, the survey said.

An improvement in tourism activity supported new business, as well as a sharp rise in export orders that was the strongest since February.

Despite improving price signals, business confidence among non-oil companies was subdued in December. Roughly 23 percent of companies gave a positive outlook, as hopes of a recovery from the pandemic conflicted with concerns about the Omicron variant and the impact of high prices.

"Sentiment data showed that businesses remained relatively downbeat about their prospects in December, with confidence rising only slightly from November's 12-month low. Hopefully, a sustained drop in inflationary pressures could bolster optimism for future activity," he said.

Lower sales reflected in reduced hiring across Egyptian firms. However, according to the survey, the rate of job reduction was softer than in the previous month and largely driven by decisions to not replace voluntary leavers.

(Reporting by Seban Scaria; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2022