On the surface the figures look impressive.

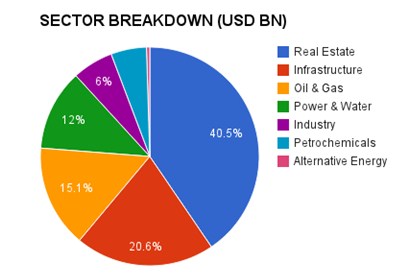

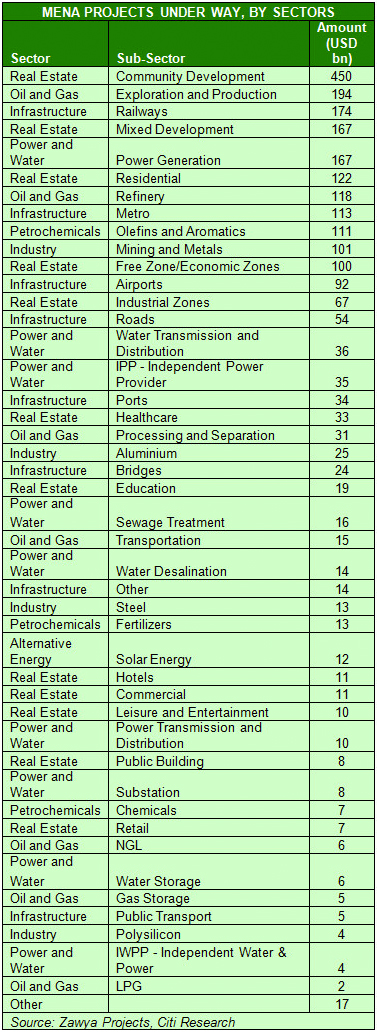

More than USD 1 trillion worth of real estate projects are under way in the Middle East and North Africa, as regional authorities move swiftly to address chronic housing shortages across the Arab World.

In addition, infrastructure is attracting just over half a trillion dollars, while the oil and gas sector - the lifeblood of many regional economies - has garnered USD 376 billion. The water and power sector have just under USD 300 billion -- all key sectors that would determine the future prosperity of the region's economy.

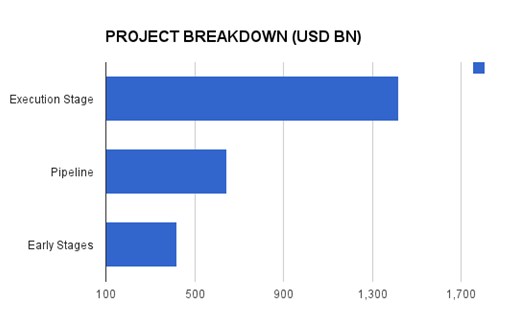

All in, there are projects worth USD 2.5 trillion worth in the region, out of which USD 1.4 trillion are moving to execution stage. An additional USD 645 billion worth of projects have reached tendering stage but have yet to be awarded, while USD 422 billion are in early stages, according to Citibank research report, sourcing data from Zawya Projects Monitor.

UNEVEN INVESTMENT

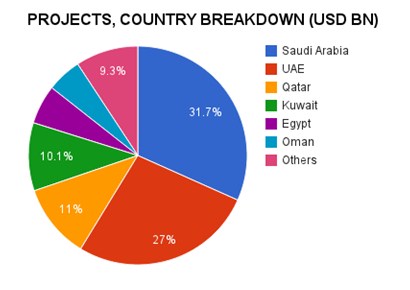

But the figures mask the uneven nature of investments. Gulf nations account for 87% of the investments, focused on a population roughly one-seventh of the Arab World's 367 million people.

Saudi Arabia accounts for USD 784 billion of projects and the UAE follows closely on its heels with USD 669 billion. Qatar's infrastructure-led spree makes up USD 273 billion of investments, while Kuwait's USD 249 billion is the fourth largest project program in the region. Oman has USD 127 billion worth of projects under way.

Only Egypt breaks the GCC dominance, with USD 143 billion worth of projects being planned or under development.

"The Maghreb countries lag their regional peers in terms of project-driven economic stimulus, with the value of projects underway there typically below 20% of GDP," said Citibank.

Compared to their economies, less populated nations are responsible for some of the biggest projects.

"Projects underway in Bahrain, the UAE and Oman are valued at over 150% of current GDP, providing significant potential stimulus to economic growth," said Citibank. "The extent to which this potential is fulfilled depends on such factors as execution, the timeline of the projects, the nature of the projects, and so on."

And while Saudi Arabia has more projects than anywhere else in the region, the kingdom ranks lowest among the GCC countries "in terms of value relative to GDP, indicating the relatively weak stimulus projects are giving the economy."

THE CHALLENGE OF AFFORDABLE REAL ESTATE

Jones Lang LaSalle, the real estate consultant, pegs overall MENA's housing shortage at 3.5 million.

Part of the reason is that MENA lags behind other regions in delivering financing innovation, according to Ernst & Young. "Long-term fixed rate lending for housing is not readily abundant. Some countries' mortgage laws are still in development. Issues of Shariah-compliant products and customer acceptance of Shariah-compliant interest rate arrangements are still less than optimal."

Virtually all the major countries in the region suffer from chronic housing shortages and governments are paying special attention to address the huge gaps between demand and supply.

In Saudi Arabia, the government has a plan to build 500,000 units over the next few years, while the Algerian government is looking to build 250,000 houses.

Egypt, which has a housing shortage of 1.5 million - the highest in the region - has launched a USD 40 billion plan to build 1 million low-income units. The country is investing between USD 37 billion-40 billion in infrastructure, and just over USD 30 billion in real estate, according to Zawya data gleaned by Citi.

Morocco, which has a population of 32 million, has perhaps the most advanced house financing market in the region, but still has a massive shortage.

"The housing shortage in Morocco was estimated at 800 000 units, with demand growing by about 150,000 units a year," according to Centre for Affordable Housing Finance in Africa. "Most of this shortage is in the low income market segment, with overall stock of affordable houses estimated at 2.8 million for the 3.4 million low income households, leaving many to live in informal housing."

In Algeria, oil and gas sector garners the biggest share of investments accounting for nearly USD 20 billion. Power and water is second only with USD 10 billion, while real estate is a distant third, with approximately USD 9 billion worth of housing projects under way.

Thirty years of conflict and underinvestment have created a major housing shortage across Iraq, notes Jones Lang La Salle, adding that the authorities are looking to construct one million economic housing units.

DEMOGRAPHIC TIME BOMB

The Arab World's demographic challenges are making demands on each country's housing market. Indeed, populations are growing at two or three times global averages, EY noted.

By 2050, the populations of Bahrain, Egypt, Iraq, Jordan, Kuwait, Mauritania, Oman, Saudi Arabia, Syria and Yemen are projected to more than double -- and all of this net growth will be in cities, because people in these countries are moving, rural-to-urban, EY noted.

In the face of this pressure, the housing systems these nations put in place until 1990 are not keeping pace, said EY, noting that in places like Bahrain, waiting list of nationals for affordable housing runs to more than 50,000 families, while in Kuwait, the list is 95,000 long, and growing at 6,000 names a year.

"The widening gap of effective demand over affordable housing is not arising because governments do not care; rather, it is proof that governments' existing frameworks are being asked to do much more than they were ever designed to deliver."

A survey by Booz & Co. last year had revealed that home ownership remains a "bedrock desire among the middle class."

The project investment figures coming from the MENA region look massive on paper, but there are still clear opportunities for governments and the private sector to focus on housing that the middle class can afford.

The feature was produced by alifarabia.com exclusively for zawya.com.

© Zawya 2014