PHOTO

S&P Global Ratings on Monday announced it had lowered its forecast for oil prices by $10 per barrel (bbl) for 2019 and by $5/bbl for 2020, amid concerns a global economic slowdown will dent demand, while increased production of U.S. shale will see supply remain relatively static.

The ratings agency lowered its average annual price assumptions for Brent and West Texas Intermediate (WTI) crude oil for 2019 down to $55/bbl and $50/bbl respectively, with these average prices likely to remain stable until 2021. (Read the full S&P Global Ratings report here).

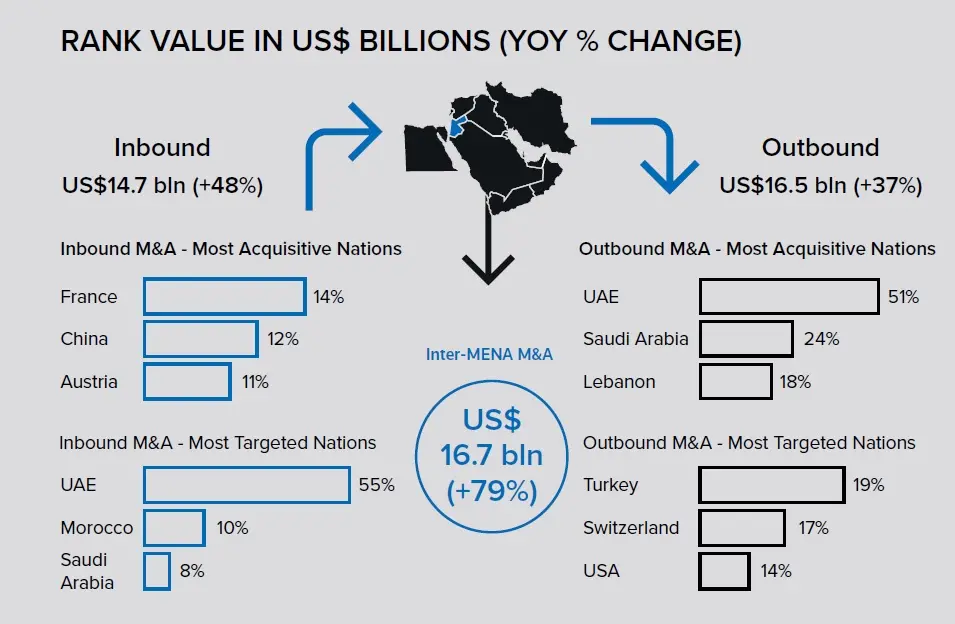

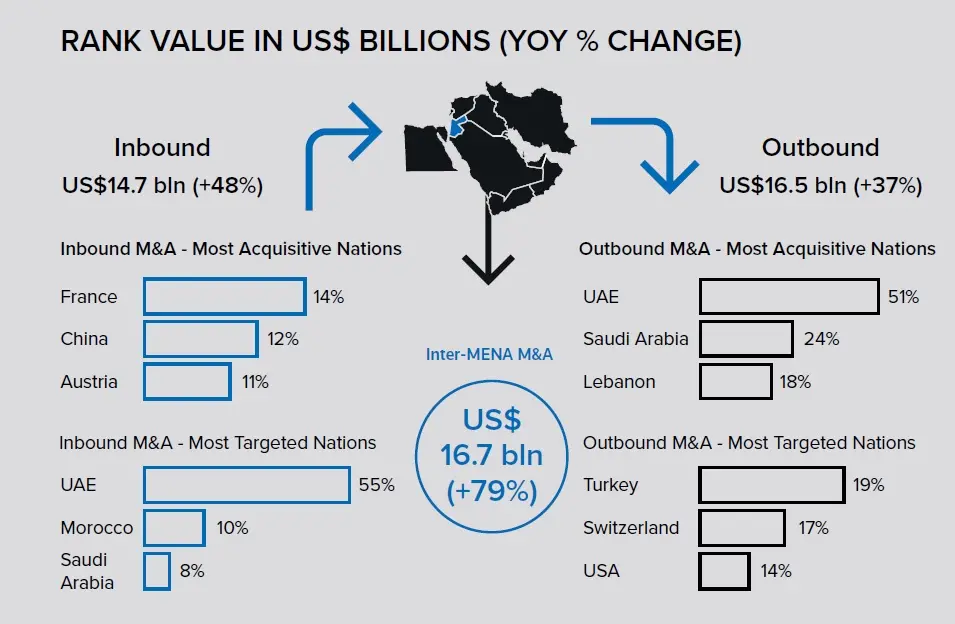

Click image to enlarge

S&P Global Ratings outlined the factors that led it to its latest assumptions: It said the ongoing trade war between the United States and China, coupled with China’s economic slowdown had sparked concerns that a global slowdown would lead to a slump in demand.

At the same time, towards the end of last year supply levels were high after major suppliers, such as Russia and Saudi Arabia, boosted production in order to cover a likely shortfall resulting from the introduction of new U.S. sanctions against Iran. However, Washington’s announcement that eight importers would be awarded six month exemptions from the sanctions on Iranian oil led to a glut in supply.

While the Organization of the Petroleum Exporting Countries (OPEC) and Russia agreed in December to cut production by 1.2 million barrels for six months from the start of 2019, S&P Global Ratings said “the announcement did little to stem the decline in oil prices as concerns about global demand and whether OPEC would honor the production cuts, continued to put pressure on prices”.

Brent prices have declined from $86.07/bbl on October 4 to $51.49/bbl on December 27, the report said. On Wednesday, oil prices rose on the back of hopes that Washington and Beijing can resolve their trade dispute. WTI crude oil futures were at $50.29/bbl as at 0131, up 51 cents, or 1 percent from their last session, the first time this year WTI has topped $50/bbl mark. At the same time, Brent crude futures were up 42 cents, or 0.7 percent, at $59.14/bbl. (Read more here).

“Crude continues to extend gains as early reports from Beijing regarding trade negotiations are fuelling optimism around successful trade talks between the U.S. and China," Stephen Innes, head of trading for Asia/Pacific at futures brokerage Oanda in Singapore, told Reuters.

"After a dreadful December for risk markets, Crude oil continues to catch a positive vibe," he added.

Another major factor impacting S&P Global Ratings’ assumptions is the growth of U.S. shale production, which it said will balance out any cuts OPEC and Russia plan to make in 2019. “The U.S. Energy Information Administration (EIA) has forecasted that at a WTI price of $54/bbl, U.S. production will grow 1.18 million barrels per day (bbl/d), just shy of the 1.2 million of production cuts announced by OPEC, effectively undercutting OPEC's efforts to balance the market,” the report said.

The Arab Petroleum Investments Corporation (APICORP), a financial institution founded in 1975 to help provide funding options to the Arab energy industry, on Tuesday also released its outlook for the year, forecasting that oil prices will likely trade between $60-70/bbl from the second half of 2019, barring any major global economic slowdown. (Read the full APICORP energy research report here).

“As we enter the new year, there are growing concerns about the broader macro environment and the rise of protectionist policies, which are impacting oil demand,” Mustafa Ansari, senior economist at APICORP, said in a press statement. “The dynamics of oil prices in 2019 will also depend in large part on OPEC+’s effectiveness in implementing the cuts, balancing the market and reinforcing the credibility of their signals,” he added.

In terms of gas prices, S&P Global Ratings’ said natural gas price assumptions are unchanged at $3/MMBtu [million British Thermal Units - the measurement used in the gas industry] band through 2021.

Last week, rival ratings agency Moody’s also released its annual outlook, in which it stated that the oil and gas sector has started the year “on a steady footing” but prices are likely to remain volatile.

"Market expectations for continued strong oil demand growth remain in place, despite concerns about slowing demand growth as a result of weaker economic growth, the impact of tariffs and a strong U.S. dollar," Steve Wood, Moody's managing director for oil and gas, said in a press release issued with the report on Thursday.

"Very high Saudi and Russian production, in particular, has heightened supply volatility, so whether OPEC and Russia maintain production discipline and renew agreements to limit output are key concerns going into the new year," Wood added.

Moody’s predicted that, in the medium-term, WTI crude prices will be $50-$70/bbl, while natural gas prices will stay within the $2.50-$3.50/MMBtu band through 2020. (Read the full Moody's report here).

Further reading:

• No slip ups: Oil, gas sector on 'steady_footing' - Moody's

• UAE energy minister says concerned about China-U.S. trade tensions

• U.S. oil prices rise above $50 on trade talk hopes

• Oil prices to trade between the $60-$70 per barrel range by mid-2019: APICORP

• COLUMN: Hedge funds dump crude and diesel, as economic outlook darkens - Kemp

• Oil bulls charge back as new year starts

• Iran says despite U.S. sanctions it has found new potential oil buyers

• Oil rises on China-U.S. talks, gains capped by U.S. fuel build

• Iraq says committed to OPEC oil output reduction

• OPEC oil output posts biggest drop since 2017 on Saudi move

• Oil prices decline on swelling oversupply, volatile markets

(Writing by Shane McGinley; Editing by Mily Chakrabarty)

(shane.mcginley@refinitiv.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019