PHOTO

- Data charts sovereigns’ rise to influential $33 trillion global investors

- US has replaced UK as sovereigns’ favourite market, with India rising to #2

- Private asset allocations have risen rapidly but may start to slow, with fixed income back in favour

- Next ten years characterised by demographic considerations and tilt from US exposure to emerging markets

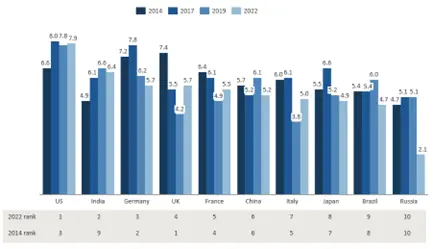

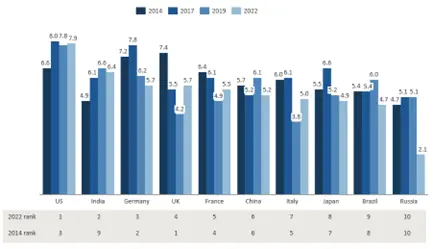

Dubai – The UK has fallen from sovereign investors’ favourite market to fourth favourite, according to a special tenth anniversary edition of the Invesco Global Sovereign Asset Management Study. In 2014, the UK ranked as the most desirable destination for sovereign investors’ capital, but has since fallen behind the US, India, and Germany respectively.

Invesco’s study, which is based on data collected over the past ten years, charts sovereigns’ rise to highly influential public institutions who are assuming a leadership role commensurate with their scale and importance as global investors.

Sovereigns’ successes fuel new launches

Since Invesco’s first study sovereign investors have grown in scale to become some of the most influential institutional investors in the world, managing $33 trillion* in assets. In doing so, they have matured into high-profile public institutions expected to be transparent, accountable, and driving positive economic and social change.

The success of sovereign funds has prompted many countries to create their own. The last decade has seen a steady increase in the number of development sovereigns, which are funds committed to diversifying and developing the local economy. Governments across several emerging markets, particularly in Africa, increasingly recognise the role they can play in driving long-term development. In the past decade, 12 new sovereign wealth funds have been established in Africa, of which 11 have a strategic role in developing their local economies.

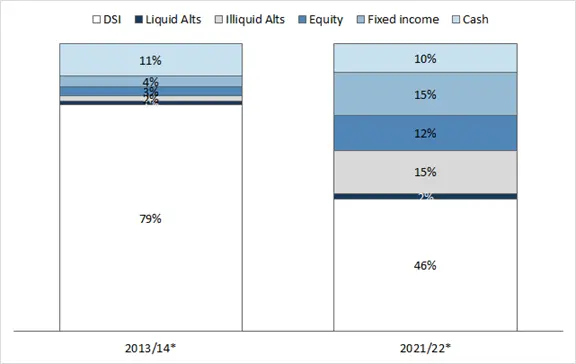

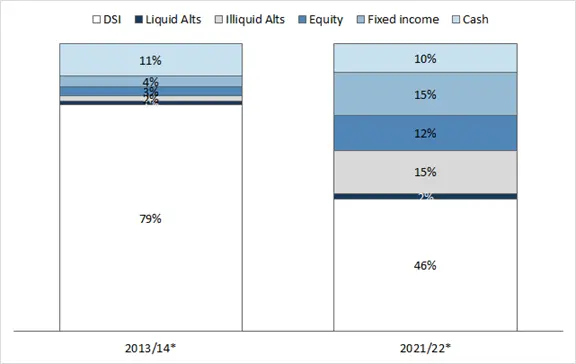

Development sovereigns have grown in sophistication as well as in number. Once seen as custodians of state assets, they are now more conventional global investors with aggressive return targets. Direct Strategic Investments, which in 2013/14 made up 79% of development sovereigns’ portfolios, have fallen to 46% in 2022, in favour of higher equity, fixed income and alternatives allocations (Fig. 1).

While sovereigns see a much more challenging environment ahead in which tighter monetary policy exerts downwards pressure on asset prices, most are long-term investors and price retracements create opportunities. Middle East sovereigns have very long-term investment horizons, allowing them to evolve and develop new strategies to accommodate changing market conditions and harness opportunities.

Climate change and the energy transition is one area where sovereigns are providing global leadership. As more governments pass legislation defining their carbon commitments, sovereign investors will be driven to enact concrete carbon targets. Middle East sovereigns in particular have taken on a more active investor role and focus on low carbon solutions such as investing in innovation to support the transition to a low-carbon economy.

US supplants UK as top market

In 2014, sovereigns considered the UK as the most desirable destination for investment, followed by Germany and the US respectively. However, the US has since supplanted the UK as the most desirable, due to its steady economic growth, strong currency, and regulatory stability (Fig. 2).

While the US has been a major destination for investment over the past decade, recent interviews have revealed an increased desire for more balanced global exposure. Some sovereign investors believe they have become overly reliant on returns from the US market, which has left them vulnerable to the 2022 correction in equity markets.

A rebalance towards emerging markets

Emerging markets look set to be the beneficiaries of this rebalance.

India has overtaken China as the most popular emerging market, having climbed from ninth most favoured market overall in 2014 to second in 2022. While this is partly because funds with dedicated Asian allocations are trimming their China exposure, investors have commended India’s positive economic reforms and strong demographic profile.

“Demographic patterns have been a key theme in our recent discussions with sovereigns”, said Rod Ringrow, Head of Official Institutions at Invesco. “As very long-term investors, they are generally more comfortable with the political and currency risks often found in countries with rapidly growing populations, which can deter other types of institutional investors. These markets are seen as offering long-term opportunities in real estate and infrastructure in particular.”

The peak of private markets?

In pursuit of diversification amid low yields, sovereigns’ allocations to private equity, real estate and infrastructure increased from 8% in 2013 to 22% in 2022. Sovereigns now manage $719 billion in private assets, up from $205 billion in 2011**.

However, sovereigns have had to compete with other large institutional investors for these assets, and in recent interviews, many have questioned whether this pace can be maintained over the next decade. One respondent remarked that the “ever greater demand for private markets…tilts against asset owners in terms of pricing and is likely to create challenges over the long term.”

Rising yields may offer a release valve. From 2013/14 to 2021/22, liability sovereigns’ fixed income allocations had fallen from 38% to 29%, but this trend could be set to reverse in the coming years, with many noting that fixed income is once again showing defensive, long-term diversification potential.

“Over the past ten years, sovereigns have invested with the wind at their backs”, Ringrow continued.

“The sovereigns we spoke to for this report see a much more challenging environment ahead, in which tighter monetary policy challenges the macroeconomic assumptions they have been working under for the past decade. That said, sovereigns have almost unparalleled horizons and falling valuations create attractive entry points for capitalising on long-term opportunities.

“Throughout the past decade, sovereigns have adapted and evolved, developing strategies to weather fluctuating markets and capitalise on opportunities. With 2022 looking like an inflection point, they will need to continue to do so over the next ten years.”

-Ends-

Press contact

Zeeshan Masud, Weber Shandwick

E:ZMasud@webershandwick.com

Areen Alfahel, Weber Shandwick

E: AAlfahel@webershandwick.com

* Source: https://www.swfinstitute.org/news/90462/sovereign-wealth-fund-and-public-pension-assets-reach-record-33-trillion-for-2021

** Source: https://www.preqin.com/insights/research/blogs/swfs-in-alternatives-in-pursuit-of-higher-returns

Appendix

About Invesco

Invesco is an independent investment management firm dedicated to delivering an investment experience that helps people get more out of life. NYSE: IVZ; www.invesco.com.

Important Information

This press release is for trade press only. Please do not redistribute. This document is by way of information only.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

The Invesco Global Sovereign Asset Management Study is an annual survey of sovereign investors that has been running since 2013. For this special anniversary report we brought together key data from the past ten years and combined it with a series of in-depth interviews with prominent sovereign investors to understand how the segment has evolved over this period and what the next decade might look like.

This document is issued in:

This document is issued by Invesco Asset Management Limited, PO Box 506599, DIFC Precinct Building No.4, Level 3, Office 305, Dubai, United Arab Emirates. Regulated by the Dubai Financial Services Authority.