Iraq continues to trundle along on the back of solid macroeconomics, but great political uncertainty remains.

Amidst huge doubts and anger towards Prime Minister Nour Al Maliki's government, the parliament managed to pass the budget despite a boycott from Kurdish lawmakers and other opposing parties.

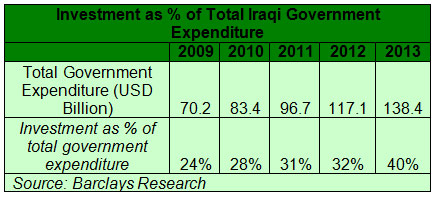

"Domestic and regional political risks notwithstanding, Iraq's macro outlook remains solid. The 2013 budget was recently approved despite unresolved disputes with the KRG and rising local sectarian tensions," said Alia Moubayed, analyst at Barclays Capital. "We expect the 2013 budget to register a surplus of 3% of GDP, and investment spending to support GDP growth above 10% year-on-year as oil output continues to expand."

Expressing its dismay, the semi-autonomous Kurdish Regional Government denounced the budget and said its approval was tantamount to "negligence to[wards] the role of the Kurdish component in the country, thus minimizing their natural and constitutional rights."

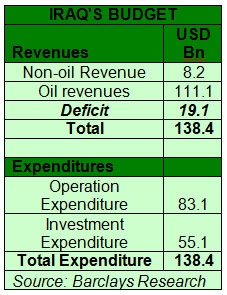

The budget forecasts a USD 16-billion deficit based on an oil price of USD 90 per barrel, which many analysts believe is on the conservative side.

The government is looking to spend USD 118 billion this fiscal year, 18% higher than last year, and at least 40% is being spent on investment spending.

However, the authorities have a "woeful record on implementing capital projects," providing much-needed essential service provision and combating corruption, warns the Economist Intelligence Unit in its March report on the country.

In addition, 93% of the country's revenues are dependent on oil exports, which suggest Iraq's vulnerability to a crude price crash.

"Given the track record of budget under-execution, and as our commodities' analysts forecast the average oil price for 2012 at USD 125 per barrel, Iraq could register a fiscal surplus of over 3.2% of GDP in 2013 on our estimates, compared to 4% of GDP in 2012 as indicated recently by the IMF," noted the Barclays analyst.

Baghdad and Erbil's tensed relation

Given oil's importance to the country's economy, the budget failed to resolve the dispute between the central government and the Kurdish regional government.

The KRG has signed a number of oil and gas deals with major oil companies such as ExxonMobil Corp, Gazprom and Chevron Corp, but the government in Baghdad considers them illegal and has threatened to ban companies that deal directly with KRG.

"An increasingly hostile and intractable confrontation between Erbil and Baghdad over contested territory and Kurdish issuance of oil contracts remain a source of concern for investors," said risk management consultancy Maplecroft. "Tensions peaked in November 2012 when both the KRG and federal authorities sent thousands of troops to a disputed border in the Diyala governorate. A de-escalation of the military stand-off has yielded progress but political statements regarding the incident remain vitriolic."

Baghdad has also blocked payments to KRG and many companies in the Kurdistan are complaining of not being paid for their oil.

Despite the challenges and seemingly dysfunctional management of the wider economy, the country has managed to raise production from 2.665 million barrels per day in 2011, to 3.06 million bpd by February of this year, and replaced Iran as OPEC's second largest producer after Saudi Arabia, OPEC figures show.

The government is hoping to spend USD 130 billion to raise output to nine million bpd by 2020, although the International Energy Agency believes it's more likely to produce 6.1 million bpd by that time. Meanwhile, Bank of America-Merrill Lynch has an even more conservative 4.9 million bpd estimate for the country.

The output numbers may vary, but they are likely to rise, and could help Iraq reduce its external debt ratio from 71% of GDP to around 55%.

"In the short to medium term, the key risk to Iraq's macroeconomic outlook remains potential downside to oil prices. However, given our current oil price forecast, we remain comfortable that Iraq can continue to accumulate small fiscal buffers," said Barclays.

"Moreover, we expect the C/A balance to GDP to register 24.2% of GDP in 2013, which is likely to raise FX reserves at the CBI from USD 70 billion to an estimated USD 80 billion by 2014, on top of the USD 18 billion at the Development Fund for Iraq."

Sectarian conflict raises risk

While Iraq's macroeconomic strength is not in question, analysts are worried about the country's sectarian tension, which are escalating. Fifty people died in a bomb blast in a Shiite neighborhood in Baghdad on the eve of the 10th anniversary of the United States invasion of Iraq, while scores of other explosions over the past few months have also shook up the country.

Iraq's current national unity government is frayed and unwieldy; the defense and interior ministries are still without permanent ministers, notes the Economist Intelligence Unit.

"Many within the government would undoubtedly like to see its dissolution, but the status quo suits Mr. Maliki and his close allies. Despite dissension from within the ranks of some members of the national unity government, such as the Iraqi National Movement (INM), the government will stumble on in its current form."

© alifarabia.com 2013