PHOTO

Stock markets in the region performed well in H1 2019, as oil and world stocks surged during the first six months of the year.

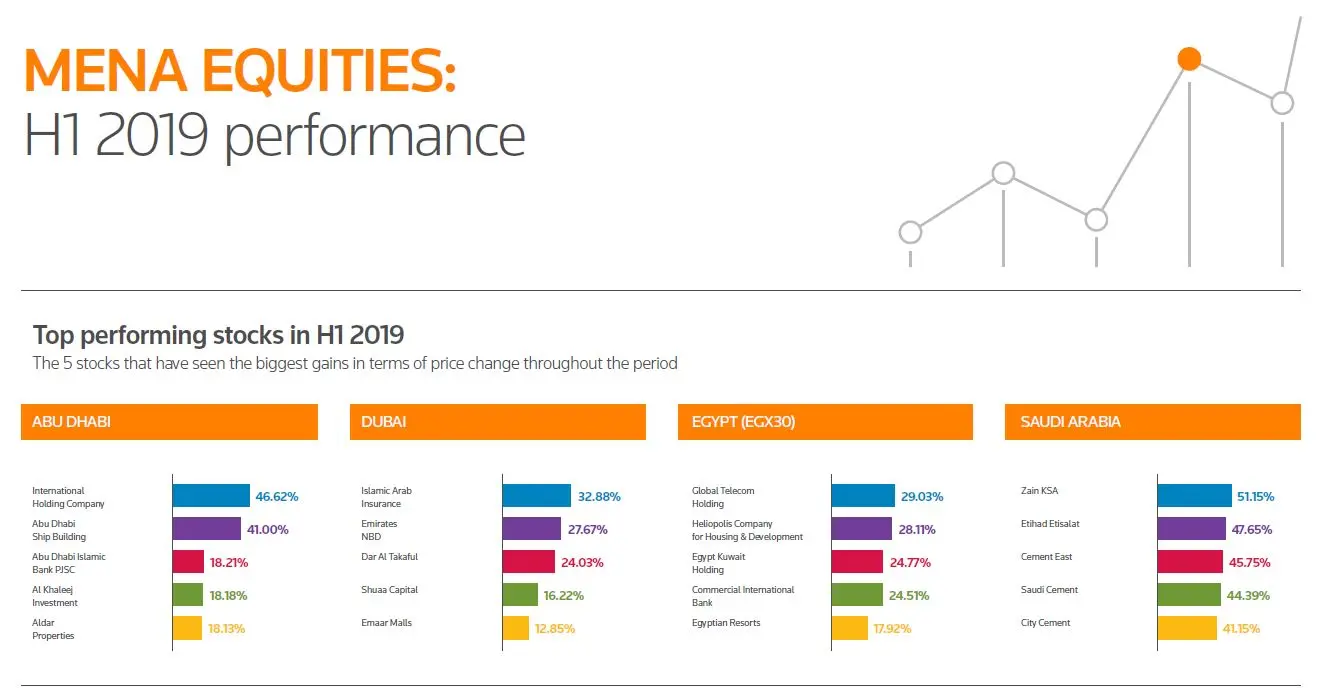

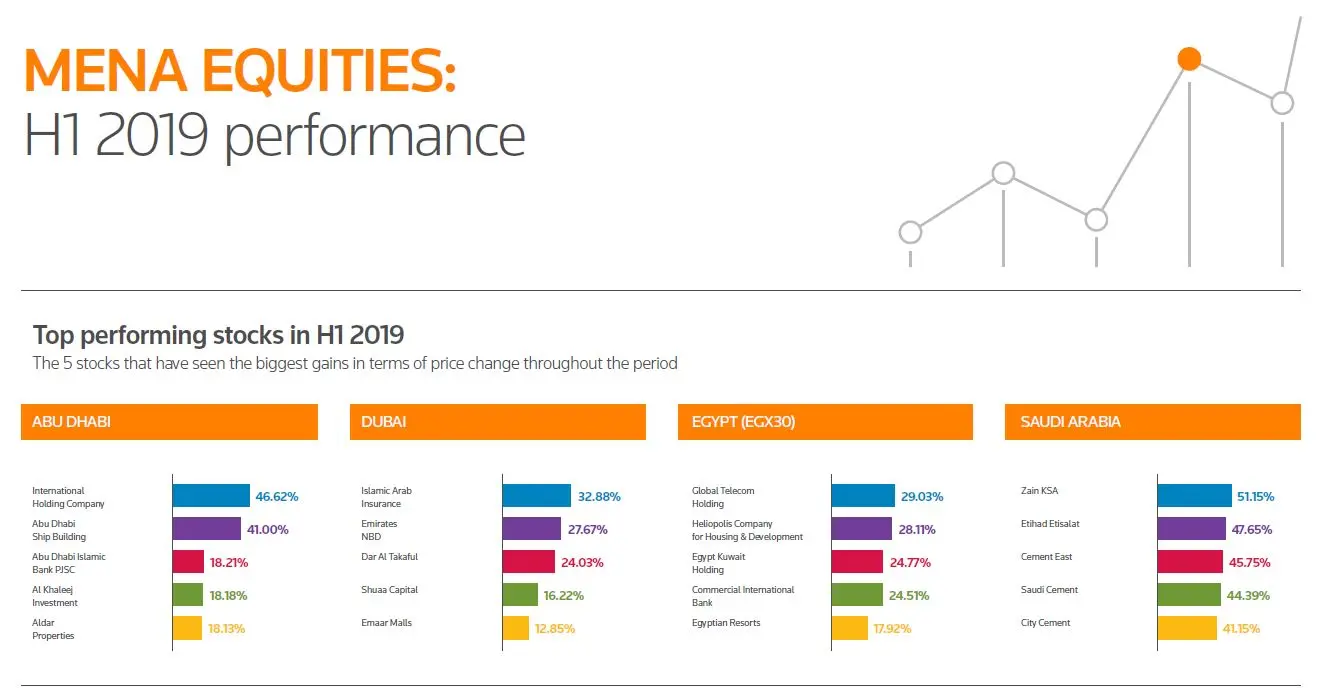

Zawya has compiled data on the top and worst performing stocks in the UAE, Saudi Arabia and Egypt in the first half of the year and calculated the change in market capitalisation in each of the listed countries, based on data from Refintiv’s Eikon.

Click on the image above to open the full PDF version in a new tab.

Sharing views on MENA markets’ performance in H1 2019, Charles-Henry Monchau, head of investment management at Dubai-based Al Mal Capital said: “When looking back at macro numbers over H1 in the region, we can see clear signs of a divergence in local business cycles. Encouragingly, some of the largest regional economies – including Saudi Arabia, the UAE and Egypt – are all showing signs of an acceleration in consumption and investment.”

Saudi Arabia, the biggest market in terms of index weight closed flat in Q2 2019. “May saw the first phase of passive money flowing in from MSCI trackers,” Monchau noted.

“Growth in the oil sector slowed sharply to only 1.0 percent y-o-y in Q1 from 5.9 percent in Q418, and with OPEC having recently announced an extension to its production-cut agreement through the end of 2019, the sector is likely to remain a headwind on the broader economy this year,” he said, adding, “That said, it can certainly be argued that while the overall pace of growth has slowed, the quality of Saudi Arabia’s economic recovery has actually improved.”

Though UAE once again underperformed the wider S&P Pan Arab Index in the second quarter of 2019 according to Al Mal Capital’s Monchau, there were marked differences between Abu Dhabi and Dubai.

Dubai’s index rose 5.09 percent in H1 2019, while Abu Dhabi’s index gained 1.32 percent. For Q2 2019, Abu Dhabi’s index fell 1.87 percent and Dubai’s index rose 0.9 percent.

The Augmented Economic Coincident Indicator which is calculated and published by the central bank showed growth in the non-oil economy rising to 1.6 per cent y/y in Q1

“This pace of expansion is below historical trend, but also indicative of an economy on the mend. Particularly encouraging from our point of view was the strong rebound in employment growth in the first three months of 2019, as there was a net +60k new jobs created in the UAE’s private sector in this time period,” Monchau said.

On Egypt he said: “Egypt, which did very well during the first quarter gave back some of the gains (-4 percent in Q2 2019), as inflation stayed due to electricity price hikes and fuel subsidy reforms.”

“The Egyptian economy’s recovery has been stellar, with headline GDP growth running between 5.0-5.5 percent currently.”

(Writing by Gerard Aoun, editing by Seban Scaria)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019