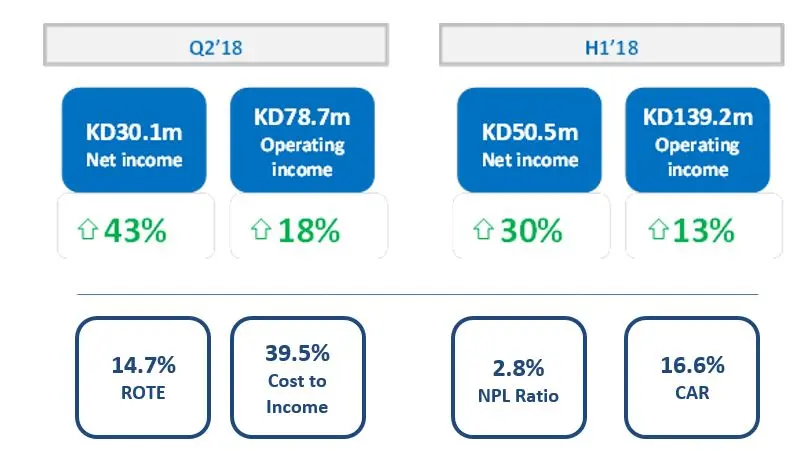

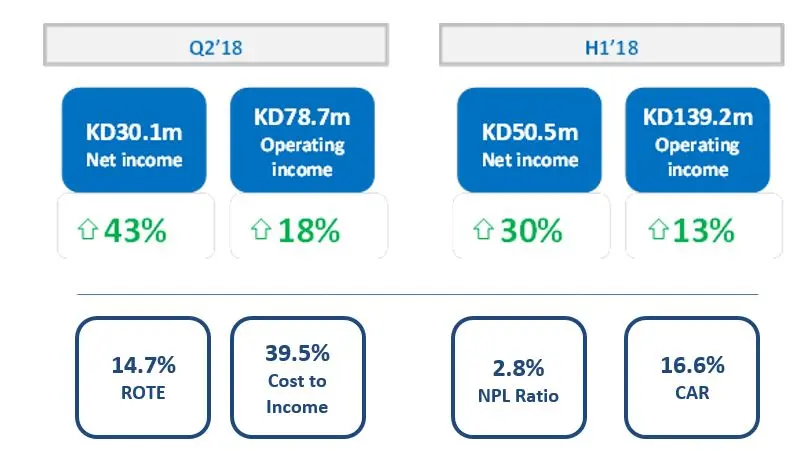

Operating Income reaching KD139.2 million (USD462 million) in H1, 13% growth YoY reflecting Solid Operating Capabilities

Cost to Income Ratio at 39.5% showing continues improvement in operating efficiencies

Capital at adequate levels with Capital Adequacy Ratio at 16.6%

Kuwait: Burgan Bank Group announced today its first half earnings for the financial year 2018 reporting KD50.5 million (USD168 million) with a growth of 30%. During the second quarter the Bank registered KD30.1 million (USD100 million) growing 43% in comparison to the same period last year. The set of results for the period ending in 30th June 2018 demonstrated solid operating capabilities and efficiencies. Earnings per share grew for the first half by 34% year-on-year reaching 20 Fils, and achieving return on tangible equity (ROTE) of 14.7% for the same period.

During the first half of 2018 and compared with the same period of 2017, operating income grew by 13% to reach KD139.2million (USD462 million). Asset quality measured by the Non-performing loans (NPL) to gross loans ratio, was significantly enhanced when compared to the same period in 2017, with NPL to gross loans ratio declining from 4.3% to 2.8% while NPL coverage ratio reached 168.5%.

Mr. Majed Essa Al Ajeel, Chairman of Burgan Bank Group said: “We are very pleased with the overall performance of Burgan Bank Group. Our strategy continues to deliver, our business model is solid, and our execution and deliverables are well ahead of expectations.”

“We trust our operating capabilities. Our domestic and international Banking arms are delivering and we are reaping the diversification benefits with our international operations contributing 42% thus diversifying risk, enhancing our revenue stream composition, and grasping the opportunity to benefit from operating higher growth markets. Our business pipeline remains strong with a focus on prudence and selective growth.” added Al-Ajeel.

"On behalf of the board, I take this opportunity to thank our customers and shareholders for their confidence in our capabilities. I would also like to thank our executive management team for their leadership and the excellent execution of the corporate strategy, and to our staff for their continued support and commitment." concluded Al Ajeel.

The consolidated financials encompass the results of the Group’s operations in Kuwait, and its share from its regional subsidiaries, namely Burgan Bank – Turkey, Gulf Bank Algeria, Bank of Baghdad, Tunis International Bank. Burgan Bank Group has one of the largest regional branch networks with 169 branches across Kuwait, Turkey, Algeria, Iraq, Tunis, Lebanon and representative office in Dubai-United Arab Emirates.

© Press Release 2018Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.