PHOTO

The total value of initial public offerings (IPOs) undertaken by Gulf companies listing their shares on regional stock markets could reach record highs this year - even if the anticipated flotation of a stake in oil giant Saudi Aramco doesn't take place, according to a new report by international law firm Hogan Lovells.

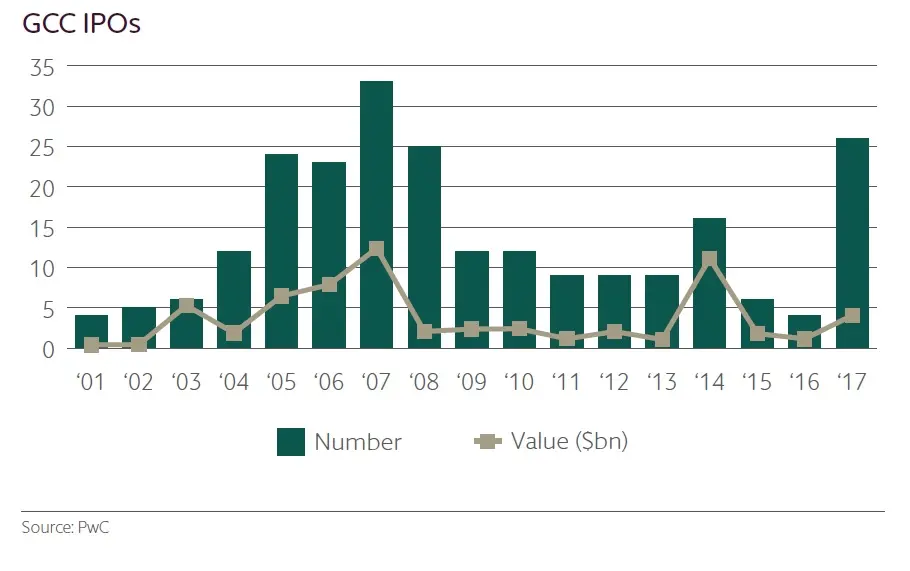

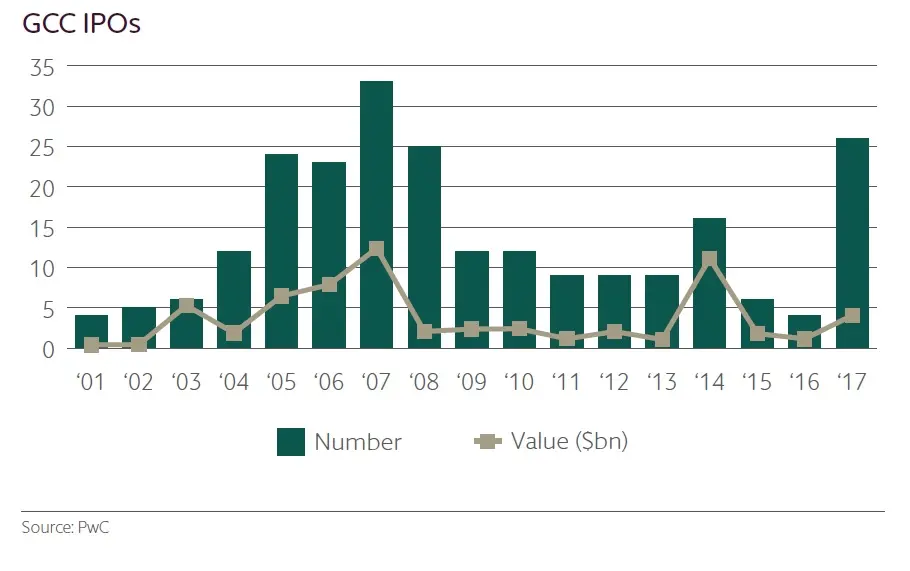

The firm's 'Investment Outlook 2018: Transaction and deal trends in the GCC' report published on Tuesday argued that the market for IPOs in the Gulf picked up sharply last year following two subsequent years of decline.

The 26 entities listed on Gulf exchanges was the second-highest number ever and the $3.7 billion total value of IPOs was the highest since 2007.

"It looks likely that 2018 will be an even better year for the IPO market, with several important listings already confirmed," the report said, pointing to Kuwait’s Shamal Azzour Al Oula, an independent water and power plant that will become the first public-private partnership project to list on Boursa Kuwait.

The report said that it expected a number of sizeable private IPOs to take place, such as Dubai-based GEMS Education's proposed listing on the London Stock Exchange and Riyadh-based Acwa Power's listing in its home market, with "the total value of new listings potentially setting a record even without Aramco".

Notable absentees from public markets in the United Arab Emirates so far have been the big, family firms, Hogan Lovells argued, despite a change to the country’s companies law in 2016 that reduced the minimum float level to 30 percent, which was expected to encourage some of them to list.

Andrew Tarbuck, a Dubai-based partner with Hogan Lovells, told Zawya by email that “an expected uptick in family business IPOs did not occur in 2017, but the more friendly legislative and regulatory environment to enable such conglomerates to come to market remains. Valuation and creating the equity story are the bigger headwinds.”

Global challenges

Another potential barrier facing firms sizing up an equity listing is the recent volatility in global equity markets, which experienced a sudden fall in value earlier this month in response to rising bond yields.

Tarbuck said that global equity markets will be more volatile this year. He said this "should not hinder the launch of regional IPOs in the long-term but there may be more tactical discussion on timing".

The firm also predicted an uptick in mergers and acquisitions this year, but Tarbuck said any increase will be “muted and sector-specific”.

The firm said that it expects the mergers market to be driven by consolidation, especially in the banking, technology and real estate sectors.

In an interview with Reuters on the sidelines of the Global Financial Forum in Abu Dhabi yesterday, the chief executive of Emirates Global Aluminium confirmed that it is planning a stock market listing this year.

“We hope EGA will become a public company in 2018, subject to market conditions,” EGA chief executive Abdulla Kalban told Reuters.

EGA is jointly owned by Abu Dhabi state fund Mubadala and Dubai's sovereign fund, Investment Corporation of Dubai.

The company, which was created through the merger of Emirates Aluminium and Dubai Aluminium, said in a press release on Tuesday that its net profit had increased by 59 percent to 3.3 billion dirhams ($898.6 million) as revenue climbed by 20 percent to 20.5 billion dirhams on the back of a global rise in aluminium prices.

(Reporting by Michael Fahy; Editing by Shane McGinley).

(michael.fahy@thomsonreuters.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018