PHOTO

Environmental, social and governance (ESG) risks are becoming more significant for banks’ creditworthiness as regulatory policies, market developments and social attitudes change rapidly, a recent report by Moody’s Investors Service said.

The ratings agency said that ESG risks affect its assessment of a bank’s liquidity, funding, asset quality and capital strength.

The type of exposure to ESG risks and their potential impact on a bank’s creditworthiness differs among regions.

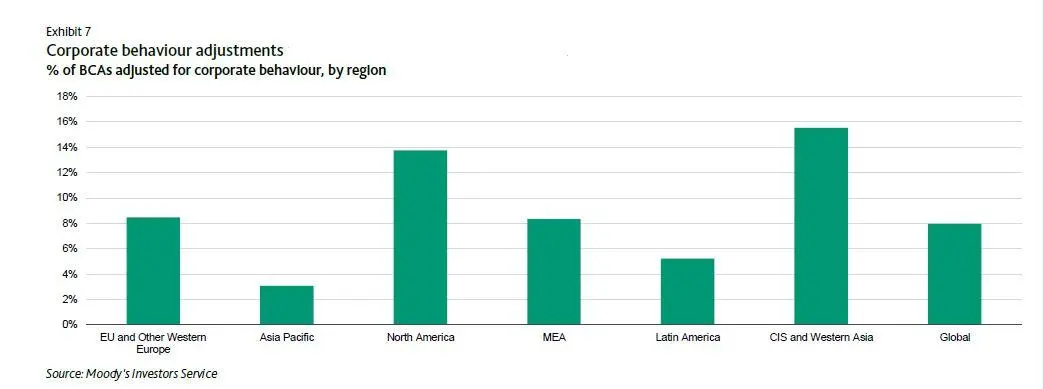

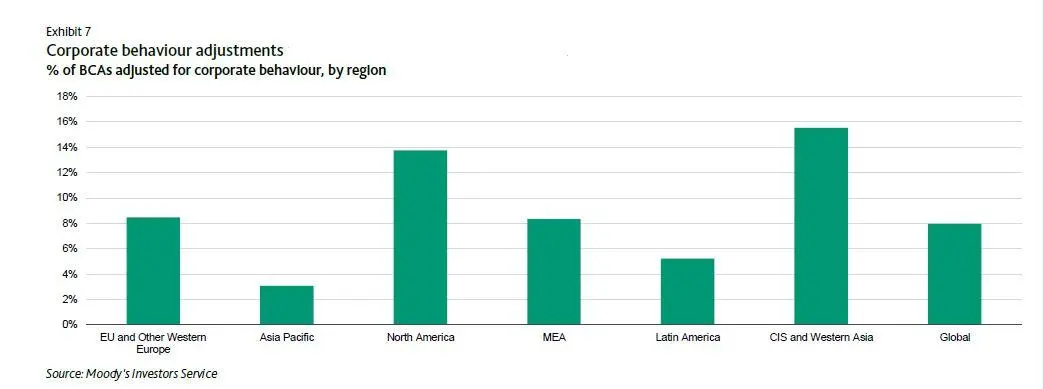

Governance factors are relevant for banks across all geographies, but specific types of risk are more commonplace for banks in certain regions. For instance, adjustments for negative corporate behaviour are most common in CIS region.

On the environmental front, there are direct risks, and indirect risks arising from regulation. Developing countries have higher physical exposure to environmental risk due to lower levels of economic diversification, a higher dependence on agriculture and a higher likelihood of negative impacts from natural disasters.

For environmental regulation, the impact is generally higher in Europe, where regulatory initiatives assess banks’ frameworks in relevance to climate change. But there are growing risks from the transition to low-carbon economies in emerging countries, especially ones with high exposure to carbon-intensive industries.

As for banks’ exposure to social risks, developed markets witness higher litigation risks as a result of misconduct claims, and they also tend to have more intensive consumer protection legislation.

Sustainable finance going mainstream

While banks see new lending opportunities with the rise of sustainable finance, there are higher risks of regulatory penalties, reputational damage, asset stranding (assets which lose all value due to their environmental burden or remediation cost), and capital constraints as regulators promote sustainable finance, according to Moody’s.

Worldwide, there have been international agreements that promote ESG-friendly investments. These include the European Commission Action Plan on Sustainable Finance in March last year, the United Nations Agenda for Sustainable Development in 2015, and the Paris Climate Agreement in 2015.

According to Moody’s, the current level of direct environmental regulation aimed at banks is low. But the ratings agency expects a gradual increase in regulation to support environmental policies and to ensure a more resilient system to risks related to climate change.

Nevertheless, bank stakeholders are demanding improvement in ESG management with investors increasing integration of ESG factors in asset allocation.

In September last year, BlackRock, the world’s largest asset manager, partnered with Thomson Reuters to launch an exchange-traded fund (ETF) with an ESG focus in developed and emerging markets.

A report on sustainable investment in the United States published in October last year argued that ESG investments were now being driven primarily by investor ‘self-interest’, according to Reuters.

“Money managers are responding to client demand, as well as seeking to improve returns, minimise risk and fulfill their fiduciary duty,” the report said. Read more here.

The Moody’s report said that banks are under growing pressure to integrate ESG considerations into their investment decisions.

“The rise of sustainable finance offers banks opportunities to unlock new lending markets, and to reinforce their relationship with clients, for instance by advising them on the impact of ESG factors on their businesses. Banks can also reinforce their franchise value through strong management of ESG factors,” the Moody’s report said.

(Reporting by Nada Al Rifai; Editing by Michael Fahy)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019