Dubai: Topaz Energy and Marine (“Topaz”), a leading offshore support vessel and marine logistics company, today announces its results for the twelve months ended 31 December 2018 (“the period”).

Q4 2018 Results HighlightsStrong cash flow generation and increased profitability

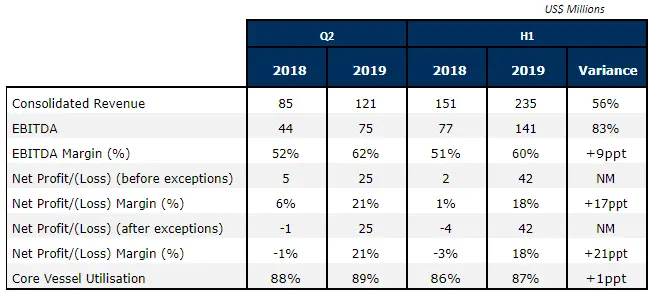

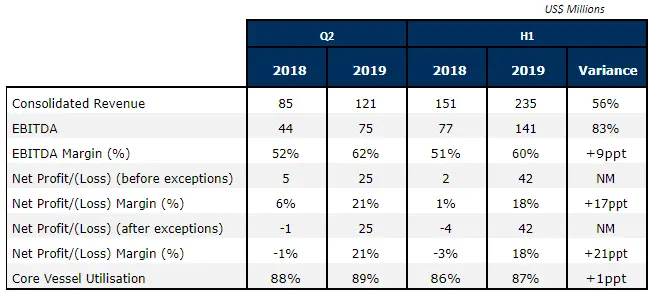

- Q4 2018 revenue increased to US$106m, up 54% compared to Q4 2017; EBITDA increased by 100% to US$62m in Q4 2018 against Q4 2017.

- Operational efficiencies and the impact of all Tengiz project vessels being fully operational towards the end of the period ensured an increased EBITDA margin to 58% for the period, despite ramp-up costs for Tengiz.

- The company significantly enhanced profitability, with two consecutive quarters of profits (before exceptional items) and a positive PAT for the year.

Continued growth and significant contribution from the Tengiz project (part of Topaz Solutions)

- Record revenue and EBITDA contributions of US$45m and US$40m, respectively, from Topaz Solutions during the quarter.

- All 20 vessels for this project have been received from the shipyards and are earning full revenue as at 31st December 2018.

Market leading asset portfolio and fleet utilisation rates combined with improving market conditions

- Overall core fleet utilisation was at 86% in 2018 with significant improvements in MENA and Africa regions.

- BP contract in Azerbaijan extended up to 2025 (plus options), bringing the contract backlog to a record high of US$1.7bn, providing further revenue visibility and converting a significant portion of our backlog from “options” to “firm”

- Secured contracts for the two newbuild subsea vessels Topaz Tiamat and Topaz Tangaroa during Q4 2018, ahead of their Q1 2019 delivery from the shipyard

Robust financial performance driving balance sheet deleveraging

- Continued to be fully compliant with all financial covenants with sufficient headroom.

- Reaffirms corporate credit ratings by both Moody’s & S&P. Moody’s upgraded the outlook on Topaz from negative to stable.

Proven health and safety track record

- Topaz’s strong commitment to safety is illustrated by 36 consecutive months without Lost Time Injuries (“LTIs”).

René Kofod-Olsen, Chief Executive Officer, Topaz Energy and Marine said:

“Topaz delivered a strong financial performance in 2018, with full year profit after tax (before exceptions) of US$28m compared to a loss of US$24m in 2017. Cash generated from operations after tax increased by US$62m in the last quarter to reach US$146m for the year.

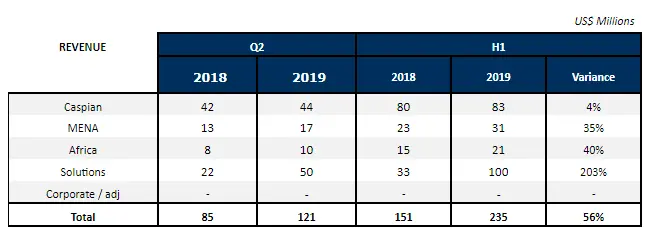

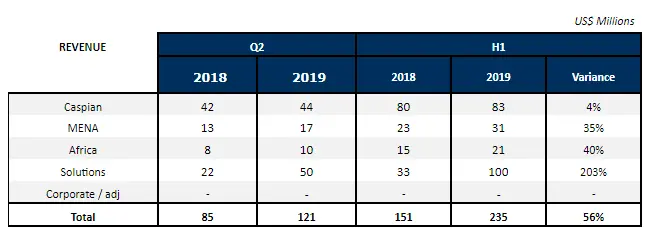

“Our market-leading utilisation rates increased to 86%, compared to 65% in the prior year, driven by higher deployment in our Solutions business through the Tengiz project, MENA and Sub-Saharan Africa fleets, as well as the addition of modern vessels. Our robust business performance was well reflected in our strong financial results for the year, with revenues and EBITDA up by 43% and 61%, respectively, compared to 2017, strengthening our balance sheet, while enhancing our profitability.

“With the stability of our home market position in the Caspian Sea, our transformational Tengiz project and the turnaround achieved in Sub-Saharan Africa, it’s satisfying that our strategies are progressing and delivering robust results, and that our revenue visibility has been further enhanced as our contract revenue backlog increased to US$1.7bn by the end of 2018.

“We remain agile in the management of our asset portfolio to ensure that we are at the forefront of industry innovation to drive growth in established and new markets. Following vessel divestments earlier in the year, we added two modern AHTSVs which were deployed into the growing market in the Kingdom of Saudi Arabia, to service a major oil company. Meanwhile, we secured contracts for the two modern subsea newbuildings which we took delivery of in Q1 2019.

“Tengiz, our strategic marine logistics project, part of Topaz Solutions, delivered better than expected returns in 2018 thanks to operational efficiencies and strict cost control. We expect to capitalise on these and continue delivering robust returns in 2019 as all 20 vessels of the fleet will be earning full revenue for the year.”

Revenue for the 12-month period was US$349m, an increase of 43% compared to US$244m in 2017. This increase was mainly the result of (i) increased revenue from Solutions of US$94m and (ii) increased utilisation in the Africa fleet generating US$24m in revenue. However, this increase was partially offset by (i) loss of revenue of US$18m in the Caspian due to vessels coming off-charter and between projects and (ii) lower revenue from two vessels working on bareboat contracts in the Caspian (US$6m).

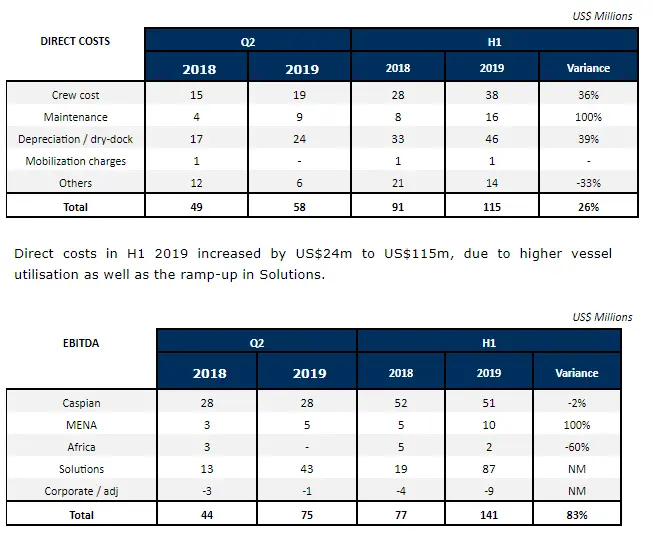

For the 12-month period ended 31 December 2018, direct costs increased by US$25m to US$194m. The increase in costs was directly linked to the higher vessel utilisation in Africa and MENA as well as the ramp-up in Solutions.

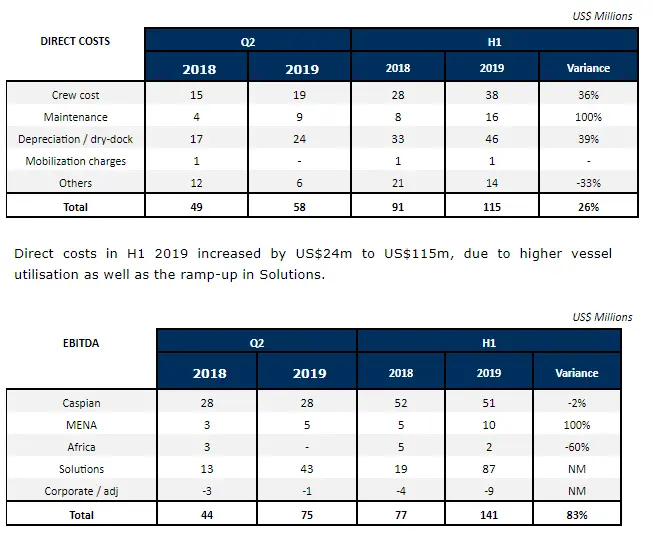

EBITDA increased by US$72m, or 61%, to US$190m during the period. This increase was mainly the result of (i) increased EBITDA from Solutions of US$80m and (ii) improved performance in Africa generating US$18m. However, this increase was partially offset by (i) loss of EBITDA of US$15m in the Caspian fleet due to off-charter post completed projects and (ii) lower revenue from two vessels in the Caspian working on bareboat contracts (US$6m).

Administrative expenses:

Administrative expenses increased by US$13m compared to the same period in 2017 (2018: US$40m; 2017: US$27m) as a direct consequence of the increase in our Solutions business, along with a provision of one-off project related costs.

Finance costs:

On a like-for-like basis, finance costs increased by US$4m, or 7%, to US$63m during the period mainly due to increased debt and LIBOR rates. On an overall basis, finance costs in the period were US$71m which is US$8m lower than the same period last year. Finance costs in the same period last year, however, included a one-off charge incurred on the re-financing of the HY bond of US$19.1m.

Income tax expenses:

Income tax expenses increased by US$6m to US$19m from US$13m in the same period last year due to increased revenue.

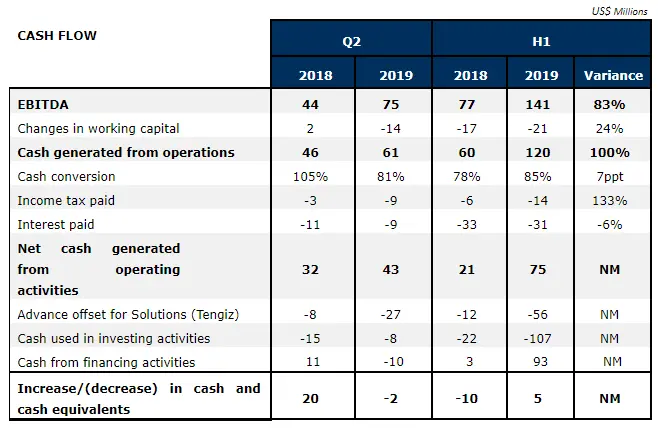

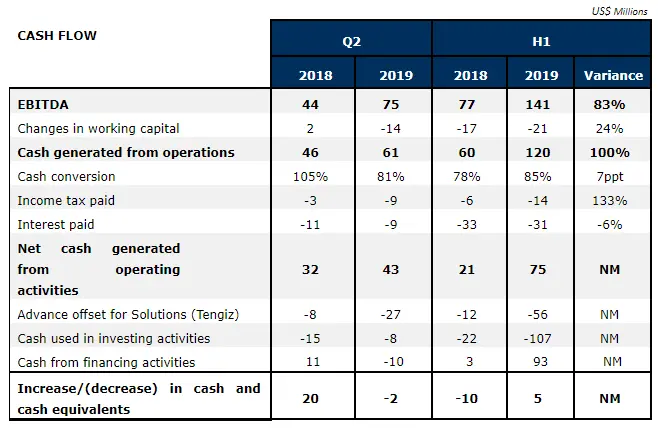

Cash generation as a percentage of EBITDA for the twelve months ended 31st December 2018 was 81% (January to December 2017: 119%). The table below illustrates the cash flow for the reporting period:

The increase in working capital was driven by higher revenue during the period. The outflow on advance offset for Solutions represents the repayment of pre-mobilisation advances on acquired vessels. Interest payments included US$34m bond coupon payments and US$14m of interest payments on the senior secured debt facility. Investing activities include US$29m towards expansion CAPEX, which includes US$~21m for two newbuilt anchor handling vessels, and US$19m towards dry-docking and upgrade CAPEX. Financing activities include senior secured debt repayment of US$32m, dividend payment to minorities of US$17m and a draw-down of US$35m from the RCF facility.

Unutilised banking lines as at 31st December 2018 include an RCF of US$40m expiring in April 2020.

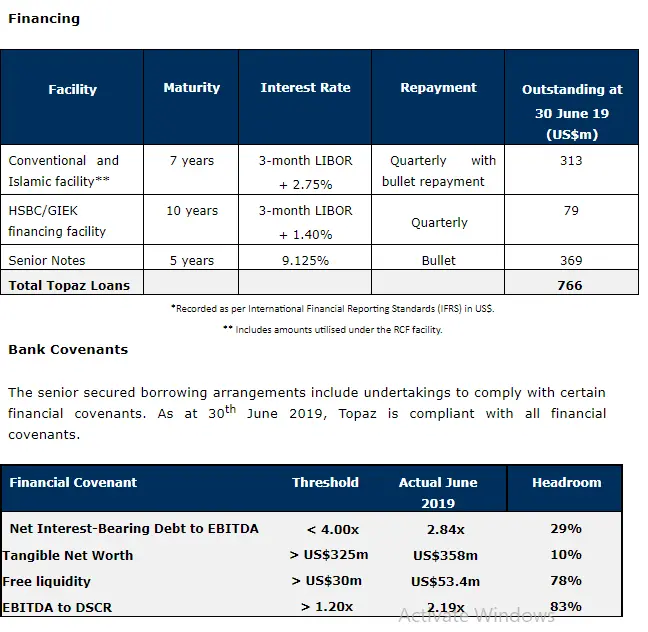

*Recorded as per International Financial Reporting Standards (IFRS) in US$.

** Includes amounts utilised under the RCF facility.

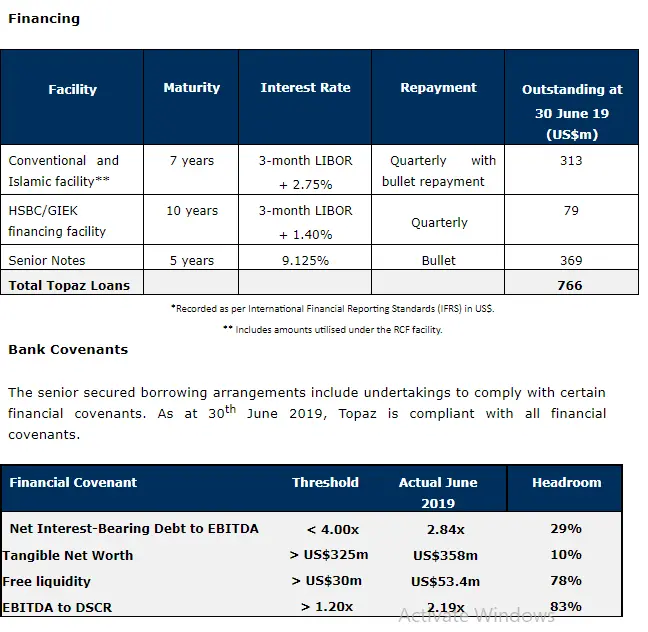

Bank Covenants

The senior secured borrowing arrangements include undertakings to comply with certain financial covenants. As at 31st Dec 2018, Topaz is compliant with all financial covenants.

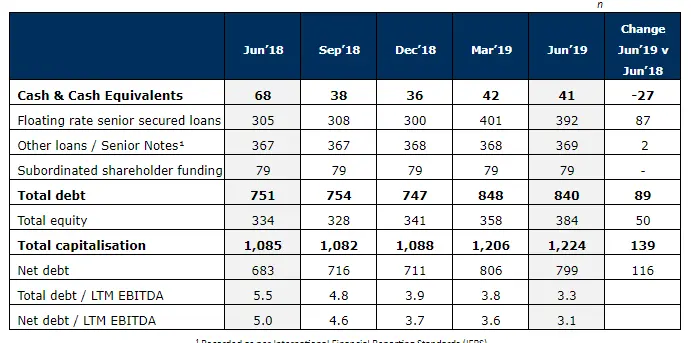

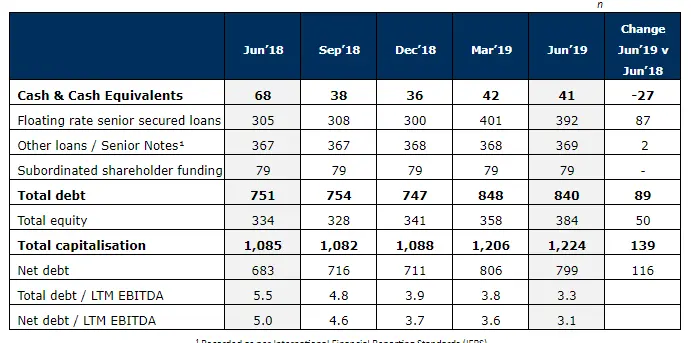

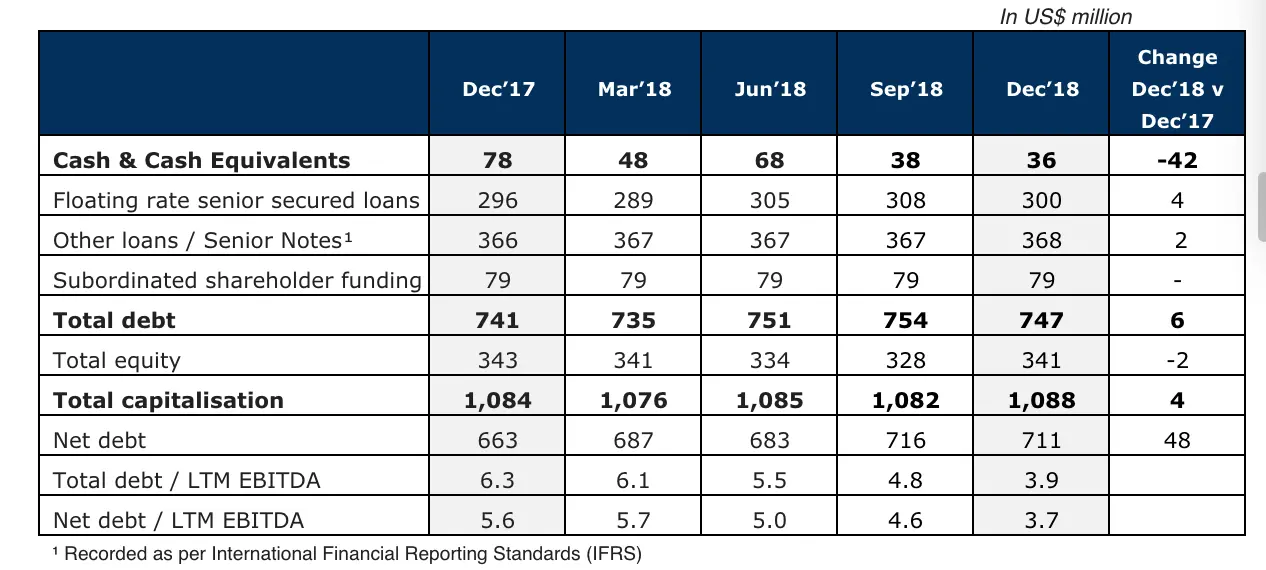

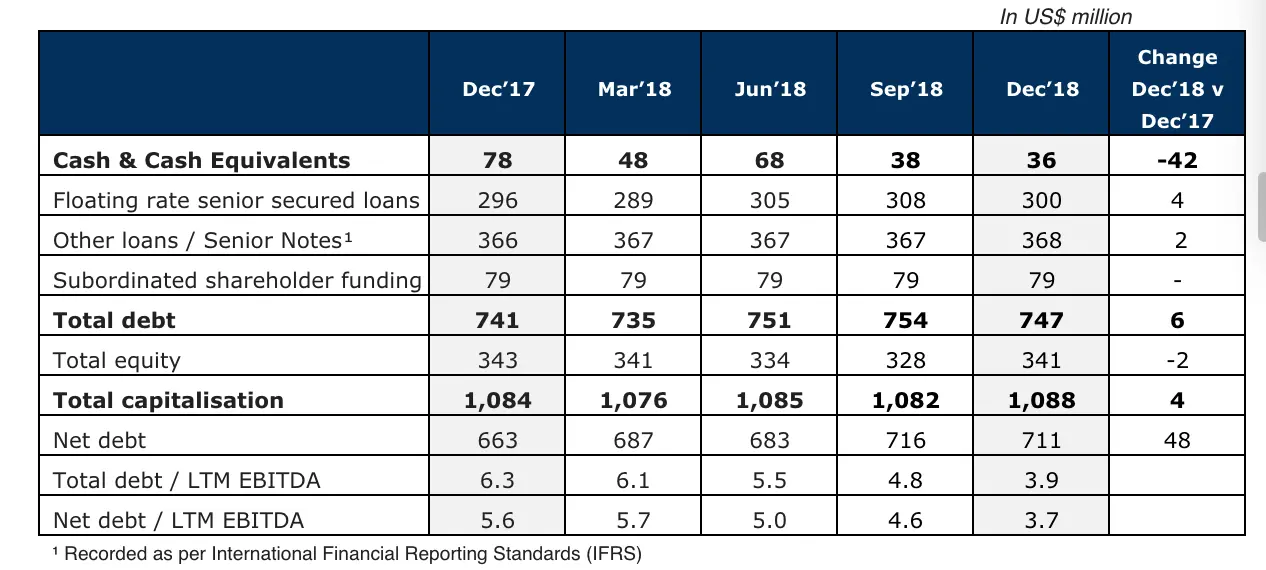

The following table sets out the consolidated cash, total indebtedness, shareholders’

funds, total capitalisation and net debt at the end of the last five quarters.

Other loans / Senior Notes¹

¹ Recorded as per International Financial Reporting Standards (IFRS)

About Topaz Energy and Marine

Topaz Energy and Marine is a leading international offshore support vessel company providing logistics support and marine solutions to the global energy industry with primary focus on the Caspian Sea, the Middle East, West Africa and global Subsea operations. Headquartered in Dubai, Topaz Energy and Marine operates an existing fleet of about 120 offshore support vessels with an average age of approximately nine years. Topaz Energy and Marine is a subsidiary of Renaissance, a publicly traded company listed on the Muscat Securities Market in Oman. In addition, Standard Chartered Private Equity holds a minority position in the company.

For further information, please contact:

Investor Relations:

Morten Wedel Jorgensen

Head of Strategy & Corporate Planning

Tel: +971 4 440 47 00

Email: ir.topaz@topazworld.com

Media Contacts:

FTI Consulting

Email: topaz@fticonsulting.com

Dubai: Jon Earl / Aashti Bawa

Tel: +971 4 437 2100

London: Sara Powell

Tel: +44 (0)203 727 1000

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.