PHOTO

Dubai-based Gulf Navigation Holding’s accumulated losses stood at more than AED667 million ($181 million) as of the third quarter of the year, according to a bourse filing on Friday.

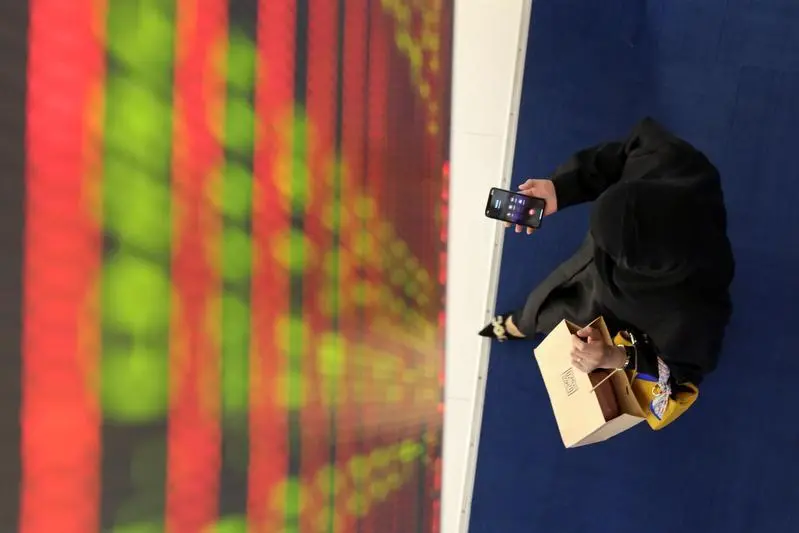

The losses, representing 52.3% of the capital, were mainly due to lower revenue caused by the COVID-19 pandemic and high net finance cost, the company said in a disclosure on the Dubai Financial Market (DFM).

The company’s finances were also impacted after a write-off of one of its vessels GL1, which sank off this year.

Measures to address losses

The company said it is taking the necessary measures to stabilize its fleet performance and “overcome the COVID-19 pandemic challenges.”

“The group refinanced the vessels with a lower finance rate. [It is also] chartering ships with trusted clients on long-term basis and exiting unprofitable business sectors.”

For the third quarter of 2022, the company posted a total net profit of AED4.2 million, down by 27% from AED5.8 million in the same period last year.

The first nine months of the year recorded a total net profit of AED1.75 million. Operating revenue for the period rose by 16.6% to AED104 million, driven by the petrochemical vessel chartering and agency business.

Last August, Gulf Navigation refinanced five petrochemical tankers under new and preferential terms for a period of five years.

In a separate statement, the company pointed out it has seen debt conditions improve after it managed to cut financing costs and converted more than AED85 million of the company’s debts into shares.

(Reporting by Cleofe Maceda; editing by Daniel Luiz )