Qatar has ruled the liquefied natural gas (LNG) world for the past few years, but it will see the market flooded with new rivals eager to sign up Asian investors over the next five years, just when its own gas production lines goes flat.

Australia's quest to become the largest LNG supplier eclipsing Qatar has been well-documented, but it is hardly the only country gunning for the Asian markets.

A combination of rising shale gas production in North America and expensive oil across the world has brought a number of major players interested in exploiting the LNG market.

That could threaten Qatar's position and reduce prices over the long-term due to abundance of supply.

For now though, Qatar reigns supreme, producing 77.4 million tonnes each year - making it the largest LNG producer in the world.

'Visionary' is a word often bandied about for large-scale projects by Gulf government, but the Qatari authorities were really onto something with the development of their gas riches.

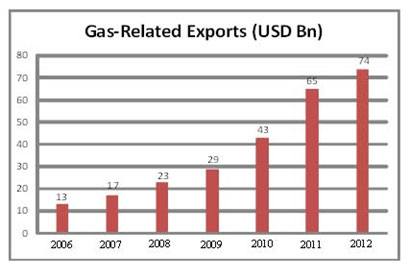

And the investment has yielded tremendous economic prosperity. Since 2007-11, the country's total gas production has grown 24% to reach 11.3 million cubic feet per day, transforming the country into one of the fastest growing economies in the world, if not the fastest.

Qatar National Bank expects gas production growth to slow to 4.3% in 2012-13. The moderation will be mainly due to the production outlook in Qatar. In 2012, the state will experience its first full year at LNG production capacity and will also increase gas production to feed a new GTL plant, leading to production growth of 6.9%. However, in 2013 production will be relatively flat.

The Barzan project in Qatar is scheduled to come on stream in 2015, adding 1.4bn cu ft/d of gas production for domestic use.

"Beyond 2015, Qatar will again begin to drive further growth in GCC gas production," says the bank. "A moratorium is currently in place on new production projects on the North Field until a study on sustainability has been completed."

That will be the opening other LNG producers need to get a piece of the expanding LNG market.

Qatari energy minister Dr Mohamed bin Saleh Al-Sada told Zawya that a study on the North Field will be completed next year.

"The study will help us to plan for future energy and gas field projects in Qatar," Dr. Al-Sada told Zawya. "We will not begin the second phase of the development of the North Field before we make sure that it will not have any adverse effect on the reservoir," the minister said.

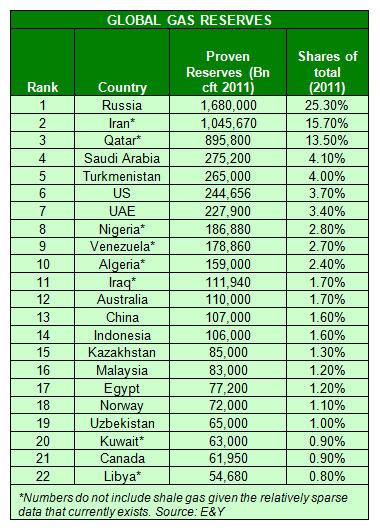

The North Field, of course, contains 900 trillion cubic feet of gas, making Qatar home to the third largest gas reserves in the world behind Russia and Iran.

Virtually all the countries on the list above harbour strong LNG ambitions. And the prize is the energy-hungry Asian markets.

According to the International Energy Agency World Energy Outlook 2011 report, gas is the only fossil fuel expected to grow in demand in 2012 -- at an expected rate of 1.7% per year through 2035. Of that percentage, non-Organisation for Economic Co-operation and Development countries will account for 81% of growth, with the majority expected from China, whose current policies are set to increase domestic demand by almost 400%.

"In recent years, the rise of emerging economic powerhouses in India, China and other parts of Asia have led many natural gas suppliers to ramp up production in countries such as Qatar in the face of what seems like unlimited demand," said consultants Ernst & Young in a report. "This increase in natural gas production has been followed closely by LNG production, which the Institute for Energy Economics expects to catch up to gas within a year."

By 2020, total Pacific basin demand is expected to rise to 241 million metric tonnes per annum, up from 120 million metric tonnes today. At the same time, future exports from Asian suppliers are estimated at just 200 million to 230 million metric tonnes per annum (mtpa) based on the supply realities of key exporting countries in the Asia-Pacific region and around the world.

"While there is a gas glut right now, there will be a gap in supply to meet projected demand within the next decade," E&Y noted.

PIECE OF LNG ACTION

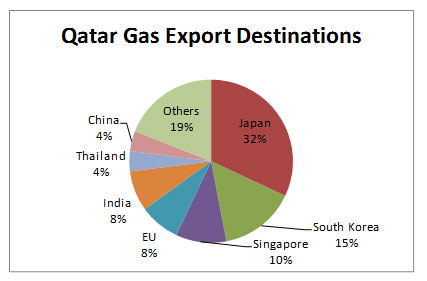

While Qatar has been basking in its long-term contracts with Asian clients, other countries are also signing up customers.

Some key developments in the LNG market that could have a long-term impact on Qatar:

* Russia's gas giant Gazprom has signed a deal with three energy companies to supply up to 7.5 million metric tonnes per year.

* Chevron Australia has signed a 20-year binding agreement with Tokyo Electric Power Company for as much as 3.1 million metric tonnes a year from its Western Australia development.

* South Korea has announced long-term agreements worth US$84 billion with Royal Dutch Shell and Total to buy 5.64 million metric tonnes per year from

LNG projects in Australia from 2013 to 2035.

* Sinopec recently finalized an agreement with Origin Energy and its LNG partner ConocoPhillips to supply 4.3 million metric tonnes of LNG per year for 20 years from its Australia Pacific project.

* There are 12 LNG projects being proposed and under way in Canada and the United States, which could come on stream from 2014 to 2020.

* According to Global LNG Info, 29 LNG projects are already on stream, 10 are under construction and other 19 are being planned.

There is a great likelihood that not all of these plans will see the light of day. Indeed at least three projects in Iran are going to be victims of the western sanctions imposed on the country. Others could fall through poor planning and inadequate financing.

Already, Australia - Qatar's closest competitor - is feeling the heat. Reports have emerged that a project being developed by Petrochina and Shell has seen costs rise by 50%. Elsewhere, expansion of the country's existing Pluto project developed by Woodside Petroleum won't go ahead due to a disappointing drilling programme.

But while some will fall through, enough will come on stream to change the LNG landscape.

Here's what Qatar's competitors are developing on the LNG front:

QATAR'S KEY COMPETITORS

Australia

Current LNG export capacity: 19.9 mtpa

Proven reserves: estimated at 110 tcf

Australia is the third-largest LNG exporter in the Asia-Pacific region and the fourth largest in the world. Together, its current North West Shelf project in Western Australia and its Darwin plant produce almost 20 million metric tonnes each year. A massive Gorgon project is under construction and is expected to add an additional 15 mtpa by 2015, and Chevron has approved a CDN$29-billion Wheatstone project in Western Australia, which will begin producing gas in 2016 and add an additional 25 mtpa within a few years. Longer term, a number of projects are under consideration, with the potential to increase Australia's output to an estimated 91.5 mtpa by 2020.

Russia

Current LNG export capacity: 17.7 mtpa

Proven reserves: 1,680 tcf

The Russian government, along with the nation's largest producer Gazprom wants to use its proximity to Asian market and exploits the world's largest gas reserves in its backyard. European market already consumes 96% of Russian exports, but lower EU demand has led Russia to delay development of key projects until 2016. Looking ahead, Russia has significant additional capacity, and we might start to see additional Russian export capacity coming into Asian markets, both new and existing.

Iran

Current LNG export capacity: 0 mtpa

Proven reserves: 1,045 tcf

Iran sits on the second-largest natural gas reserves in the world. A key plant is under development at Tombak Port, including two LNG trains with capacity of 10.8 mtpa, which is set to begin exporting as early as next year. The country aims to become a major LNG supplier, with a production target of 70 million metric tonnes by 2015, and is already in talks with an Indonesian company to export 1.5 million metric tonnes annually. There are, however, reservations as to whether Iran can feasibly develop the facilities and infrastructure required amid increasing sanctions and lack of required skills and associated investment.

Malaysia

Current LNG export capacity: 22.87 mtpa

Proven reserves: 83 tcf

Malaysia recently inked deals to buy 1.5 mtpa in 2013 from Qatar and 3.5 mtpa from Australia's Gladstone project, in which it has a 27.5% stake. But it also continues to export through long-term supply contracts to Japan, Korea and Taiwan. Petronas' recent strategic partnership deal with Progress Energy in Canada will provide Petronas with desired upstream assets and Progress Energy with capital investment and a potential LNG export channel in the future.

QATAR'S PLAN

While Qatar has a moratorium on its North Field, it is moving in other directions as well to maintain its economic advantage.

The country's non-oil sector has been boosted by the 2022 FIFA World Cup which has unleashed billions in investment.

Qatar is also developing its expanding its gas to liquids offering, consolidating its position as the number one gas-to-liquids producer in the world.

GTL enable Qatar to add value to its natural gas resources by transforming raw gas into globally marketable and easily transportable liquid fuels, notes Qatar National Bank. Oryx GTL, a joint venture between Qatar Petroleum and Sasol of South Africa, was the first GTL plant in Qatar. It became operational in 2006 and was the world's largest at the time. The US$1bn plant converts 330m cf/d of natural gas into 24,000 b/d of high grade diesel, 9,000 b/d of naptha and 1,000 b/d of LPG.

Then there is Pearl GTL, is an even larger joint venture between QP and Shell. It completed the first 70,000 b/d GTL train in 2011. A second train will add another 70,000 b/d of capacity during 2012. In addition the plant will produce 120,000 b/d of natural gas liquids (NGL) and ethane. The total cost of the project is expected to be in the region of USD19-billion.

In addition, Qatar is taking direct stakes in major blue-chip companies. Its most high-profile investment is Royal Dutch Shell, which is the second largest publicly listed oil company after Exxon Mobil.

Other stakes includes an 8% stake in Xstrata, a major resource trading company, Italian oil giant Eni and French oil company Total.

Qatar will also use its existing relationships with Chinese, Korean and Japanese partners to launch new long-term LNG as and when it decides to pursue the next wave of development.

CONCLUSION

Qatar has competition breathing down its neck, but it has always shown a remarkable ability punch above its weight diplomatically, politically and economically.

While the moratorium is in place, Qatar is hopefully using the time to assess the changing LNG landscape and plotting policies that would ensure the country retains its place as the gas capital of the world.

© alifarabia.com 2012