PHOTO

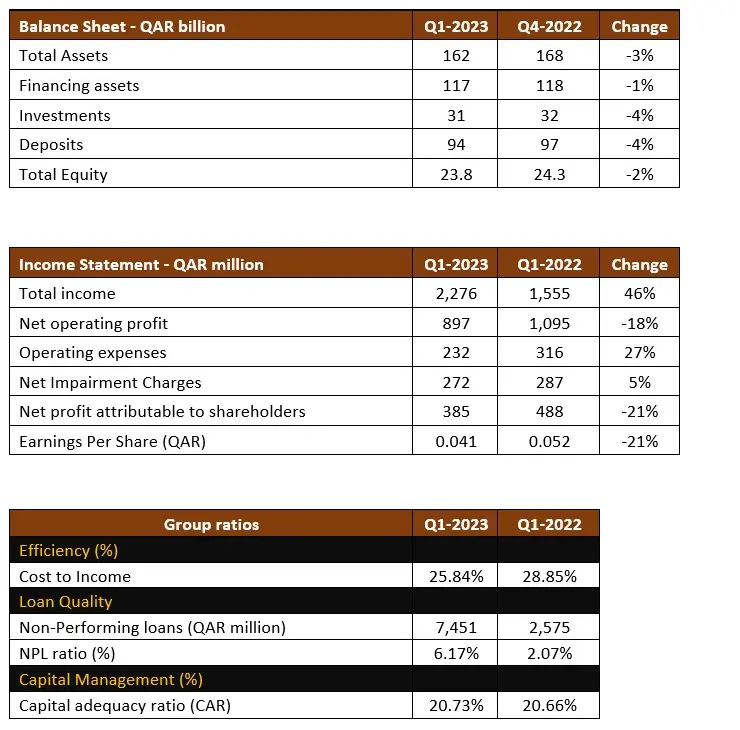

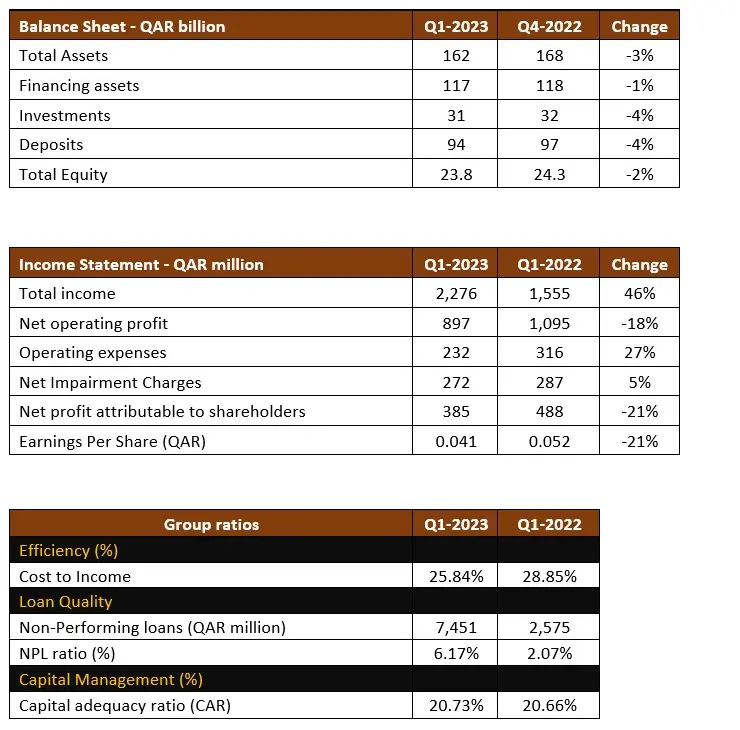

- Net financing assets closed at QAR 117 billion, versus to QAR 118 billion at year-end 2022;

- Deposits closed at QAR 94 billion, compared to QAR 97 billion as at Q4 2022;

- The Capital Adequacy ratio stood at 20.73%,

Doha: Masraf Al Rayan Q.P.S.C today released its consolidated financial statements for the three-month period ended 31 March 2023 with a Net Profit attributable to the equity holders of the bank of QAR 385 million.

His Excellency Sheikh Mohammed Bin Hamad Bin Qassim Al Thani, Chairman of the Board stated:

Our Total Income for Q1 2023 was QAR 2.27 billion, up by 46% from Q1-2022. This reflects stable revenues from our banking activities. Our capital base is robust, with capital adequacy ratio of 20.73%. We have strong funding and liquidity profile, and a healthy liquidity coverage ratio above the regulatory requirement. During this quarter, we have laid the foundation stone of process enhancement, to enrich the customer experience through greater investment in technology.

Commenting on Q1 2023 performance, Fahad Bin Abdulla Al Khalifa, Group Chief Executive Officer said:

We are pleased to announce a net profit for the first quarter of QAR 385 million, which is lower than the prior year, due to the rising cost of fund. Our overall key financial indicators remain strong. The bank’s financing portfolio stood at QAR 117 billion, and total assets at QAR 162 billion, and net operating income of QAR 897 million.

He added, “Our cost to income ratio improved to 25.8% down from 28.9% for the same period last year. We will continue to maintain and improve our efficiency across all functions of the business. We also continue to prioritize prudent risk management, while wisely seeking opportunities to grow our business and enhance our shareholders value”.

Key Financial Highlights

For further information please visit our investor relations page on our website https://www.alrayan.com or contact our Investor Relations team at IR@alrayan.com