PHOTO

The main risk to Lebanese banks' solvency following Lebanon's $1.2 billion Eurobond default is their exposure to the central bank, Banque du Liban (BdL), Fitch Ratings said in a report.

Lebanon’s prime minister, Hassan Diab, said on March 7 that the country will not make a $1.2 billion bond payment due on March 9. With Lebanon in default for the first time in history, banks are facing a huge crisis and the economy is in freefall.

Defaulting now is a necessary evil. Lebanon’s gross public debt-to-GDP ratio has increased to 170 percent. Foreign-currency reserves are under $30 billion; making this payment and defaulting later would be unfair to all other creditors and only defer the crunch, Lebanon’s Prime Minister Hassan Diab had said.

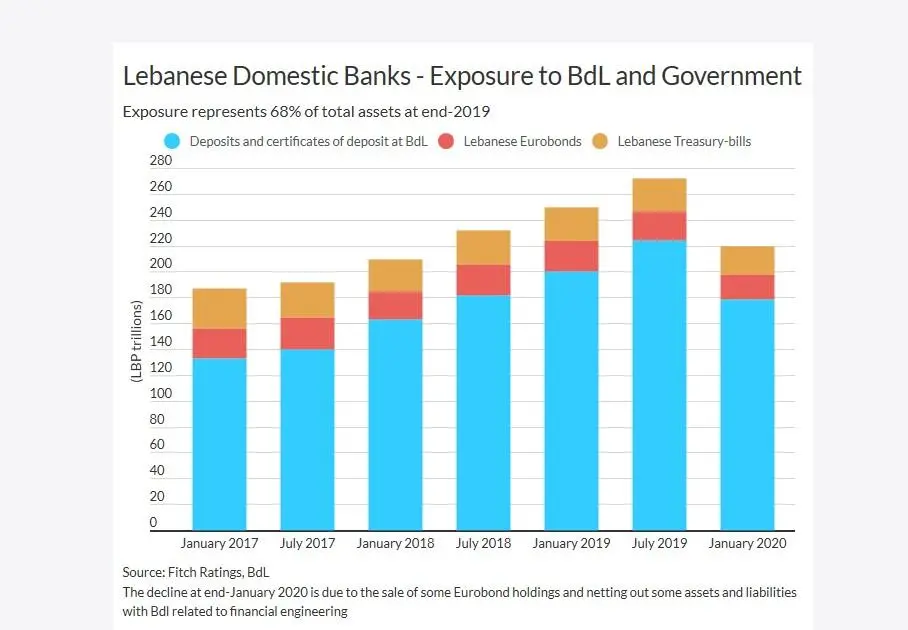

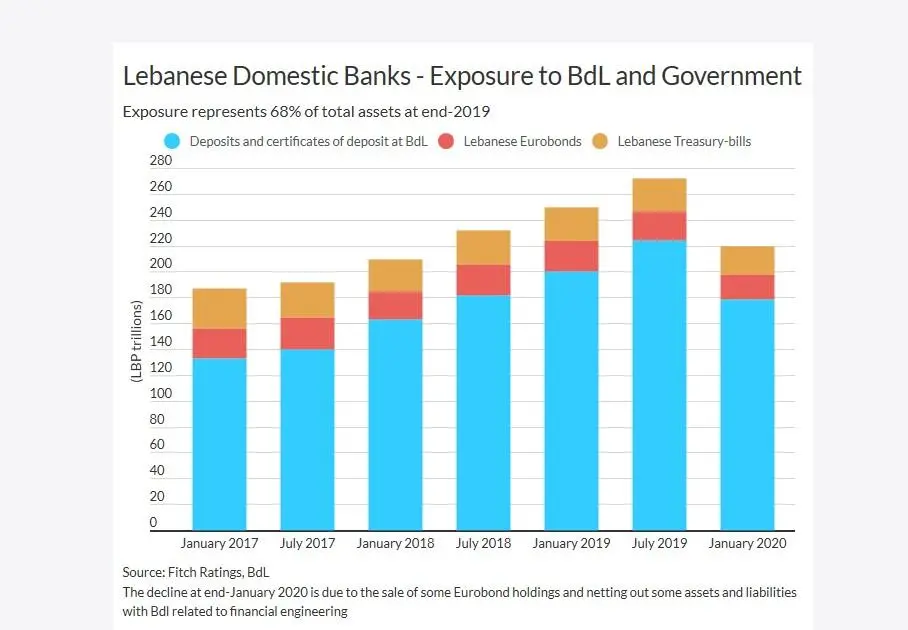

Deposits and certificates of deposit at BdL were 54 percent of commercial banks' total assets and 6x their core capital at end-2019. BdL's ability to meet its foreign-currency (FC) obligations to banks was already weak due to increasing pressure on its FC reserves. Its FC assets, excluding $5.7 billion Eurobond holdings (and gold) at end-2019, were $32 billion, less than half of its FC liabilities to banks, which according to Fitch is at $70 billion.

"BdL faces particular pressure in 2022-2023 when significant amounts of FC certificates of deposit, bought by banks during financial engineering operations in 2016, reach maturity. If BdL is unable to meet its FC obligations to domestic banks, this could lead to depositor bail in," Fitch said in its report.

Direct exposure to the Eurobond default represented 6% of domestic banks' balance sheets and about two thirds of their equity at end-2019. Domestic banks sold $1.1 billion of this exposure in January 2020, in need of FC liquidity and fearing a default. This was traded at less than half of the face value, the report noted.

On March 12, S&P Global Ratings had downgraded Lebanon's foreign currency ratings to 'selective default' and warned that talks on restructuring of the debt could be complicated and drawn out.

Fitch said that the restructuring scenarios are not clear but could involve nominal haircuts, coupon omissions or maturity extension. The ratings agency noted an increasing risk that banks' access to assets at BdL becomes restricted, especially as most deposits are long term.

“BdL's circular in December 2019 stating that interest on banks' US dollar deposits and certificates of deposit with the BdL would be paid 50 percent in local currency highlights the intensifying pressure on BdL's FC assets. A 20 percent haircut on BdL's liabilities to the banking sector would wipe out the sector's equity,” Fitch said in its report.

(Reporting by Seban Scaria; Editing by Mily Chakrabarty)

#LEBANON #ECONOMY #BANKING #FINANCIALSERVICES #DEFAULT #FITCH

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here

© ZAWYA 2020