PHOTO

The top 10 UAE banks posted a 21.2 percent jump in net profits for Q2 as a result of lower provisioning and increased cost efficiency. Additionally, according to a new report, top lenders are likely to focus more on improving their efficacy in the coming period, with increased efforts towards cost optimisation in response to a challenging operating environment.

Despite the market conditions, the banks witnessed a fringe surge in loans and advances as well as in deposit growth. This has added liquidity in the banking system, professional services firm Alvarez & Marsal (A&M) said in its latest UAE Banking Pulse for Q2 2020.

Asad Ahmed, A&M Managing Director and Head of Middle East Financial Services, said: “The profitability of the UAE banks in Q2 2020 rebounded as cost optimisation measures and lower provisioning supported income. The UAE lenders are among the most profitable globally, bolstered by a mix of sound liquidity, strong capitalization, low levels of nonperforming loans and a substantial proportion of non-interest-bearing deposits."

DIB and ADCB reported the highest decline in cost of risk. DIB’s cost of risk declined at the fastest pace (215.4 bps), as the bank had reported one-off impairment charges in Q1 2020. ADCB’s cost of risk fell by 189 bps QoQ, as the bank reported lower provisioning on NMC Health, Finablr and related entities.

While DIB reported the highest RoE (12.6 percent), followed by FAB (10.6 percent), NBF reported losses during the quarter, and consequently, the bank’s RoE remained in the negative range.

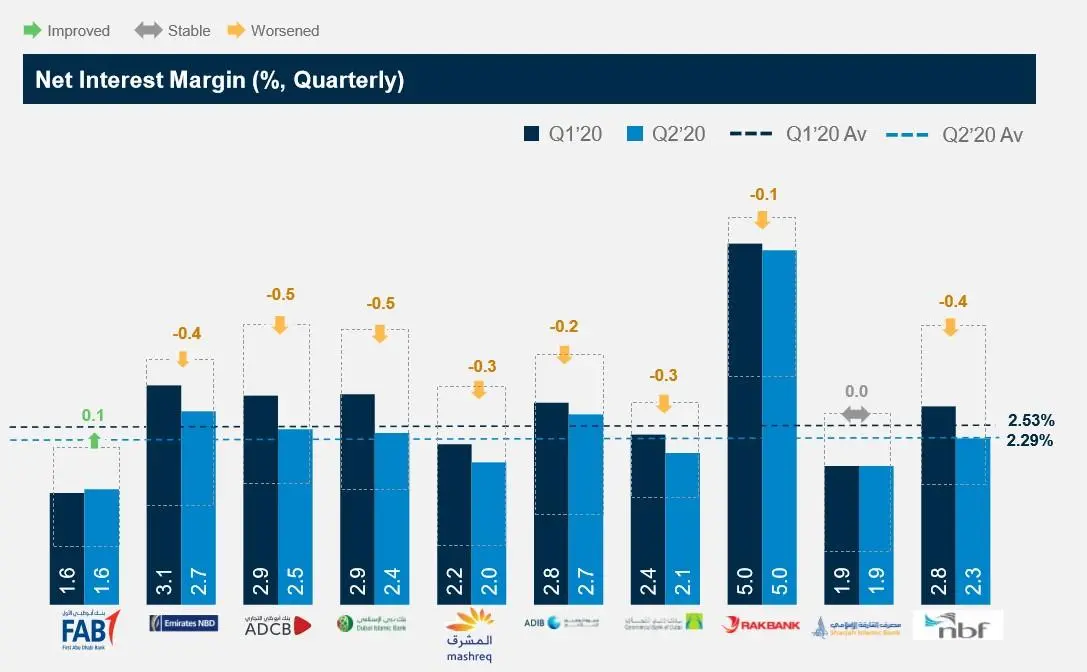

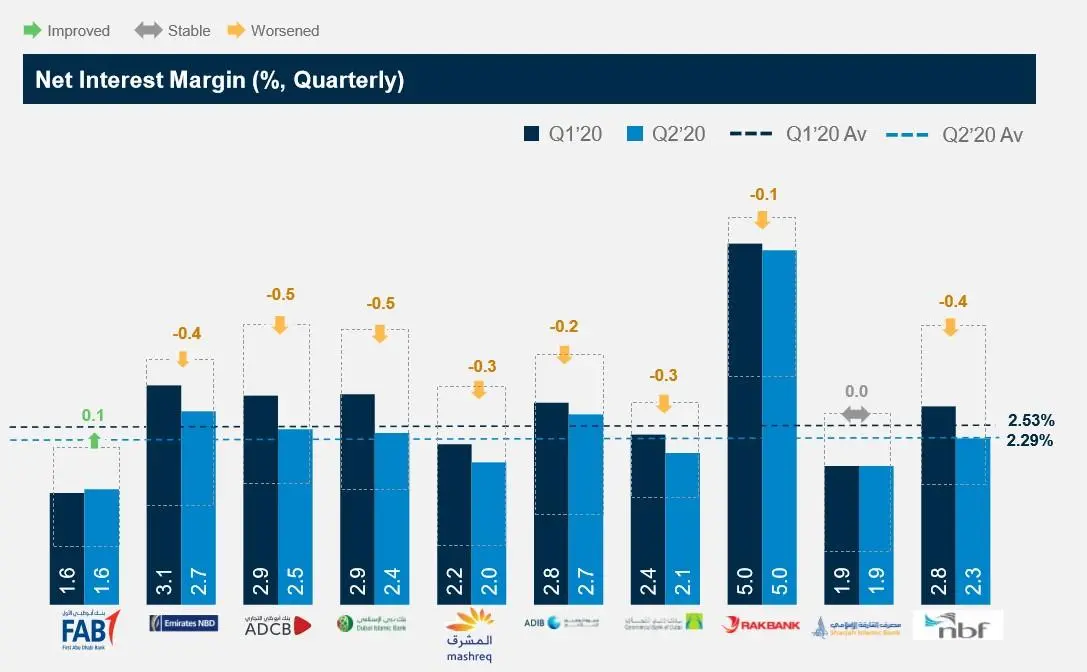

Lenders witnessed a considerable contraction in net interest margins (NIM) in the second quarter due to many factors such as the shift to the marginal cost of funds-based lending rate, and an all-time low interest rates.

DIB reported the steepest contraction (54 bps QoQ), followed by ADCB (47 bps QoQ). On the other hand, FAB’s NIM increased by 5 bps to 1.62 percent. While ENBD’s NIM fell 36 bps, the bank received some support of higher margins through its Turkish subsidiary, DenizBank.

While there has been a peripheral increase in profitability, the outlook for the domestic banking sector still remains subdued as a result of the weakened after-effects of COVID-19, in addition to low oil prices, and the postponement of Expo 2020. Moreover, the low interest environment, along with a possible increase in impairments, is expected to further weigh on profitability.

“While the central bank expects a pickup in corporate credit demand for Q3’20, the recovery would likely be fragile. In the forthcoming quarters, it may be beneficial for banks to introduce efficiency boosting measures and increase their focus towards digitisation to save costs and support the bottom-line,” Ahmed noted.

(Writing by Seban Scaria; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2020