PHOTO

North Korea denounced on Wednesday United States-South Korean military exercises as a provocation and called off high-level talks with Seoul, raising concerns on the June 12 summit planned in Singapore between the U.S. President Donald Trump and the North Korean leader.

Global markets

Asian shares dropped early on Wednesday as tensions in the Korean Peninsula worried investors.

MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.1 percent.

South Korea's KOSPI was 0.4 percent lower, Japan's Nikkei was down 0.3 percent.

On Wall Street, the Dow Jones Industrial Average fell 193.00 points, or 0.78 percent, to 24,706.41, the S&P 500 lost 18.68 points, or 0.68 percent, to 2,711.45 and the Nasdaq Composite dropped 59.69 points, or 0.81 percent, to 7,351.63.

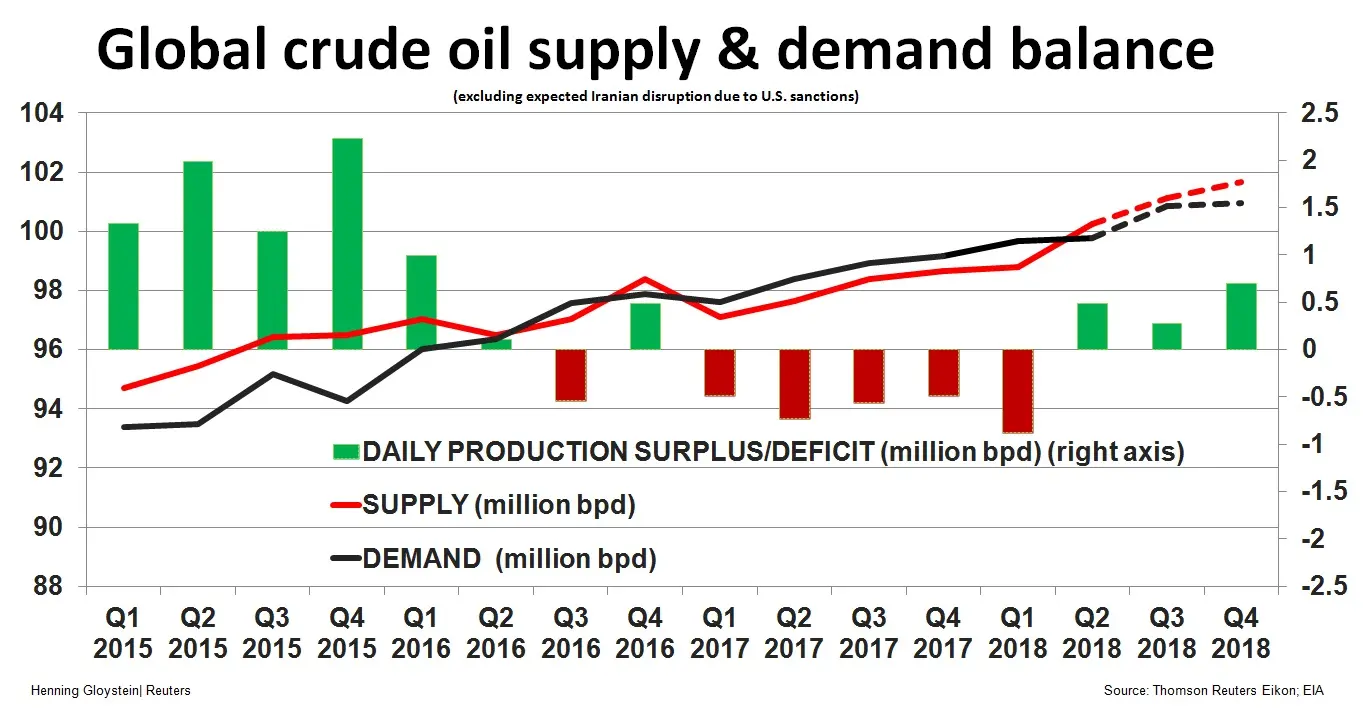

Oil prices have been trading lately near high levels not seen since November 2014 and global demand has been rising sharply

Please click here to gain a deeper understanding of financial markets through Thomson Reuters Eikon.

Middle East markets

Stock markets in the Middle East were mixed on Tuesday.

Dubai’s index added 1.1 percent, as Dubai investments jumped 7 percent, Drake & Scull added 5.3 percent and Emaar Properties rose 2.6 percent.

Emaar Development gained 1.5 percent after MSCI decided overnight to add the stock to its United Arab Emirates index at the end of this month; the decision had been widely expected.

Abu Dhabi’s index rose 0.5 percent as First Abu Dhabi Bank rose 0.9 percent and Aldar Properties closed 1 percent up.

Saudi Arabia’s index lost 0.4 percent, dragged down by property developer Jabal Omar and the kingdom's largest food products company Savola which fell 2.6 percent and 4.1 percent respectively.

"The index has recovered from its recent correction and remains solid above 8,000 points, backed by upbeat sentiment as investors await MSCI's announcement over the next two to three weeks," Muhammad Faisal Potrik, head of research at Riyad Capital, told Reuters.

MSCI will announce in June whether it will upgrade Saudi Arabia to emerging market status.

"We expect banks and petrochemicals to lead market movement over the next few weeks, although activity will usually be lower during Ramadan," he added.

Qatar’s index closed 0.1 percent lower, Qatar Gas Transport fell 6.3 percent after MSCI downgraded the stock to its small cap index.

Egypt’s index was flat, Bahrain’s index rose 0.2 percent while Oman’s index fell 0.1 percent and Kuwait’s index rose 0.3 percent.

Oil prices

Oil prices fell early on Wednesday as a rise in supply outweighed ongoing production cuts led by OPEC.

Brent crude futures were at $78.17 per barrel at 0210 GMT, down 26 cents, or 0.3 percent, from their last close.

U.S. West Texas Intermediate (WTI) crude futures were at $71.02 a barrel, down 29 cents, or 0.4 percent, from their last settlement.

Currencies

The dollar index against a basket of major currencies was up 0.05 percent at 93.270. On Tuesday, the index had hit its highest level this year, lifted by the 10-year yield.

Against the yen, the dollar was mostly flat at 110.29 yen.

Precious metals

Gold prices recovered slightly on Wednesday.

Spot gold rose 0.3 percent to $1,293.89 per ounce at 0330 GMT, after shedding 1.7 percent and marking the lowest this year at $1,288.31 in the previous session.

In other news…

Tunisia’s investment minister said on Tuesday that the country’s economy grew 2.5 percent in the first quarter of 2018, compared to 1.9 percent in the same period a year ago.

(Writing Gerard Aoun; Editing by Shane McGinley)

(gerard.aoun@thomsonreuters.com)

For access to market moving insight, subscribe to the Trading Middle East newsletter by clicking here.

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018