PHOTO

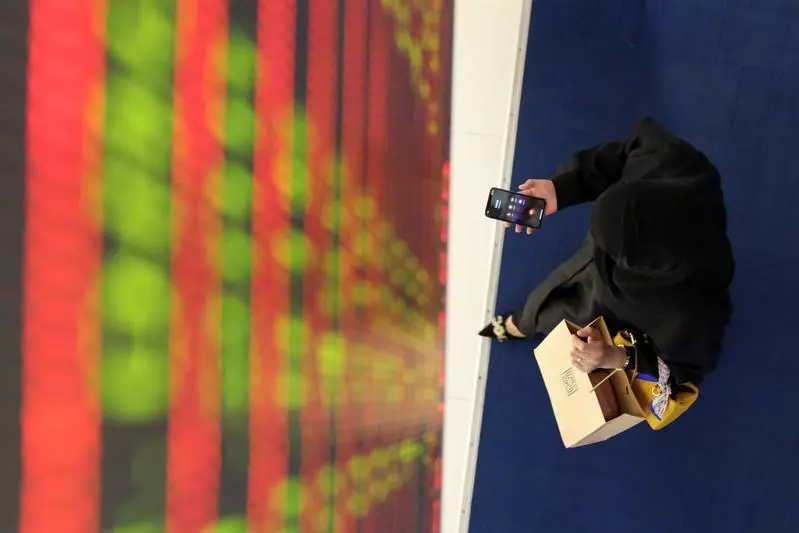

DUBAI - Here are some factors that may affect Middle East stock markets on Monday. Reuters has not verified the press reports and does not vouch for their accuracy.

INTERNATIONAL/REGIONAL

* GLOBAL MARKETS-Asia stocks off highs, yields up on looming U.S. stimulus

* Oil prices fall on renewed coronavirus concerns as China cases mount

* MIDEAST STOCKS-Egyptian stocks outperform in rising Middle Eastern markets

* PRECIOUS-Gold hits near 6-week low on firmer dollar, higher Treasury yields

* U.S. to designate Yemen's Houthi movement as foreign terror group as soon as Monday -sources

* End in sight Israel rolls out COVID booster shots

* Iran tells S.Korea not to politicise seized vessel, demands release of fund

* Iran raises February crude official selling prices to Asia -source

* Algerian president returns to Germany to be treated for COVID-19 complications

* Lebanon Christian leader rules out joining Hariri government

* Pope unsure if March trip to Iraq can take place because of COVID-19

EGYPT

* Egypt's December headline inflation decelerates to 5.4%

* Three-way talks on Ethiopian dam reach new impasse

SAUDI ARABIA

* Saudi Crown Prince launches zero-carbon city in NEOM business zone

* Saudi cut to boost oil market de-stocking, even as demand falters

UNITED ARAB EMIRATES

* UAE's SHUAA Capital buys out Stanford Marine's debt as part of restructuring

* ADNOC raises Feb Murban crude OSP to Platts Dubai plus $0.75/bbl

* Celtic player tests positive for COVID-19 after squad return from Dubai

BAHRAIN

* Bahrain says it will open airspace to Qatar from Monday

* Bahrain airport's new passenger terminal to open Jan. 28

KUWAIT

* Kuwait raises February KEC crude export price for Asia

(Compiled by Dubai newsroom) ((dubai.newsroom@thomsonreuters.com))