Dubai government's approval of the mandatory insurance law last year is starting to trigger a new wave of growth in the emirate's healthcare sector, according to Shuaa Capital.

The law would push Dubai's insured population to 3 million by 2016, from its current level of one million people, boosting companies and services involved in the sector.

The law stipulates that companies with more than 1,000 employees must provide mandatory health coverage to employees by October 2014. In the next phase, firms with between 100 to 999 employees must comply with the law by July 2015, and small-to-medium enterprises have until June 2016 to meet the requirements.

While Abu Dhabi has nominated state-backed Daman Insurance as the primary provider for low-income individuals in the emirate, the Dubai government has chosen seven preferred insurance providers to cover people earning AED 4,000 (USD 1,088) per month or less. These companies are AXA Insurance, RAKNIC, Daman Health, Oman Insurance, Arab Orient, American Life and Takaful Emarat.

"Our discussion with various Participating Insurers indicates that a number of key details related to the Essential Benefits Plan still need to be addressed (annual insurance premium, network of healthcare facilities included in coverage etc.), with greater clarity expected by June 1, 2014," said Shuaa Capital in a note.

In addition, health coverage for spouses and children of expatriates in the UAE has also been made mandatory and residence visas for family members will not be re-issued without health cover, according to Alpen Capital.

Residents with health insurance would pay only 20% of the cost of doctor's consultation fees, treatment and medicine cost, while the premium is expected to cost between AED 500 and 700 (USD 136 and 190) per year.

HEALTHY GROWTH

With Dubai following Abu Dhabi's lead to implement mandatory healthcare insurance, the stage is set for rapid growth across the sector.

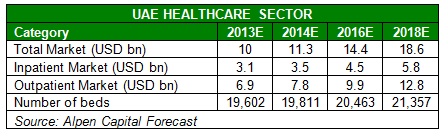

"The UAE is one of the most organized and fastest growing healthcare markets in GCC," said Alpen Capital in a recent study, noting that the market is expected to expand at an annual growth rate of 13.1% over the next five years, to reach USD 18.6 billion from a current USD 10 billion.

"Over 2013-2018, the market is expected to expand [with] the outpatient market likely to be worth USD 12.8 billion and inpatient [at] USD 5.8 billion. The number of hospital beds is estimated to increase at a CAGR of 1.7% to 21,357 in 2018 from an estimated 19,602 in 2013."

BOON FOR INVESTORS

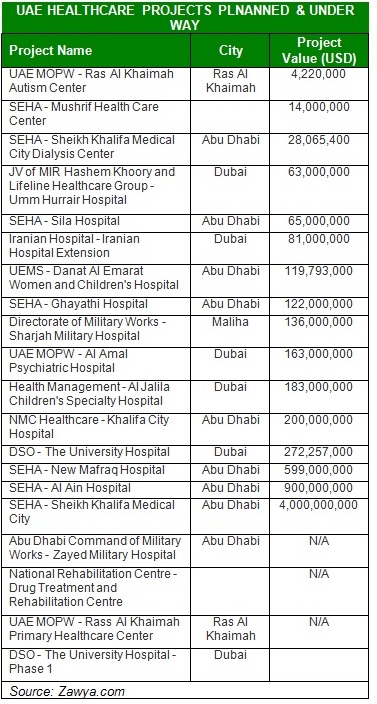

Healthcare projects with a combined value of USD 3.1 billion are being built in the country, highlighting the scale of developments under way.

The sector has already seen major investment activity in recent years, as investors eye the country's impressive growth trajectory. Waha Capital acquired a 97% stake in Anglo Arabian Healthcare, and said it plans to invest USD 68 million over the next three years. Abu Dhabi-based Centurion Investment also bought a stake in CSH Investment, for an undisclosed sum earlier this year.

South African-based Mediclinic International has also strengthened its UAE portfolio by acquiring Medical-Pathology Laboratories for USD 25.8 million and a 49.6% stake in Emirates Healthcare Holdings for USD 223.6 million.

UAE-based healthcare companies such as NMC Healthcare Plc and Al Noor Hospital Group Plc also recently listed on the London Stock Exchange as a sign of greater confidence in the country's vastly-improving healthcare.

BUSINESS COSTS

While a boon for individuals and healthcare companies, the mandatory insurance will add to business costs for UAE companies that have to foot the doctors' bills.

A report by recruitment consultancy Mercer notes that employers in the UAE spend 6.1% of payroll on healthcare, compared to 3.9% in the wider region and 3.3% in Western Europe 3.3%.

"The GCC countries, especially the UAE and Qatar, have one of the highest rates of growth in healthcare costs," Alpen Capital analysts said. "The major reasons attributed to the rise in healthcare costs include the advent of new medical technologies and higher length of stay driven by better healthcare facilities."

MEDICAL TOURISM

Mandatory healthcare insurance is just one aspect of growth. Dubai's efforts to improve its medical tourism proposition are gaining ground as well.

The Dubai Healthcare City was created a decade ago to raise the emirate's medical tourism credentials and is now home to two hospitals, 120 outpatient medical centers and 4,000 licenses professionals,

"It is the medical tourism hub in the region, attracting patients from other GCC as well as Arab nations," Alpen Capital said. "The government now seeks to compete with established medical tourism destinations such as India."

Analysts expect the country's medical tourism market to have grown to nearly USD 1.7 billion last year. The number of medical tourists in Dubai alone could rise from the current 100,000 to 170,000 by 2016, generating around USD 330 million. The Dubai Health Authority expects to see half a million tourists spending USD 710 million by 2020.

"For the same, DHA is taking initiatives such as launch of a new portal to promote medical tourism and special medical packages introduced for target markets, which will include the cost of treatment, visa costs, flight fares and even leisure activities for the patient's family members," Alpen noted.

However, shortage of skilled medical personnel may be a key obstacle that could curtail growth. With neighboring Saudi Arabia and Qatar also looking to attract healthcare professionals, the market for skilled labor is tight, which could lead to higher wages and higher healthcare costs.

The feature was produced by alifarabia.com exclusively for zawya.com.

© Zawya 2014