PHOTO

Emirates Islamic announced a record AED 3.9 billion profit before tax for 2025, marking a 26% increase over the previous year, reflecting robust revenue growth across all business units. Strong performance in both funded and non-funded income highlights positive market demand and effective diversification of revenue streams. Total income surged by 11% to AED 6 billion as assets grew by a remarkable 31.2% to AED 146 billion in 2025. Further underscoring the strength of the regional economic environment, Emirates Islamic’s customer financing increased by an impressive 26% to AED 89 billion and customer deposits rose by 33% to AED 102 billion. In 2025, the Bank took significant strides in advancing its ambition of becoming the Islamic banking leader in the UAE by fulfilling the banking needs of all segments of customers.

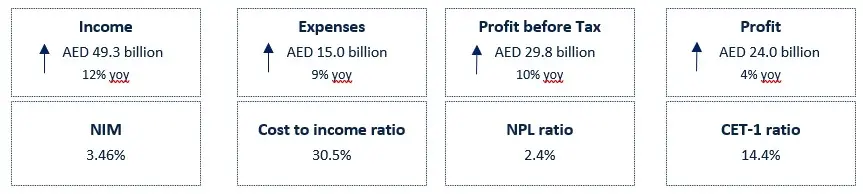

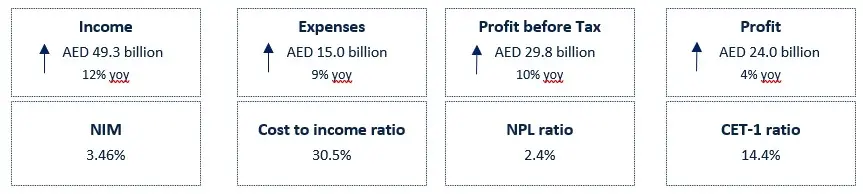

Key Highlights – FY 2025

- Very strong operating performance on higher funded and non-funded income

- Total income grew by 11% y-o-y to AED 6 billion driven by higher funded and non-funded income

- Expenses up 14% y-o-y, as the Bank continues to invest in technology and talent

- Impairment allowances decreased 68% y-o-y due to improvement in credit quality

- Profit before tax increased to a record AED 3.9 billion, up by 26%

- Net profit 19% higher to AED 3.3 billion reflecting strong growth momentum

- Robust capital and liquidity position, supported by healthy deposit mix, ensures continued support for customers and growth

- Total assets up by 31.2% to AED 146 billion, reflecting continued balance sheet growth in 2025

- Customer financing grew by 26% to AED 89 billion, driven by strong business momentum

- Customer deposits increased by 33% to AED 102 billion in 2025 supported by a strong Current Account and Savings Account mix representing 67% of total deposits

- Credit Quality remained strong, with the non-performing financing ratio improving to 2.6% and a healthy coverage ratio at 152.1%

- Capital: Tier 1 ratio of 14.7% and 15.8% Capital adequacy ratio reflect Bank’s rock-solid capital position

- Headline Financing to Deposit ratio at 87%, underlines healthy liquidity in the UAE

About Emirates Islamic:

Emirates Islamic Bank PJSC (Emirates Islamic) is the Islamic banking arm of the Emirates NBD Group and is a leading Islamic financial institution in the UAE. Established in 2004 as Emirates Islamic Bank, the Bank has established itself as a major player in the highly competitive financial services sector in the UAE.

Emirates Islamic offers a comprehensive range of Shariah-compliant products and services across the Personal, Business and Corporate banking spectrum with a network of 36 branches and 222 ATMs/CDMs across the UAE. In the area of online and mobile banking, the bank is an innovator, being the first Islamic bank in the UAE to launch a mobile banking app and offer Apple Pay, as well as being the first Islamic bank in the world to launch Chat Banking services for customers via WhatsApp.

Emirates Islamic has consistently received local and international awards, in recognition of its strong record of performance and innovation in banking. The Bank won the “Islamic Retail Bank of the Year – Middle East” and “Most Innovative Murabaha” awards at the prestigious The Banker’s Islamic Banking Awards 2025. Additionally, the bank was named ‘Best Islamic Corporate Bank in the World’ and ‘Best Islamic Financial Institution in the UAE’ at the Global Finance - Best Islamic Financial Institutions Awards 2025. Emirates Islamic was also awarded the prestigious title of ‘The World’s Best Islamic Digital Bank’ at the Euromoney Islamic Finance Awards 2025.

As part of its commitment to the UAE community, the Emirates Islamic Charity Fund provides financial aid to those in need, with a focus on food, shelter, health, education and social welfare contributions.

For further information please visit www.emiratesislamic.ae

Or please contact:

Amina Al Zarooni

Media Relations Manager, Emirates Islamic

Tel: +971 4 4397430; Mob: +971 56 6405080

Email: AminaAlZarooni@emiratesislamic.ae

Burson

Dubai, UAE

Tel: 971-4-4507600

Email: ei@bm.com