PHOTO

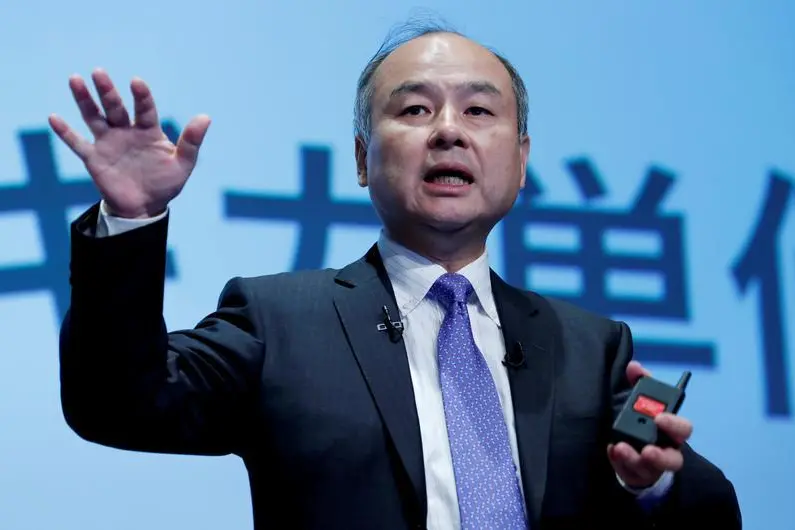

SAN FRANCISCO - Remember Webvan? The ill-fated online grocer was one of SoftBank Group boss Masayoshi Son’s first Silicon Valley forays in the 1990s. It didn’t work out so well as an investment. After this fall’s WeWork rescue, a third shot will encounter more investor skepticism.

A lot of folks made bad bets during the internet’s early days but SoftBank’s misses were outsized, even then. As the bubble burst, the Japanese group’s shares lost almost all of their value from 2000 to 2002, reflecting a paper loss of more than $70 billion for Son.

Webvan, like WeWork, had a big-name founder in Louis Borders, of Borders bookstores fame. It reached a $1 billion valuation less than three years after its birth, becoming the first so-called unicorn. SoftBank’s $160 million investment, mostly just before Webvan went public in November 1999, made it the second-largest shareholder. Webvan filed for bankruptcy in 2001.

To be fair, SoftBank’s biggest investment success also began in those years: its stake in a young e-commerce upstart called Alibaba. And a streamlined WeWork may have a business model that works, just not as well as people hoped before the debacle of its failed initial public offering.

Even assuming WeWork does become profitable, though, today’s media environment amplifies misses, making it harder to shake off. The hit to WeWork’s valuation and the slide in Uber Technologies’ stock since its IPO contributed to a $5 billion write-down at SoftBank’s $100 billion Vision Fund and Delta Fund in the quarter ending in September.

That weighs on Son’s quest for a second, larger Vision Fund. SoftBank has committed $38 billion and the second fund has made about half a dozen investments totaling $3 billion so far, a person familiar with the matter said. But outside capital raising from the likes of Saudi Arabia’s Public Investment Fund, a big backer of the original Vision Fund, has slowed since WeWork’s fall from grace.

SoftBank came back from the dot-com bust largely because of its huge wins with Alibaba and Yahoo Japan. And its current position is by no means dire. The Vision Fund’s investments were collectively still worth more than they cost at the end of September, according to SoftBank data. WeWork has forced SoftBank and its affiliated funds to focus more intently on governance and profitability over top-line growth. Even so, investors know that Vision Fund 2 will be Son’s third chance.

CONTEXT NEWS

- SoftBank Group on Nov. 25 launched a WeWork tender offer for as much as $3 billion in shares, according to Bloomberg. The offer is for stock owned by investors and employees, including up to $970 million for shares owned by the office-sharing firm’s co-founder Adam Neumann. The offer, at the previously announced terms of $19.19 per share, is open until April 1, Bloomberg reported.

- The tender offer to the founders, investors and employees was delayed by a few weeks after SoftBank sought technical revisions to the offer documents, Reuters reported. WeWork said on Nov. 21 that it will lay off around 2,400 employees globally.

- The company, which claimed a $47 billion private-market valuation earlier in 2019, abandoned an initial public offering in September and was rescued by SoftBank in October at a valuation below $8 billion.

(Editing by Richard Beales and Leigh Anderson)

© Reuters News 2019