Kuwait: Kuwait Financial Centre “Markaz” recently released its Monthly Market Review report for the month of September 2021. Markaz report noted that Kuwait’s equity market had registered gains for the sixth consecutive month, supported by the rise in oil prices. Kuwait All Share index rose 1.1% during September and extended its yearly gains to 23.8%. Brent crude breached the USD 80 level during the month, supported by the recovery in demand with the easing of the pandemic.

Among sectors, Boursa Kuwait’s Consumer Staples sector was the top gainer, rising 5.9%, followed by Financial Services at 4.7%. Technology sector index registered the biggest decline, falling 2.0% for the month. Boursa Kuwait’s banking sector index was up by 1.0% in September. Among Premier Market stocks, Humansoft Holding Company and Zain were the top gainers during the month, rising 3.1% and 2.0% respectively.

During the month, Boursa Kuwait launched its new Environmental, Social and Governance (ESG) guide to raise awareness and help embrace Corporate Sustainability in Kuwaiti capital market. Meanwhile, the International Institute of Finance (IIF) stated that Kuwait’s efficient vaccination roll-out, coupled with high oil prices and fiscal expansionary policies are set to drive Kuwait’s non-oil GDP growth rate to 3.4% in 2021.

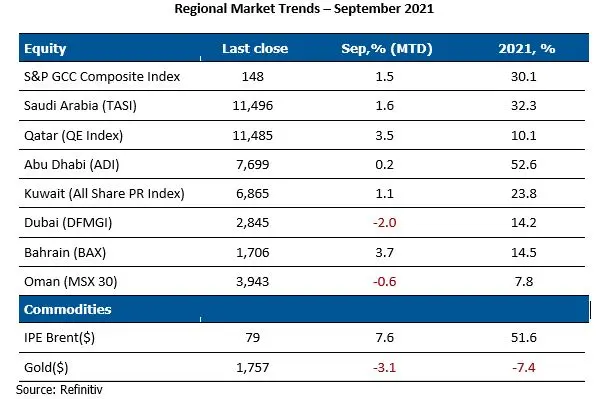

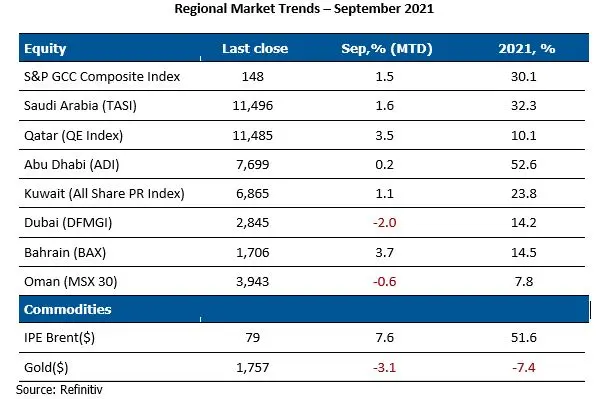

Regionally, S&P GCC composite index rose by 1.5% for the month, supported by the gain in oil prices. Most of the GCC markets registered gains for the month while Dubai and Oman declined. Bahrain was the biggest gainer among GCC, rising 3.7%. Qatar, Saudi Arabia and Abu Dhabi gained 3.5%, 1.6% and 0.2% respectively while Dubai lost 2.0%. Among the GCC blue chip companies, the best performer was Industries Qatar, which gained 20.2% during the month, followed by UAE’s First Abu Dhabi Bank, which gained 4.6%.

The Central Bank of UAE (CBUAE) decided to gradually unwind stimulus measures introduced to mitigate the economic slowdown caused by COVID-19 after its positive assessment of the UAE’s financial system. CBUAE will begin the withdrawal of its Targeted Economic Support Scheme (TESS) to avoid restricting credit supply and economic growth. After recording five straight years of growth, global sukuk issuances are expected to be flat or reduce slightly in 2021 compared to the previous year due to reduced funding needs of GCC governments on account of rising oil prices, as per Moody’s.

Global equity markets ended the month in negative territory following mixed economic signals and concerns over U.S. Fed tapering. The MSCI World and S&P 500 (U.S.) indices lost 4.3% and 4.8% respectively for the month while Japan (TOPIX) stood out with gains of 3.5%. Japanese stocks climbed to a 30-year highs after Prime Minister Yoshihide Suga’s plan to resign spurred hope that his successor will increase stimulus spending. FAANG Stocks were in the red for September with the exception of Netflix due to rising 10-year U.S. Treasury yields. Emerging market stocks continued their poor run, falling 4.2% in September. Chinese markets came under the radar as Evergrande, one of the biggest real estate companies in the world, found itself in the middle of a severe debt crisis. Many analysts fear that it could even turn into China's Lehman Brothers moment, as nearly 30% of China’s GDP contribution is from Real Estate and related industries.

Oil prices closed at USD 78.5 per barrel at the end of the month as OPEC and its allies struggled to meet rising global oil demand due to underinvestment or maintenance delays from the pandemic, causing prices to rise. OPEC’s meeting in September concluded with members agreeing to raise output again in October.

-Ends-

About Kuwait Financial Centre “Markaz”

Established in 1974, Kuwait Financial Centre K.P.S.C “Markaz” is one of the leading asset management and investment banking institutions in the MENA region with total assets under management of over KD 1,037 million as of 30 June 2021 (USD 3.45 billion). Markaz was listed on the Boursa Kuwait in 1997.

For further information, please contact:

Sondos Saad

Media & Communications Department

Kuwait Financial Centre K.P.S.C. "Markaz"

Email: ssaad@markaz.com

markaz.com

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.