PHOTO

Sukuk issuance volumes will fall this year as global liquidity dwindles and higher oil prices lower the need for financing in some Islamic markets.

Total issuance for this year is likely to reach $130 billion, a 12.5 percent drop from $147.4 billion in 2021, and a revised down from the initial forecast of $145 billion to $150 billion, according to the latest analysis by S&P.

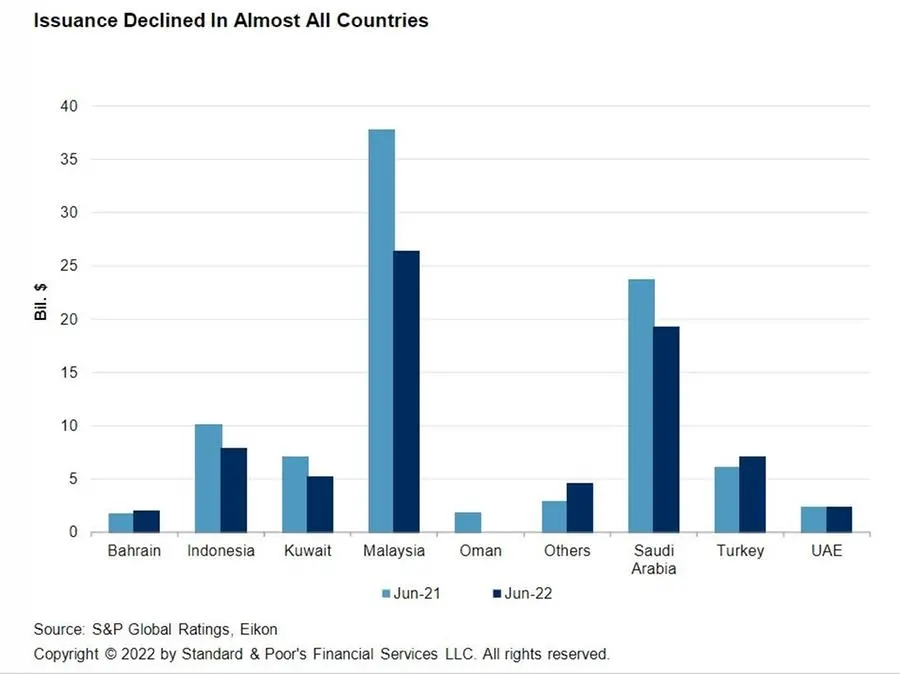

During the first half of 2022, sukuk issuance amounted to $74.5 billion, down from $93.3 billion during the same period in 2021, both in local and foreign currency. Issuance in most core Islamic finance countries posted declines, with a few exceptions.

Issuance in the UAE remained flat compared with the prior year, and slightly up in Bahrain and Turkey. Markets experiencing declines include Saudi Arabia, Kuwait, Malaysia and Indonesia.

"Sukuk issuance volumes will decline in 2022 as lower, more expensive global and regional liquidity, increased complexity and reducing financing needs for issuers in some core Islamic finance countries, thanks to higher oil prices, deter the market," S&P said in a report released on Monday.

CHART 1

The sukuk market could also face additional hurdles, such as Sharia scholars' preference for a higher proportion of profit and loss sharing. "What's more, we believe that if sukuk become an equity-like instrument, investor and issuer appetite will likely diminish," S&P said.

"Therefore, standardising sukuk structures and satisfying the needs of all stakeholders could be a plausible way for the market to maintain its appeal," S&P said.

"The market is also being supported by the energy transition and increased awareness of environmental, social and governance considerations among regional issuers in key Islamic finance countries."

Why global liquidity is down

Liquidity has dropped and become more expensive after record-high inflation prompted central banks to tighten policy and accelerate interest rate increases.

Investors have also become more risk averse, and this has led to significantly lower activity in the capital markets.

"The sukuk market, as a component of the global capital market, is not immune to global trends," S&P said.

And, with oil prices rising, balance sheets of some leading players in the sukuk market have improved, hence there's lesser need to initiate sukuk offerings.

"We also observe corporates' continued caution regarding capital expenditure plans," said S&P.

"The scars of the pandemic and uncertainty related to the financing environment have led many to rein in growth investments, turn to banks for funding, or start deleveraging."

(Reporting by Cleofe Maceda; editing by Seban Scaria)