PHOTO

BENGALURU - Indian shares were largely unchanged on Friday, as a fall in Reliance Industries was offset by gains in financial stocks, although the indexes were on track to rise about 0.6% each for the week.

By 0455 GMT, the blue-chip NSE Nifty 50 index was flat at 15,790.65 while the benchmark S&P BSE Sensex was down 0.05% at 52,672.32.

Both the indexes were set to post their fifth weekly gain in six weeks, helped by declining COVID-19 cases, easing of restrictions and a recent record surge in daily vaccinations.

Nomura said in a research note on Thursday the country's vaccination rate "skyrocketed" this week, averaging six million doses per day.

"Overall, (Indian markets) have done fairly well and for the second quarter India is the best performing market across the Asia region," said Amit Shah, head of India equity research at BNP Paribas in Mumbai.

Investors are now waiting for some new data points, and in the meantime, the markets will see sector rotation and individual stock-picking, he added.

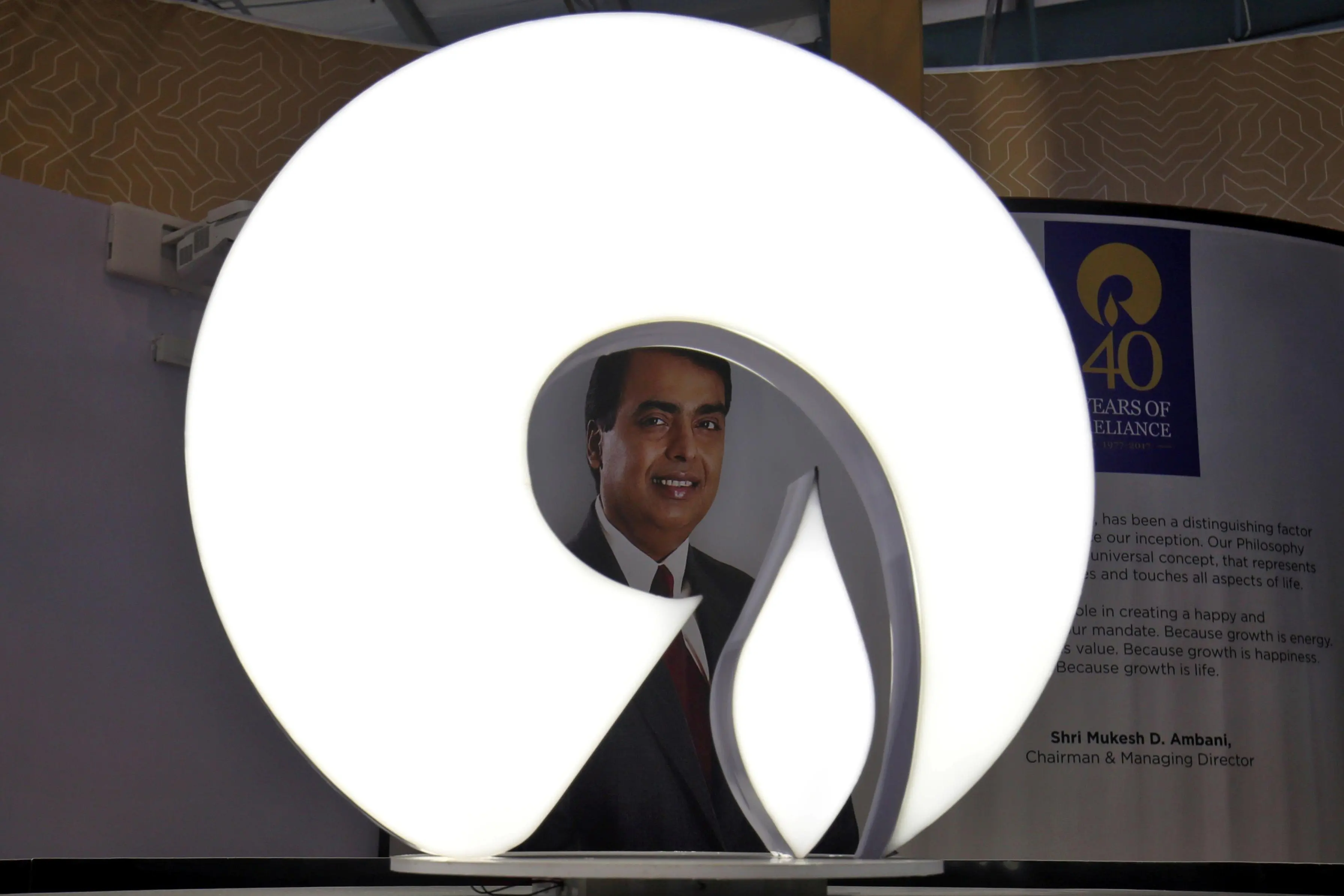

Conglomerate Reliance fell 2.5% and was the biggest drag to the Nifty 50.

At its annual general meeting on Thursday, Chairman Mukesh Ambani said he expects the company to formalise its partnership with Saudi Aramco this year, without providing any specific details, while adding that Aramco Chairman Yasir Al-Rumayyan will join the board as an independent director.

The Nifty Bank index added 0.60% and was on track for its second straight session of gains. Private-sector lender ICICI Bank and top lender by assets State Bank of India were among the biggest boosts to the Nifty 50.

Truck and bus maker Ashok Leyland jumped 7.7% after it reported a March-quarter profit versus a loss last year. Its quarterly truck volumes more than doubled year-on-year.

(Reporting by Anuron Kumar Mitra in Bengaluru; editing by Uttaresh.V) ((AnuronKumar.Mitra@thomsonreuters.com; +91 99863 58469;))