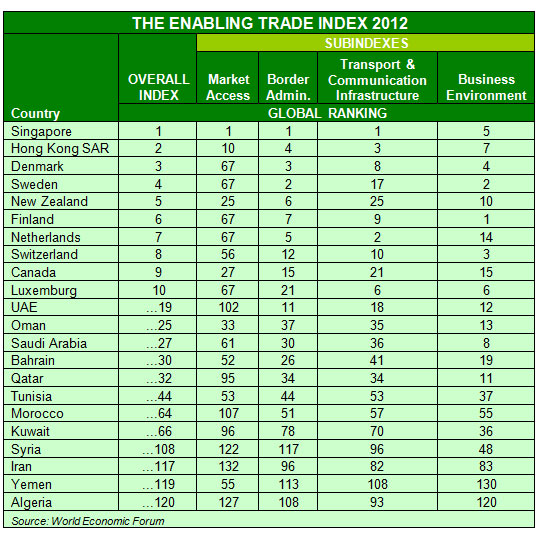

Gulf economies, led by the UAE, have fared quite well in a World Economic Forum focused on world's trade-friendliness and access to global markets.

The UAE was ranked 19th among 132 countries in an in-depth survey conducted by the World Economic Forum. Oman, with a global ranking of 25, surprisingly emerged second among Arab countries, with Saudi Arabia close at its heel, at 27.

Bahrain (30th) and Qatar (32nd) ended up among the most trade friendly nations, with only Kuwait, at 66, exactly at the mid point of the list.

The overall list was dominated by Singapore and Hong Kong - comparatively small economies that rely heavily on trade access.

"The top 10 of the ETI 2012 continues to be dominated by relatively small, open economies for which trade is key to achieving efficiency because their domestic markets are small," noted WEF in the report. "Singapore continues to lead the way by a large, and widening, margin over second-ranked Hong Kong SAR."

Even though the UAE dropped three places from the previous edition's survey, its port and airport infrastructure and open trade policies has made it a far more 'trade enabling' economy than the United States, which ranked 23rd.

"The Middle East and North African region maintains a high degree of diversity in terms of enabling trade, with the United Arab Emirates entering the top 20 while Algeria remains at the bottom of the rankings, at 120th," noted WEF.

In many Gulf countries, such as Saudi Arabia, the environment is favourable to trade because trade policies are open, border administration is efficient, and infrastructure is well developed.

"North African economies, led by Tunisia at 44th, face a different set of challenges, with trade policies and business environments that are less conducive to trade and a need to upgrade infrastructure," WEF said.

UAE: GREAT ON SECURITY, POOR ON ACCESS

The UAE was ranked fifth in physical security, but fared poorly in the market access component of the index.

"The country's share of duty-free imports has decreased from 29 to 24% and its weighted tariff rate has increased, particularly for agricultural products. At the same time, UAE exporters now face a lower margin of preference in key export markets," WEF noted.

However, the UAE's world class transportation and communications infrastructure ensured that the country remained among the top 20 most trade-friendly nation in the world.

Saudi Arabia, meanwhile was hamstrung by logistical issues and regulative barriers to foreign ownership. It has also signed a fairly small number of trade-enabling multilateral treaties, despite signing up to the World Trade Organization.

"More openness to foreign competition in the logistics sector would support the development of an efficient logistics and transport industry in the country, thereby providing a base for further diversifying exports," the report noted.

Egypt, the most populous country in the Middle East with close proximity to European, African and Arab markets, has not raised its game in international trade.

As reflected in its 90th rank, important barriers to developing trade persist, WEF stated. Egypt's most important disadvantage is its trade policy, which--despite considerable liberalization efforts--appears rather protectionist in international comparison.

"In order to take better advantage of growth and employment opportunities offered by international trade, Egypt would need to enhance its customs administration, which remains inefficient and corruption-ridden; address serious concerns of the business community regarding the deteriorating securing situation; and further promote the use of ICTs by business and individuals - Egypt ranks a low 82nd for the extent of Internet use by individuals."

Another disappointment was Kuwait, which despite its wealth, has failed to create a robust transportation and communications infrastructure. The country also lagged its Gulf peers in border administration. The huge disparity between Kuwait and other Gulf states also indicates the Gulf Customs Union has done little to enhance the logistical framework within the six members.

The report also shows that bigger is not necessarily better. BRIC countries - China, India, Brazil and Russia -fare worse than at least five Gulf states, which suggests nimble, smaller economies don't have to be dominated by economic powerhouses and can carve a strong trading niche. Hong Kong and Singapore are prime examples of that.

But clearly, there is much work to be done. Beyond the Gulf states, North African and other Arab economies seem to be fallen way behind their emerging market peers. To be fair they have been distracted over the past year with political upheavals, but this might be a good opportunity to focus on creating more vibrant economies that are open for trade.

© alifarabia.com 2012