Kyrgyzstan's economy was shaken last week after protesters disrupted the Kumtor gold mine, owned by Canadian company Centerra Gold Inc.

Roads leading to the development were blocked by protesters, and the company said it was shutting down the facility. Scores of people were injured and Kyrgyz police moved in to thwart the protests, as a state of emergency was declared by the authorities.

Mining operations have also been suspended, other than "continuing operations to manage the ice and waste" in the high movement area of the open pit, Centerra said in its statement.

"If grid power and road access is not restored in a timely manner the company expects that there will be a material negative impact on the company's operations, including its gold production and financial results."

This is a blow to the Kyrgyz economy, which depends heavily on the Kumtor mine. The project accounts for 5.5% of GDP and 18.9% of industrial output and its disruption would drastically reduce growth in the economy.

Kumtor officials have sent a letter to Kyrgyz prime minister Jantoro Satybaldiev, calling the road blockades illegal and asking the government to intervene to help safeguard the 2,741 staff at the plant, of which 2,644 are Kyrgyz nationals.

"We are citizens of the KR, having certain constitutional rights, including the right to work and rest, which are being violated in the most illegal way by a 'bunch' of people, who prevent a huge number of company staff from arriving to work and from going home," the letter said according to media reports.

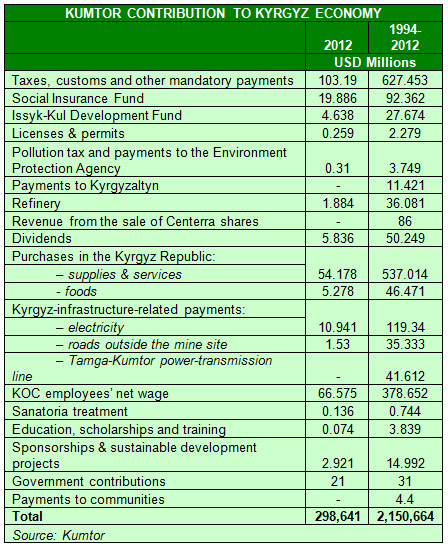

Corporate social responsibility

The company noted that it had paid USD 1.2 billion in taxes to the government and another USD 27.6 million to a fund, which finances salaries for teachers, doctors and police officers.

"But despite its size, Kumtor cannot solve all problems on its own," the letter urged.

"In the last three years alone, Kumtor has injected USD 153 million USD into the economy of Kyrgyzstan through local purchases. When Kumtor spends money locally, this creates jobs and provides additional tax revenue to the government and, as a result, the impact across Kyrgyzstan is magnified."

Close to USD 1.4 million worth of damage was reported and the protests also disrupted the start of tourist season in the country. More than 70% of Russian tourists are reported to have cancelled their trip to the region.

The protesters are demanding better infrastructure, including loans, education and healthcare facilities and more jobs. Some have called for a complete nationalization of the project as they believe the Canadian company is not benefiting local economy and residents.

The Kyrgyz government had also slapped a USD 315 million environmental damage to the company earlier this year. Centerra says the environmental claim is "exaggerated and without merit."

Kyrgyz parliament has decided to renegotiate the terms of contract with the company, but the prime minister has ruled out nationalization.

Investor disenchantment

Separately, Nasdaq-Dubai listed Gold Fields Limited said it has appointed a financial advisor to review "potential strategic alternatives" for its Talas Copper Gold Project in Kyrgyzstan.

The Talas Copper Gold Project is located in the Central Asian Orogenic Belt (CAOB) in Kyrgyzstan, which analysts say is one of the largest gold regions.

The CAOB region is home to some of the world's largest copper gold deposits, including Murantau (110 million ounces of gold-equivalent), Almalyk (80 million ounces of gold-equivalent) and Oyu Tolgoi (100 billion pounds of copper, 60 million ounces of gold).

The Talas Copper Gold Project also contains mineral resources of 1.7 billion pounds of copper and 6.7 million ounces of gold.

On May 20, Stans Energy, another Toronto-listed heavy rare earth company, said it had won a ruling from a court in Kyrgyzstan against the State Agency for Geology and Mineral Resources of Kyrgyzstan, which had asked to terminate the deal.

The firm is embroiled in a number of legal rulings with the Kyrgyzstan authorities, including its rare earth Kutessay II and Aktyuz projects.

Clearly, investor disenchantment with Kyrgyzstan is rising.

Its most telling example was an auction for the country's second largest gold deposit. The 100-ton Jeeroy has only attracted one unnamed buyer despite extensions by the government.

The USD 300 million price tag may have put off some investors, as well as the range of mining-related disputes in the country.

Internal revolt

Kyrgyzystanis are no stranger to turmoil, having overthrown two governments in the past decade and the latest episode has rocked the government once again.

To its credit, the Kyrgyz government has moved quickly to douse the protests, which signals that it is keen to keep foreign investors engaged in the country.

But it will also need to manage the expectations of the citizens.

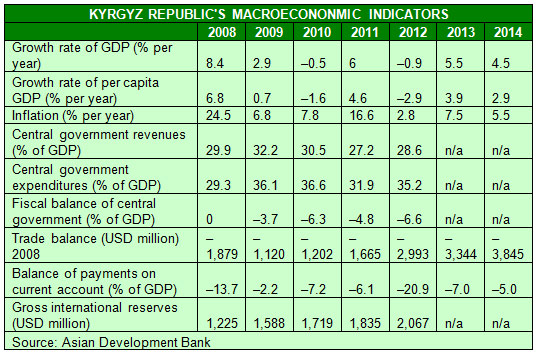

Kyrgyz's economy contracted 0.9% last year as gold production fell, but the economy was expected to rebound as conditions improved.

"Growth is expected to rebound to 5.5% in 2013 and 4.5% in 2014 on the back of higher gold production and investments, mainly from the Russian Federation and the People's Republic of China, in energy and transport infrastructure projects," the Asian Development Bank had estimated earlier this year.

"However, gold output could fall below expectations if the political environment deteriorates, weakening investment incentives. The restoration of public confidence and greater political stability should raise domestic demand, spurring growth in the private sector apart from gold."

If the uncertain situation around the country's mining sector persists, the 5.5% growth target may prove to be difficult to achieve.

© alifarabia.com 2013