PHOTO

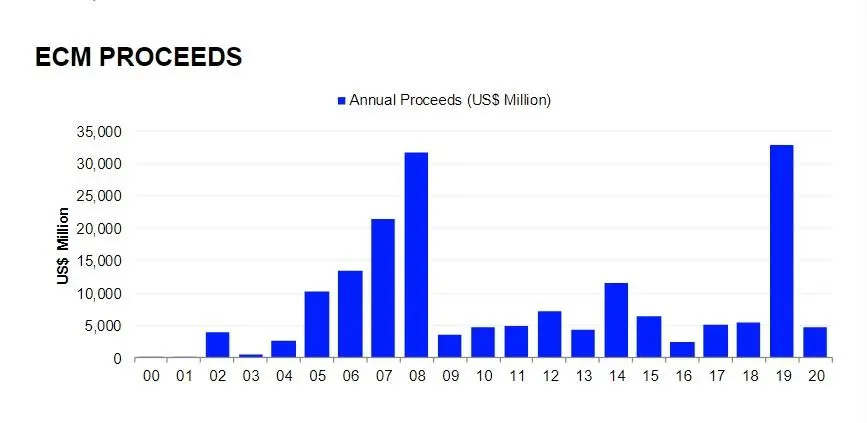

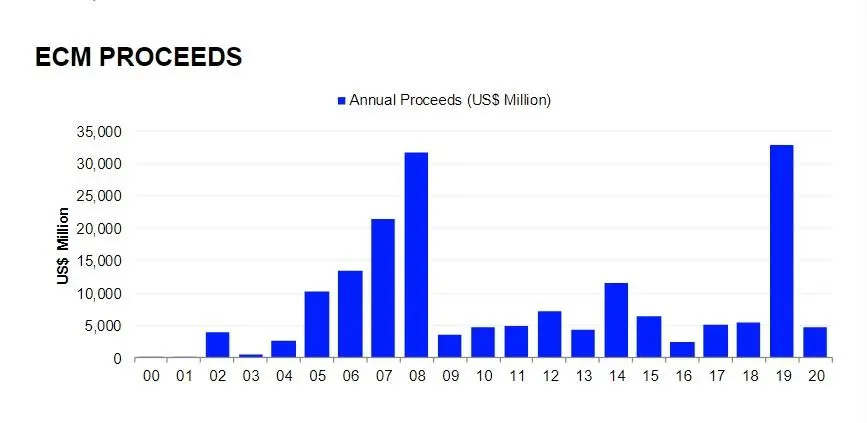

Equity and equity-related issuance in the Middle East and North Africa (MENA), which totalled $4.6 billion in 2020, is down 86 percent from 2019, a four-year low in equity capital market (ECM) proceeds, according to global data provider Refinitiv.

The largest ECM issuance in MENA was the $1.2 billion follow on from Mobile Telecommunications Company, Saudi Arabia (Zain KSA) in October 2020.

With the increase, the company’s shares went up from more than 448.729 million to 898.729 million. The offering price was set at 10 Saudi riyals a share.

According to the company, the increase was proposed to capitalise “part of the amounts due to Zain Kuwait”, which owns 37 percent of Zain KSA, and to pay “part of the Murabaha facility”.

Dr. Sulaiman Al Habib Medical Group issued the largest IPO of 2020 in MENA, raising $699.7 million in proceeds. The medical group is one of the biggest providers of health care in Saudi Arabia, operating hospitals, outpatient clinics, pharmacies and medical labs throughout the kingdom as well as in Dubai and Bahrain. Its IPO was the first in Saudi Arabia since state-owned oil company Saudi Aramco raised almost $30 billion in December 2019.

According to Refinitiv, Saudi Arabia and the UAE were the top issuing countries in the region.

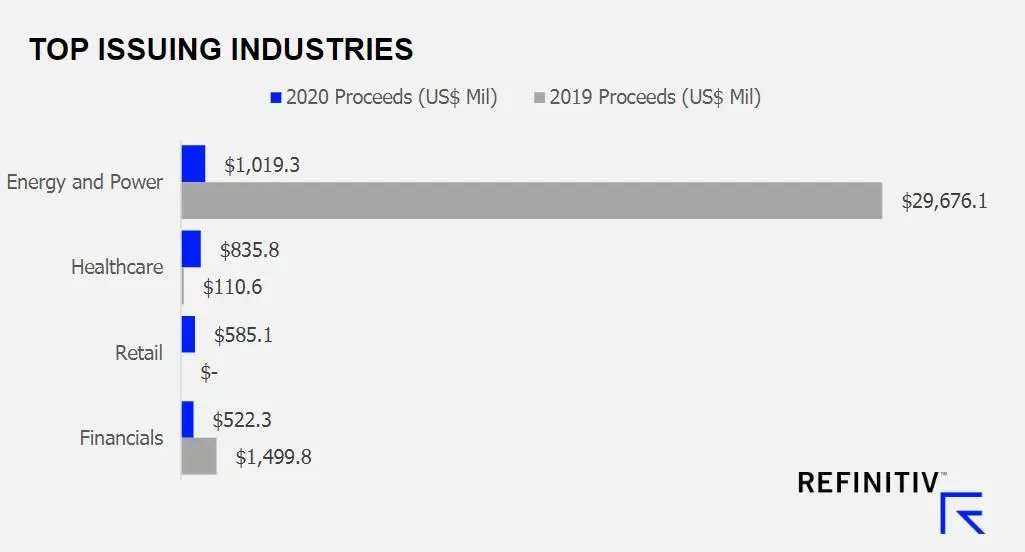

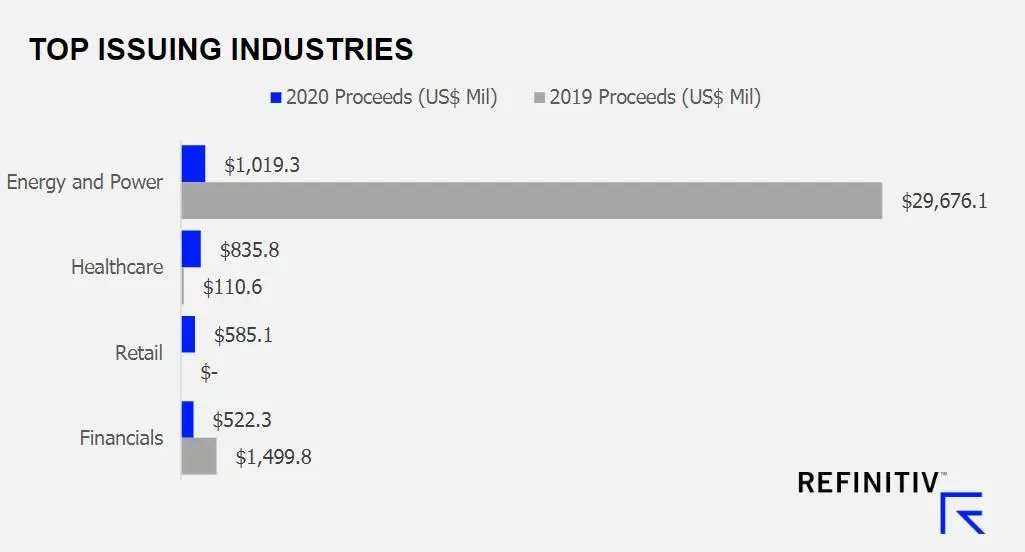

The energy sector was the best forming sector with $1 billion in equity proceeds. This was followed by the healthcare and retail sector which raised $835.8 million and $581.1 million respectively in equity proceeds.

Citi Bank takes the top spot inthe MENA ECM league table in 2020 with a 15 percent market share, closely followed by First Abu Dhabi Bank PJSC with 14 percent, Refinitiv data said.

(Reporting by Seban Scaria; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021