PHOTO

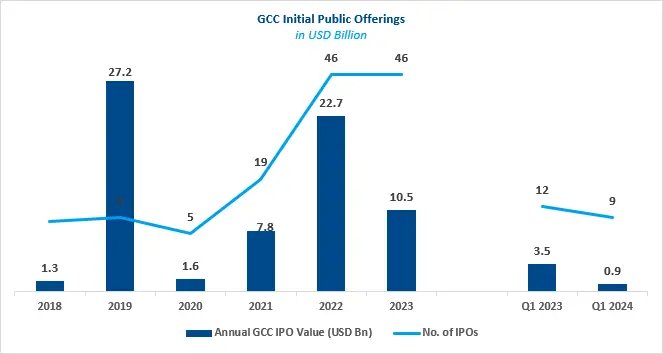

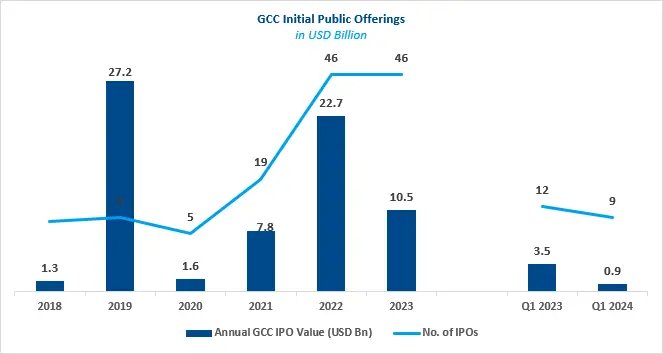

Kuwait – Kuwait Financial Centre “Markaz” released its research report titled “Initial Public Offerings (IPO) in the GCC markets”, stating that the region has raised total proceeds of USD 931 million through 9 offerings during the first three months of 2024, marking a year-on-year decline in value by 73% compared to the first quarter of 2023, where issuers raised USD 3.5 billion through 12 offerings.

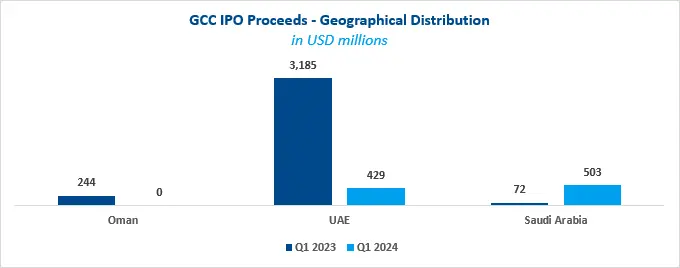

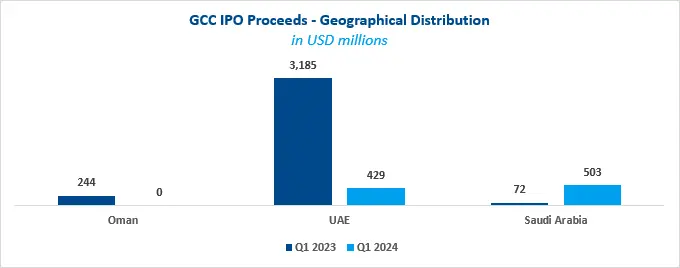

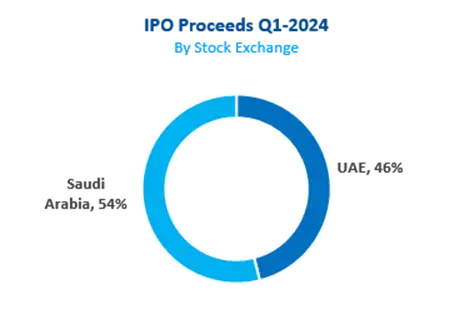

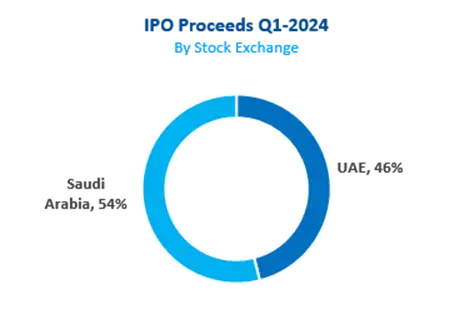

Geographical Allocation:

Markaz’s report stated that Saudi Arabia led the region in terms of IPO proceeds during the quarter, raising a total of USD 503 million from 8 offerings constituting 54% of total GCC IPO proceeds. This represented an increase of 594% in the value of Saudi IPOs compared to Q1-2023. In the UAE, IPO proceeds totaled USD 429 million during the period with 1 offering constituting 46% of total GCC IPO proceeds. However, this marked a decline of 87% in UAE proceeds compared to the same period of last year. Other GCC countries did not have any IPOs during the period.

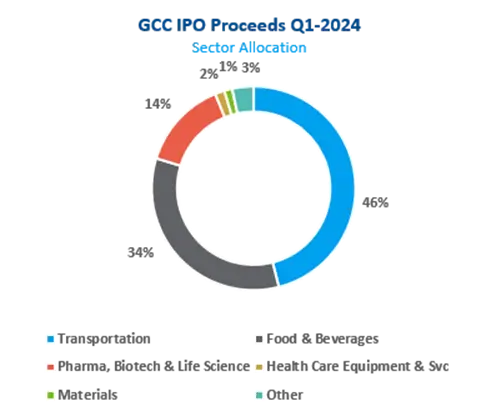

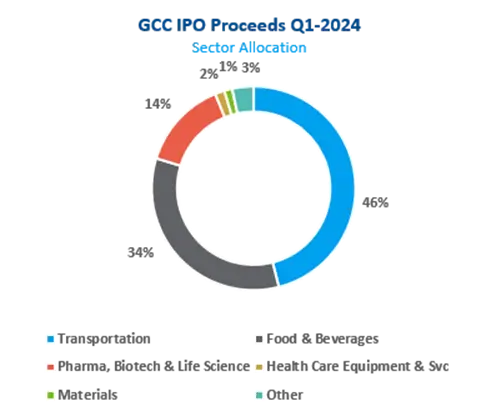

Sector Allocation:

The Transportation sector accounted for nearly 46% of the total proceeds during the period through the offering of Dubai based Parkin Company which marked the largest IPO during the period raising a total of USD 429 million.

The Food & Beverage sector raised more than USD 314 million through the IPO of Saudi Modern Mills Company, constituting 34% of total GCC IPO proceeds raised during the period. This was followed by IPOs from the Pharmaceutical, Healthcare Equipment, and Materials sectors that constituted 14%, 2%, and 1% respectively. Other IPOs primarily include companies from the Consumer Services, Financial Services, Commercial Services and Technology sector among others.

Exchange Allocation:

Saudi Arabia recorded 54% of the total IPO proceeds with the value of USD 445 million in the Main Market and USD 57 million in Nomu-Parallel Market. United Arab Emirates markets constituted 46% of total GCC IPO during Q1-2024 with a value of USD 429 million listed on Dubai’s exchange (DFM).

Top 5 GCC IPOs by Proceeds during Q1-2024:

Markaz’s report highlights the top 5 GCC IPOS by proceeds during Q1-2024. Parkin Company raised a total of USD 429 million in proceeds from floating 749 million shares, or 25% stake, which was covered 165 times. Parkin Company IPO proceeds constituted 46% of total GCC IPO proceeds in the period. The company was listed on DFM on the 21st of March 2024.

Modern Mills Company IPO raised a total of 314 million USD in proceeds making it the second largest IPO in 2024. The company was listed on March 27th on Tadawul’s Main Market and offered 24 million shares, or 30% stake. The offering was covered 21 times and the proceeds constituted 34% of total GCC IPO proceeds in Q1 2024.

Middle East Pharmaceutical Industries Company IPO raised a total of USD 131 million in proceeds. The company offered 6 million shares or 30% stake. The IPO proceeds constituted 14% of total GCC IPO proceeds in Q1 2024 and was covered 54 times. The company was listed on Tadawul’s Main Market on February 27th.

Almodawat Specialized Medical Hospital Company IPO raised a total of USD 14 million in proceeds. Almodawat Specialized Medical Hospital Company offered 475 thousand shares or 20% stake and was covered 1.36 times. The proceeds constituted 2% of total GCC IPO proceeds in Q1 2024. The company was listed on Tawadul’s Nomu Parallel Market on the 25th of February.

Taqat Mineral Trading Company raised a total of USD 11.7 million in proceeds through the sale of 2.4 million shares, or 20% stake, and was covered 1.09 times. Taqat Mineral Trading Company IPO constituted 1% of total GCC IPO proceeds of Q1 2024. The company was listed on Tawadul’s Nomu Parallel Market on the 28th of March.

Selected GCC IPO Pipeline:

| Company | Country | Sector | Market | Offering Size (shares) | Status |

| Qomel Company | Saudi Arabia | Healthcare | Nomu - Parallel | 500,000 | Closing 25 April 2024 |

| Mohammed Hadi AlRasheed Company | Saudi Arabia | Construction | Nomu - Parallel | 1,440,000 | Closing 6 May 2024 |

| Yaqeen Capital Company | Saudi Arabia | Financial | Nomu - Parallel | 3,000,000 | Closing 12 May 2024 |

| Lulu Group International | Saudi Arabia/ UAE | Retail | NA | NA | Expected for H2 2024 |

| Spinneys Dubai LLC | UAE | Retail | NA | NA | Expected for H2 2024 |

-Ends-

About Kuwait Financial Centre “Markaz”

Established in 1974, Kuwait Financial Centre K.P.S.C “Markaz” is one of the leading asset management and investment banking institutions in the MENA region with total assets under management of over KD 1.30 billion (USD 4.24 billion) as of 31 March 2024. Markaz was listed on the Boursa Kuwait in 1997. Over the years, Markaz has pioneered innovation through the creation of new investment channels. These channels enjoy unique characteristics and helped Markaz widen investors’ horizons. Examples include Mumtaz (the first domestic mutual fund), MREF (the first real estate investment fund in Kuwait), Forsa Financial Fund (the first and only options market maker in the GCC since 2005), and the GCC Momentum Fund (the first passive fund of its kind in Kuwait and across GCC that follows the momentum methodology), all conceptualized, established, and managed by Markaz.

For further information, please contact:

Sondos Saad

Corporate Communications Department

Kuwait Financial Centre K.P.S.C. "Markaz"

Email: Ssaad@markaz.com

markaz.com