PHOTO

Rising geopolitical tensions and inflation could impact demand in the hospitality market in the UAE and other parts of the Middle East, resulting in a slower than expected recovery, according to a new report by Colliers.

Most markets in the region have so far shown a year-on-year improvement during the first half of the year, as demand picked up after COVID-19 restrictions eased.

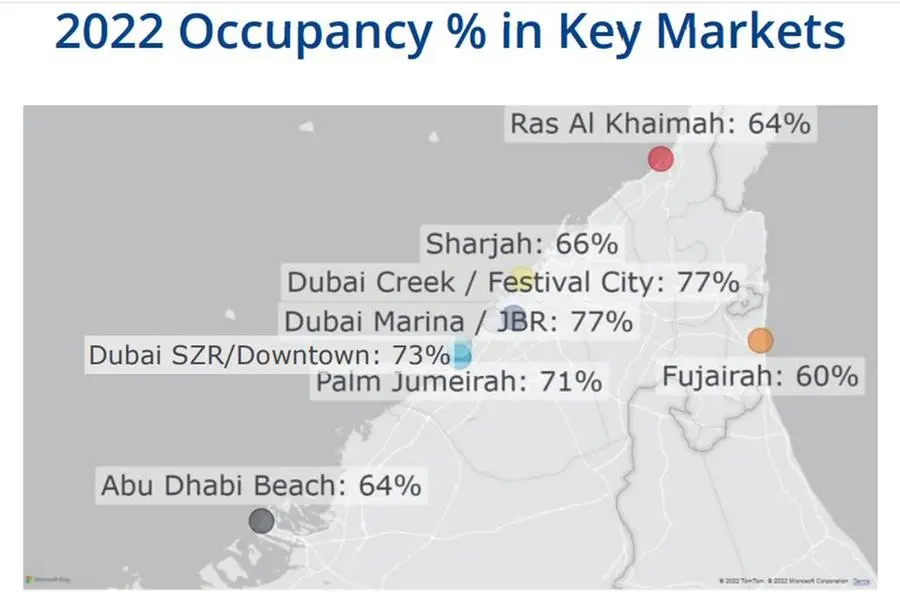

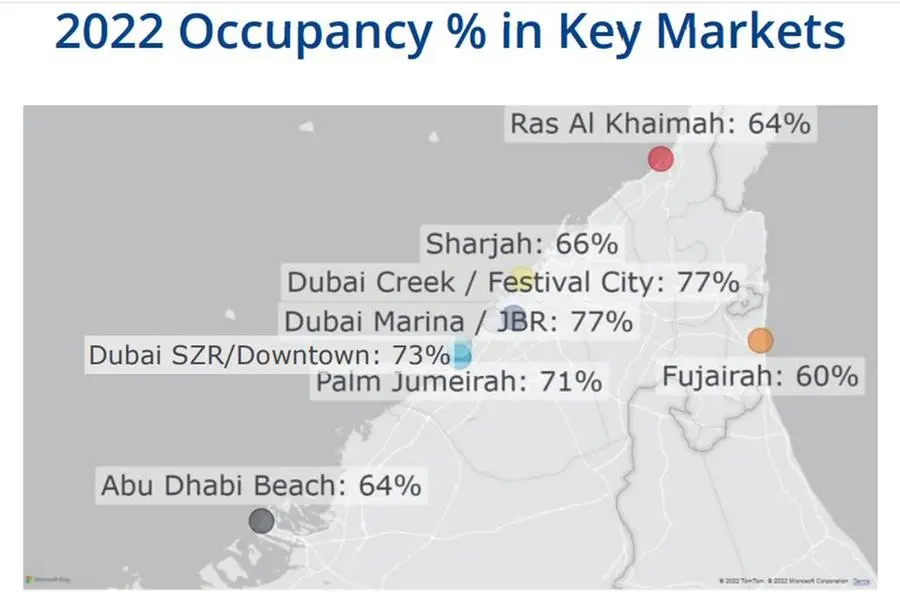

Occupancy rates at hotels across the UAE are still expected to range between 64 percent and 77 percent this year, higher than in other markets in the region.

Occupancy levels in key markets across the country will also be mostly up compared to last year, except for Sharjah and Fujairah, where occupancy is forecast to fall by 1% and 3%, respectively.

"However, increased geopolitical tension, a rising price of oil and a significant increase in inflation have affected key inbound source markets for the region resulting in a slower than expected recovery," Colliers noted.

"When factored with an increase in outbound travel from the region, this has reduced the rate of recovery in domestically oriented markets."

Impact in UAE

In the UAE, which relies heavily on demand from international markets, geopolitical tensions could suppress demand from Eastern Europe and Asia, particularly in the Commonwealth of Independent States (CIS) region, which includes Russia, Armenia, Azerbaijan, Belarus, Moldova and Tajikistan, among others.

"Rising instability in key CIS source markets is expected to suppress demand, with the largest impacts expected in Dubai and Ras Al Khaimah," Colliers said.

"Given the diversity of source markets for the UAE, additional hotel demand may be induced from alternative markets at a lower price positioning."

Other Middle East markets

Hotels in Riyadh and Jeddah have seen growing demand as pilgrims have returned. However, Colliers said, an increase in outbound travel may reduce the positive impact.

Occupancy rates in Saudi Arabia are forecast to range between 52% and 63% this year.

In Doha, Qatar, occupancy levels dropped in the first half of the year compared to the previous year, although the FIFA World Cup this year is expected to lead to "super-normal levels" of demand for its duration in the final quarter of the year. Average occupancy in the Gulf state is expected to reach 70 percent this year.

Kuwait City, Muscat and Manama will be among the lowest-performing markets in the Gulf region, with occupancy levels expected to average 34%, 52% and 47%, respectively.

(Reporting by Cleofe Maceda; editing by Seban Scaria)