It's a good thing Saudi Arabia is raking in all these oil revenues over the past few years and has accumulated USD575-billion in reserves. That's because it's going to invest around USD450-billion over the next five years to diversify the economy and create jobs for young Saudis who are rapidly entering the market, according to Standard Chartered Bank in a new report published Wednesday.

The Saudi population stands at 27.1 million, with 18.7 million Saudi nationals. "The population is expected to increase to more than 33 million by 2020, with the number of Saudis rising to nearly 28 million," wrote SCB analyst Shady Shaher in a report on Saudi Arabia.

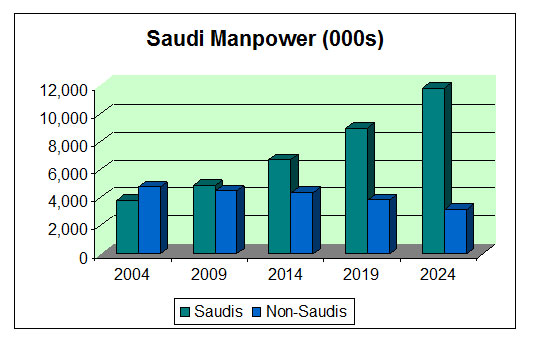

According to the official Saudi Long Term Strategy document, the country's total manpower is expected to grow at an average annual rate of 2.8%, from 8.55 million workers in 2004 to about 15 million workers in 2024, with the national workforce increasing from 3.5 to 11.8 million workers, at an average annual rate of 6.2%, with the foreign workforce decreasing at an average annual rate 2%.

The bank also seems to think that the much-maligned Nitaqat - another word for Saudization - programme is an improvement over previous nationalization plans.

"First, the law differentiates between different categories of business," notes the Mr. Shaher. "This is positive and should make targets more achievable if they are based on the available skillsets of Saudi nationals. Second, it helps make the labour market somewhat more dynamic, by allowing expat workers to seek employment in better-rated firms without the consent of their current employers."

Saudi Arabia does require a structural change to reduce its unemployment rate. Official unemployment rate stands at 10.5%, with female joblessness at 26.5% and high school graduate unemployment at 40%.

The government is looking to create five million jobs by 2025. SCB argues that the presence of a large number of expatriate residents suggests that more than enough jobs are already available for the Saudi population - it's a matter of preparing them for the job.

"The demographic challenge is one of developing skills, incentives and creating types of jobs Saudi Arabian nationals want."

WEANING SAUDIS OFF PUBLIC SECTOR

On the one hand, the Saudi government is using the carrot-and-stick policy to implement the Nitaqat programme, but on the other it is also offering no real incentives for Saudi nationals to move away from the public sector, which employs 92% of the workforce.

"We forecast that public sector wages will increase by 10.0% in 2012 (excluding 2011's two-month salary bonus)," said EFG-Hermes in a report. Last year the government made a temporary 15% increase permanent and also gave a two-month bonus to all public sector staff.

This further widened the gap between the private and public sectors, with private-sector companies finding it difficult to match the incentives of government jobs, with some professions paying four times as much as their counterparts in the private sector.

"In our view localisation programmes in the GCC and Saudi Arabia will continue to be reassessed, but they are unlikely to change significantly in the near future," said SCB's Mr Shaher. "It is encouraging that the authorities, especially in Saudi Arabia, are moving ahead with significant measures that can affect the supply side of the labour market. Investment in education is rampant, but one has to appreciate that such measures normally take years to yield results."

Saudi Arabia has responded to the Kingdom's education problems with a decision to invest a mammoth SAR81.5-billion (USD21.7-billion) in the sector.

But while the-brick-and-mortar schools, universities and institutes of learning can spring up, the real test will be finding a curriculum that melds Saudi Arabia's unique culture with modern educational programme that move away from rote memorization and arms students with skillsets required by businesses.

THEY BUILT THESE CITIES

Standard Chartered Bank believes the Kingdom should build on its highly successful hydrocarbon industry to create jobs. Jubail and Yanbu are energy powerhouses that have created more than 107,000 jobs, and attracted 300 multinational companies which ploughed in USD144-billion over the past five years.

"The petrochemicals sector is just now beginning to realise its potential in job creation, especially as the country pushes the sector further downstream," notes SCB, which believes a more integrated petrochemicals industry will create more employment even at the expense of lesser exports.

The four economic cities being built could also add USD150-billion to the economy by 2020 and create three million jobs.

NCB Capital notes that Saudi Arabia awarded constructions worth SR270bn of in 2011, more than double the value in 2010 and surpassing the previous high of SR207bn in 2009, this should support growth in the coming years as these projects are executed.

"We expect ongoing infrastructure spending by the government to continue to drive the domestic economy in 2012," said the bank. It should also spur job-creation, hopefully from within the ranks of the indigenous population.

Also Read: Saudi Arabia's USD 21Bn Education Push

Jobless Growth

© alifarabia.com 2012