The commodity sector delivered a surprisingly strong return during the first quarter of 2019 with the Bloomberg Commodity Index trading higher by 9 percent. This remarkable development relates to the fact that the rise was led by growth-dependent commodities such as energy (+17 percent) and industrial metals (+12.5 percent).

Markets, including commodities, began the year on the defensive with growth concerns and United States Federal Reserve-led liquidity tightening araising concerns about the prospects for 2019.

The year, however, was only a few weeks old before global policy panic set in. In early January, the Fed hit the pause button before abandoning it at the end of the quarter while calling a halt to further quantitative tightening. The Bank of Japan and the European Central Bank followed suit with their own measures, while in China the government stepped in with various initiatives to stabilise the economy as the chance of a trade deal between Washington and Beijing helped sentiment further.

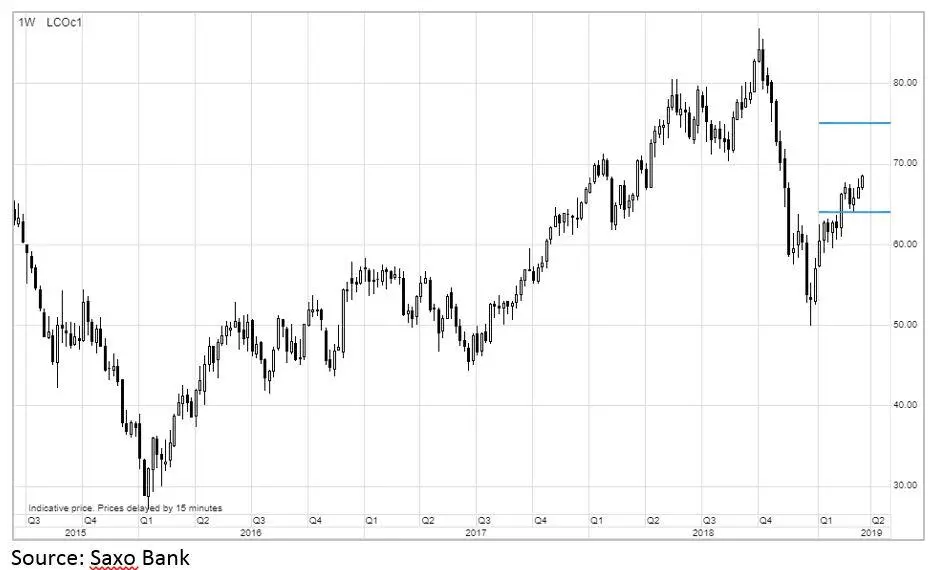

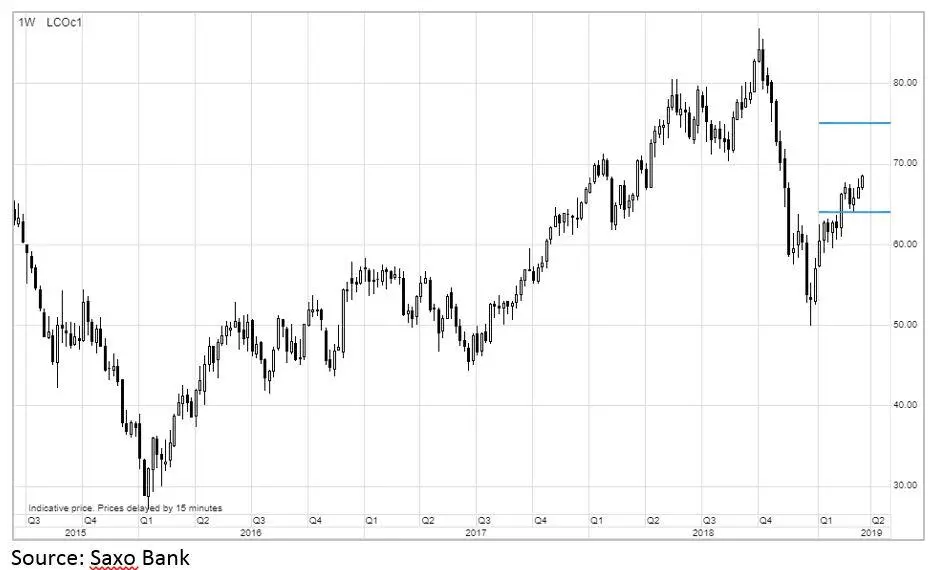

Crude oil’s near-40 percent rally from the December low has resulted in both WTI and Brent clawing back half the losses seen between October and December. With global demand growth holding up despite the prospect for lower global growth, the market has instead been left to focus on a near-perfect storm of price-supportive supply news.

Aggressive production cuts (both voluntary and involuntary) from the Opec-plus group of producers have seen supply from these countries drop by more than was expected. Saudi Arabia was probably angered by the price collapse following the surprise U.S. decision to grant waivers to buyers of Iranian oil and has been cutting production aggressively since then. In addition to these cuts, which hinge on continued cooperation between Russia and Saudi Arabia, the involuntary cuts from Venezuela and Iran (down 1.6 million barrels per day during the past year) have added an additional layer of support.

The six-month waiver that the U.S. granted to buyers of Iranian oil back in November is due to expire in early May and this has raised some questions about what will happen next. But with Opec-plus continuing to cut production and the US forcing down exports from Iran and Venezuela, only a major change in the outlook for demand will alter the current positive sentiment.

Several Opec producers, and Saudi Arabia in particular, need oil back above $80 per barrel to meet their fiscal obligations and they are unlikely to be satisfied with Brent at $70 per barrel. On that basis, we expect supply to be kept tight over the coming months, thereby supporting a potential extension towards $75 per barrel before it eventually runs out of steam amid renewed concerns about the negative impact to global growth.

Click image toi enlarge

The dramatic recent turnaround at the Fed is seen as bullish for gold as the return to a dovish stance highlights the risk of a gold-supportive recession within the next 12 months. The second quarter, however, may not yet provide the spark gold needs to break strong resistance between $1,360/oz and $1,380/oz. Into the second half, however, a formidable challenge could be seen amid support from a weaker dollar, stable-to-lower bond yields and concerns about global stocks’ ability to forge higher amid raised growth concerns.

We should always keep in mind that many investors buy gold to hold as an insurance policy against adverse movements across other investments such as stocks. On that basis, it is worth keeping a close eye on flows in and out of the exchange-traded products often used by long term investors. So long as stocks continue to show their current resilience, gold is unlikely to mount a strong enough challenge at the massive area of resistance between $1,360/oz and $1,380/oz.

Investors who remain bullish about gold might consider silver, as it remains the “forgotten metal” and is trading 12 percent below its five-year average relative to gold. Another is platinum, which should be supported by its historic $700-plus discount to palladium and its $400-plus discount to gold.

High-grade copper has managed to reclaim half of what was lost in the aftermath of the US-China trade war breaking out last year. The combination of an eventual de-escalation of the trade conflict and the Chinese policy easing already in place, combined with a relatively tight supply outlook, should continue to provide the support copper needs to yield a positive return in 2019. However, having already returned to our H2 2019 target of $3 per pound we see the upside as limited into the second quarter. On that basis, we are looking for a potential $2.80 per lb to $3.05 per lb trading range to emerge.

Any opinions expressed here are the author’s own.

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.