PHOTO

NEW YORK (Reuters) - The euro and sterling rose against the dollar on Monday after the European Union’s top negotiator said an agreement for Britain to leave the economic bloc might be reached in the coming weeks.

The pound in particular had been under pressure in recent weeks on anxiety that Britain would exit from the EU without any formal trading arrangement.

“Sterling bears have been caught off side. The euro is also getting a bump as people are jumping on a ‘risk-on’ sentiment,” said Dean Popplewell, vice president of market analysis at OANDA in Toronto.

EU chief negotiator Michel Barnier told a forum in Slovenia a Brexit deal was “realistic in six to eight weeks.”

Sterling GBP=D3 was up as much as 1 percent versus the dollar. It was last up 0.9 percent at $1.3033, Reuters data showed.

The euro EUR=EBS rose nearly 0.4 percent at $1.15965, while it touched a near one-month low against the pound, last down over 0.5 percent EURGBP=D4 at 88.98 pence.

Policy-makers at the Bank of England and European Central Bank are widely expected to leave their policy unchanged at their respective meetings on Thursday.

“It seems unreasonable to expect (Mario) Draghi to signal a course change” at the ECB, said Win Thin, global head of emerging market currency strategy at Brown Brothers Harriman in New York. “It is an easy call: unanimous decision to hold after hiking rates last month,” Thin added.

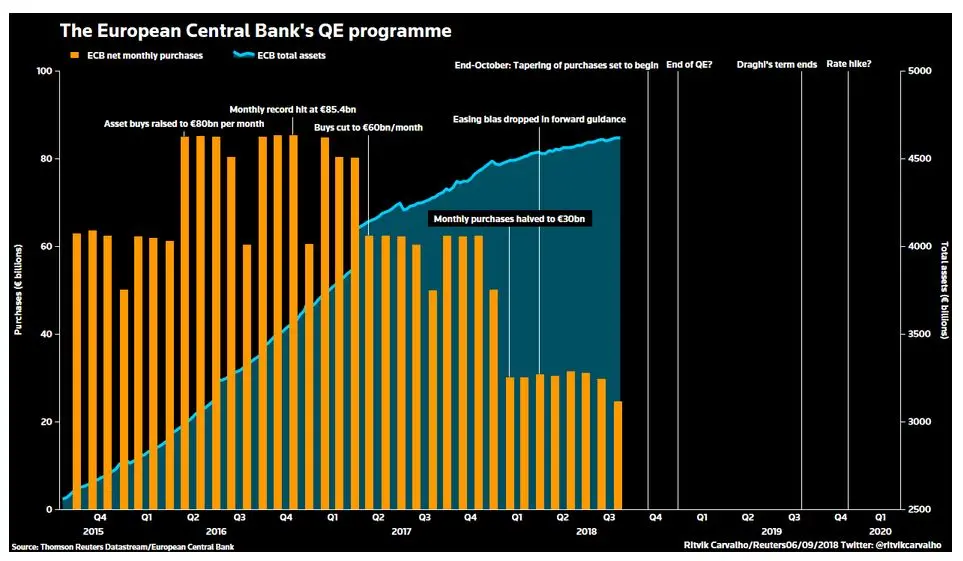

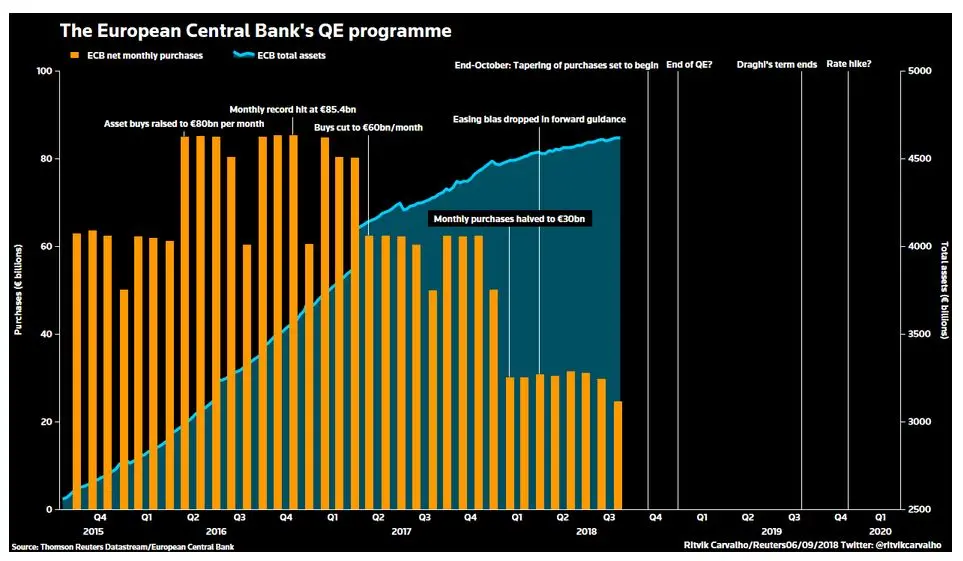

(Graphic: The European Central Bank's QE program: http://reut.rs/2wOxrNg)