- Cities in India, China and the Middle East growing more resilient and offer investors long-term opportunities - within 10 years China will occupy 43 spots in Savills Top 100 Resilient Cities ranking

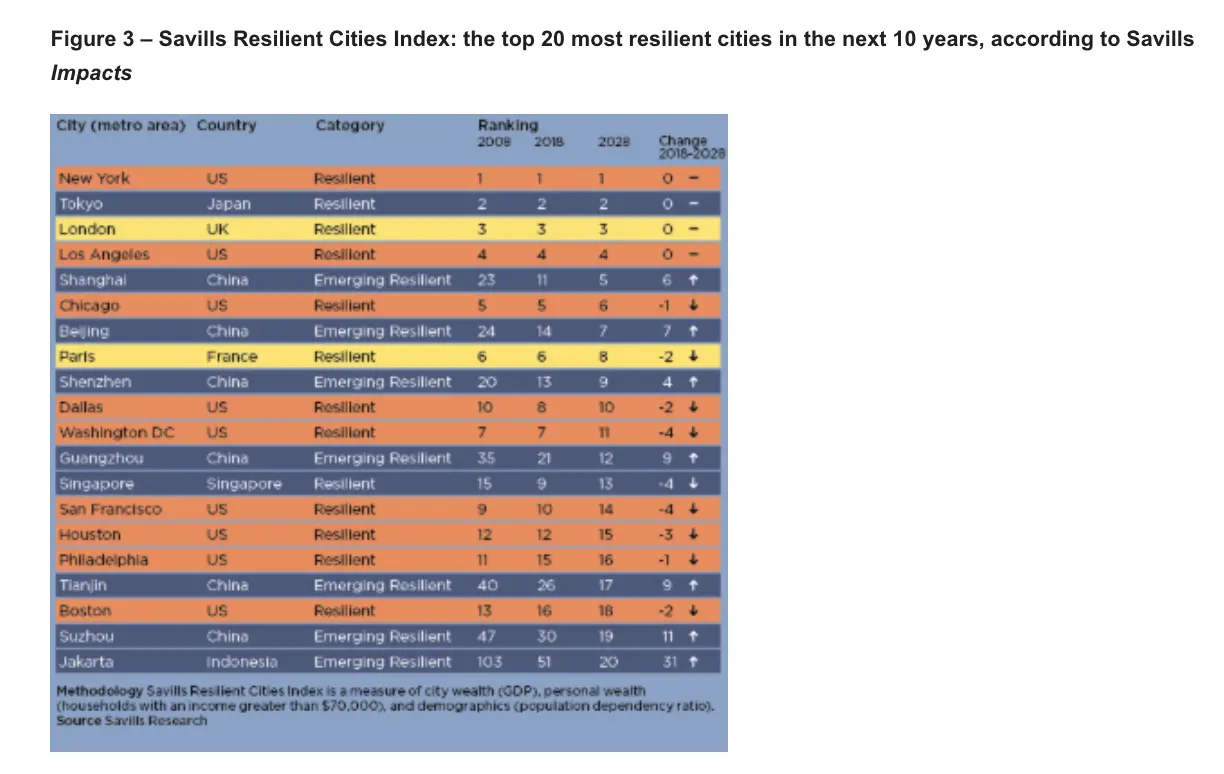

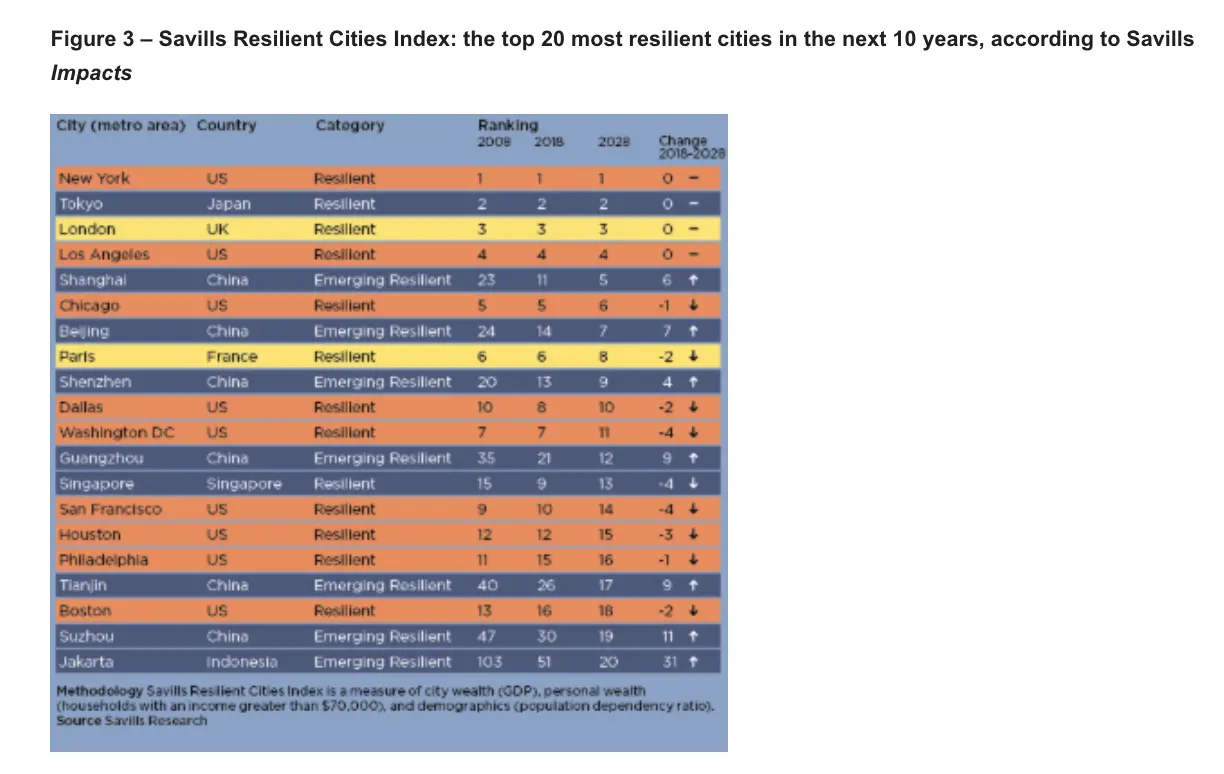

- New York, Tokyo, London, Los Angeles currently Savills top four cities most resilient to global disruption now and in 2028, but ‘challenger cities’ rising fast

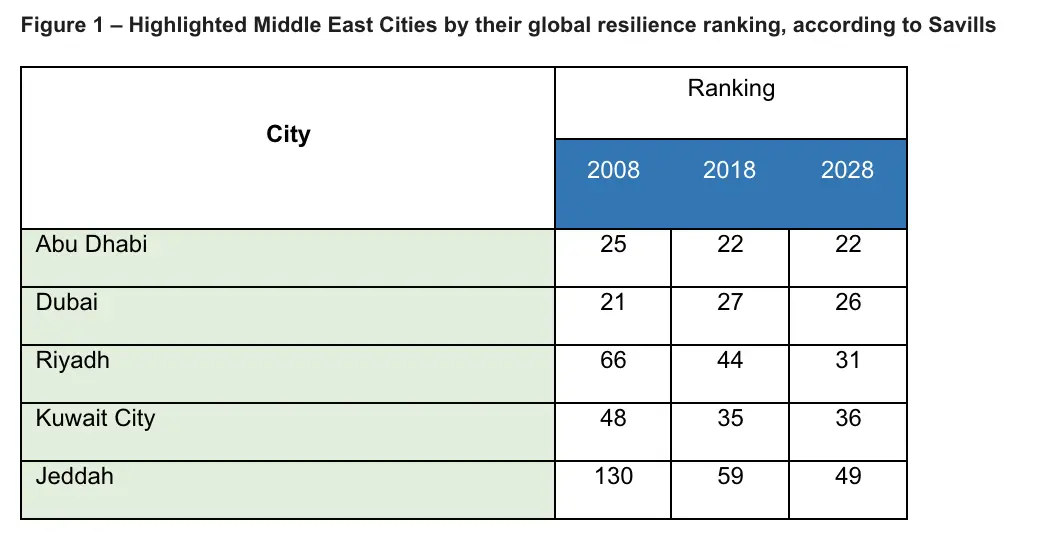

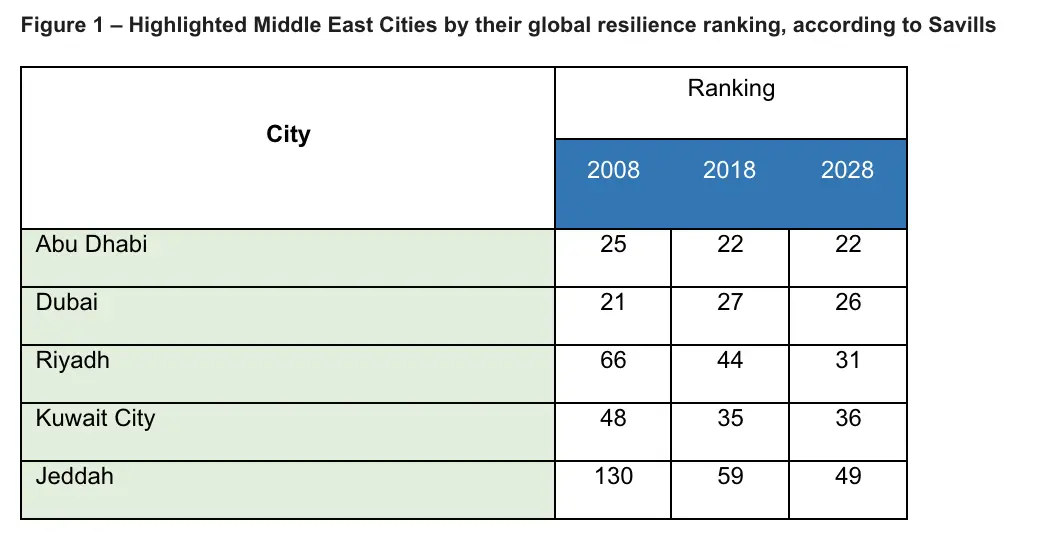

Abu Dhabi: Abu Dhabi has been named the most resilient city in the Middle East, according to research by global real estate advisor, Savills. The United Arab Emirates capital featured highest in the Savills Resilient Cities Index, launched as part of its Impacts research programme, which examines which cities will be able to withstand or embrace the technological, demographic, and leadership disruption facing global real estate today and in 10 years’ time.

Courageous investors looking for long-term returns should look to Middle Eastern, Indian and second tier Chinese cities, as the markets that are likely to grow in the face of global disruption in the coming decades, but today remain relatively untapped, says Savills. These regions are home to the ‘challenger cities’ identified in Savills Resilient Cities Index. The report specifically identifies Riyadh and Jeddah as among the eight ‘challenger cities’ that will make the biggest leaps up the ranking in the next decade. New York, Tokyo, London and Los Angeles are the top four most resilient cities today, and will remain so in 2028 according to Savills.

‘Challenger cities’ are poised to compete with established cities by using disruption to their advantage as they are often able to respond faster and more flexibly to swift changes in technology and society, says Savills, and are therefore ones to watch by real estate investors ready to take a long-term view. No contenders from either the US or Europe have been awarded ‘challenger city’ status by Savills, with London and Paris the only European cities ranked within the 20 most Resilient Cities Index.

Figure 2 – Challenger Cities, the locations forecast to jump at least 10 places and enter the top 50 Resilient Cities Index by 2028, according to Savills Impacts. N.B Bengaluru wasn’t featured in the 2008 ranking as it had a GDP <$50 bn.

“What our eight challenger cities have in common,” says Sophie Chick, director in Savills world research, “is that they are all likely to see substantial increases in their GDP and growth in household incomes, while their dependency ratios – the proportion of people of a non-working age to those of a working age – will either fall or increase at a lower rate than other major cities between now and 2028. This indicates that they are set to be young, prosperous, and able to adapt to changes in the way the world operates at a faster pace than some better known locations.”

Simon Hope, head of global capital markets at Savills, comments: “The list of the world’s top global cities may feel like it’s almost set in stone, but, as is becoming apparent, disruption is on the menu and we are set to see some sweeping changes to the way society functions and how businesses operate in the next 10 years. For real estate investors, our Resilient Cities Index shows that the long-established global cities will withstand much in the next decade, which is why they’ve seen high levels of investment as they are perceived as ‘safe havens’ for capital, with the top 10 global destinations for both domestic and cross-border capital in 2018 reflecting this old world order. However, as a result, their real estate assets have become correspondingly expensive and highly sought after.

“As such, our eight ‘challenger cities’ may offer alternative investment destinations. While not without risk, these cities are set to accelerate up the ranks as they demonstrate their resilience to the challenges ahead and investors should start investigating how to secure a footing in these markets if they’re willing to sit tight and take a long-term view.”

Paul Tostevin, director in Savills world research, adds: “All our ‘challenger city’ contenders are from China, India and the Middle East. While some of these, such as Delhi, Mumbai, Bengaluru, Riyadh and Jeddah are known internationally, they are generally yet to make it onto the global real estate investors’ radar. Those in China - Hangzhou, Nanjing and Ningbo - aren’t well known at all, despite having large populations. What all of them have in common, however, is that they have young populations, are increasing in prosperity and should be able to swiftly pivot in response to the disruption lying ahead.”

Further information about Savills Impacts research: https://www.savills.com/impacts/index.html

-Ends -

Savills Resilient Cities Index is a measure of city wealth (GDP), personal wealth (households with an income greater than $70,000), and demographics (population dependency ratio).

- Resilient Cities: These cities have been in the top 20 for at least the last decade and are forecast to remain so over the next 10 years. They are well-placed to withstand or embrace the many disruptive forces facing global real estate today and in the future.

- Emerging Resilient Cities: The new entrants to the top 20, either in the past decade or forecast to be so in the next. Although, they’re not currently as well-established on a global stage, we expect them to match the status of the Resilient Cities by 2028 as they continue their dramatic rise in economic and wealth terms.

- Challenger Cities: Cities that are forecast to make the top 50 by 2028 by jumping at least 10 places. They are poised to rise and challenge the established cities by using disruption to their advantage. For real estate investors with a long-term view, these are the cities to watch.

Impacts is Savills global thought leadership publication and research programme. This year is the ‘disruption issue’, looking at how widespread economic, political, demographic and technological upheaval is changing the world of real estate. How is the rise in populist politics affecting cross-border investment? Which cities are the most resilient to change in the coming decades? How is technology driving the repurposing of retail assets and the rise of new leisure concepts? Where will our food come from? And what are the forces disrupting the world’s prime residential markets? Impacts answers these questions and more.

For further media information, please contact:

Jon Ivan-Duke, TOH PR – jon@tohpr.com

Or

Raghad Elassi, TOH PR – Raghad@tohpr.com

+971 4382 8900

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.