PHOTO

Dubai-based developer Union Properties has posted a net loss of 12.5 million dirhams ($3.4 million) in Q1 2022, and the value of its accumulated losses reached 2.94 billion dirhams.

The property developer, which is undergoing restructuring in the face of allegations of fraud and financial misconduct, said the loss for the quarter was partly due to finance costs of 17 million dirhams relating to a legacy debt and a one-off gain of 6.9 million dirhams from the sale of an asset recorded in the prior period.

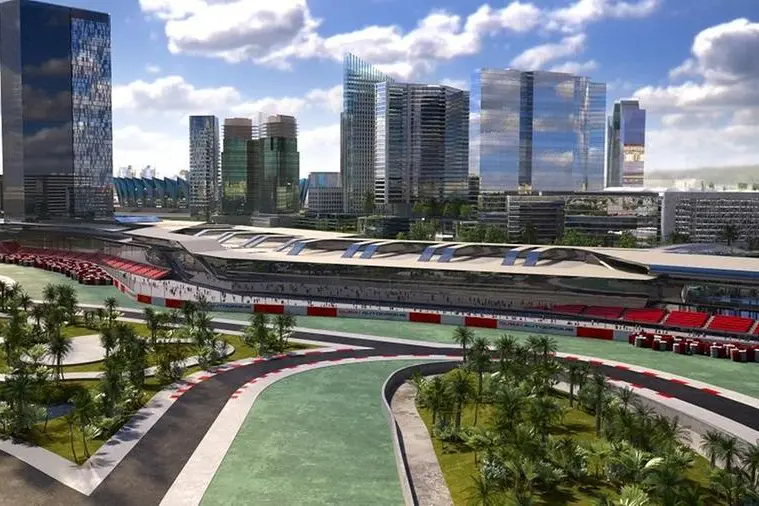

In a statement on the Dubai Financial Market where its shares trade, the company said its revenues rose nearly 8 percent to 105.7 million dirhams in the quarter due to a rebound in Dubai’s real estate sector and a significant improvement in performance in the group’s subsidiaries, including Dubai Autodrome.

In December last year the company appointed new board members after dismissing four members and said it would file a liability lawsuit against them.

A complete financial and accounting review was conducted by a third party, which, according to the company, uncovered "widespread fraud and misconduct by the company’s former management..."

It also discovered that the carrying value of its property portfolio had been inflated in prior years and it has booked a loss from the valuation of its properties amounting to 1.11 billion dirhams in 2021 versus to a gain of 743.6 million dirhams in 2020.

The ratio of its accumulated losses to share capital is now over 68 percent. Losses for FY2021 was 967 million dirhams.

Amer Khansaheb, Managing Director of Union Properties said Q1 2022 was an improved quarter for the company as it increased revenues and drove cost efficiencies across the business.

"We are also beginning to see the benefits of our business turnaround strategy and are confident that we will see further positive progress in the months ahead."

(Writing by Brinda Darasha; editing by Seban Scaria)