PHOTO

(The views expressed here are those of the author, the publisher of Income Securities Advisor.)

NEW YORK - Investors have long been preoccupied with the question of whether companies are beating their supposed “Street estimates” each quarter, but perhaps the entire concept of “beats” should be up for debate.

Consider a recent example.

Financial news publisher The Fly noted on November 5 that USA Compression, an oilfield services and equipment company, had met consensus expectations for earnings per share in the third quarter – 26 cents.

The same day, however, Benzinga Newswire reported that USA Compression had, in fact, beaten consensus third quarter EPS expectations of 22 cents.

This raises two questions.

First, did USA Compression’s EPS beat or not beat the market’s expectations?

Second, how is it that The Fly’s consensus estimate was 18% higher than Benzinga’s?

The first one is easier to answer. The stock’s price jumped 6.6% on the day of the earnings release, so while other factors may have been at play, the market was positively surprised by the result.

The second question is trickier. The disparity is partly because the universe of analysts used for these calculations varies by publication.

But it is also because producing a consensus estimate is not a cut-and-dried process of collecting leading analysts’ forecasts and calculating an average.

Take the technology sector. Broker-dealers may all provide estimates based on legally mandated Generally Accepted Accounting Principles (GAAP), but investors typically don’t pay much heed to these figures.

They tend to care more about Adjusted EPS, and unlike its GAAP counterpart, this “adjusted” number has no uniform definition.

For example, some analysts exclude stock-based compensation from their computations or adjust for M&A-related items or impairments, while others do not.

Consequently, getting the forecasts to hang together requires significant judgment on the part of the aggregators, who may also exclude estimates they deem to be statistical outliers.

Remember, too, that companies can use accounting sleight of hand to ensure that they “beat” a consensus EPS forecast that they themselves have steered with earnings guidance.

In other words, the bar used to judge a company’s success every three months can be at different heights depending on who you ask – which leads to the larger question of whether this bar matters at all.

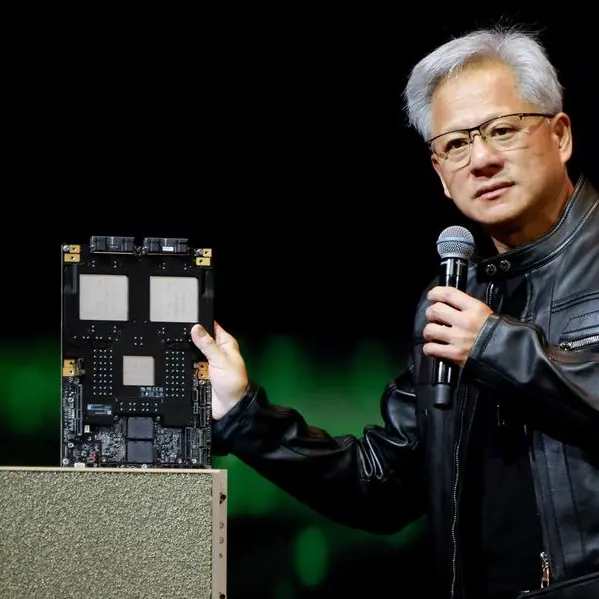

NVIDIA’S WILD RIDE

Recent price action in Nvidia suggests “beats” have become more theatrical than analytical.

The semiconductor producer’s third quarter earnings announcement was anxiously awaited by many in the investment community.

Some financial news pundits proclaimed that the numbers would go a long way in determining whether valuations of artificial intelligence-related stocks represented a bubble. Indeed, some media reports suggested that the fate of the U.S. stock market rally itself hung on whether Nvidia – the first company ever to record a market cap of $5 trillion – would beat the consensus.

Depending on which aggregator one consulted, a beat on adjusted EPS required Nvidia to eclipse a range of $1.22 to $1.26.

The chipmaker vaulted over the top of that range by reporting $1.30 after the November 19 close. Additionally, it exceeded analysts' expectations for data center revenue while also issuing higher-than-expected revenue guidance for the fourth quarter.

Nvidia’s stock surged 2% in after-hours trading, and numerous brokerage firms rushed to raise their price targets, by 35% in Evercore ISI’s case.

Amid the euphoria, though, there were a few sour notes. Nvidia’s third quarter gross margin had narrowly missed expectations, causing some analysts to raise questions about the company’s mounting costs.

Analyst Dan Coatsworth of AJ Bell pointed out that Nvidia’s inventory and receivables were rising faster than sales, suggesting that revenue might be getting booked before payment was secured.

Longtime AI skeptic Michael Burry repeated his concern that tech giants were exaggerating their earnings by stretching out depreciation of their computing equipment.

Nvidia’s share price rose another 5% in early trading on November 20, testing a technical resistance level. But by the afternoon, the stock’s gains had vanished, and the share price finished 3% below the previous day’s close, pulling down the entire S&P 500.

BEAT GOES ON?

All in all, it was an exciting 24 hours for financial news reporters, as well as professional stock traders and quantitative fund managers who make their living from minute-to-minute price action.

However, the hullabaloo over the lead-up and aftermath of Nvidia’s EPS beat was inconsequential for the vast majority of market participants who buy stocks on fundamental grounds, hoping to achieve gains over lengthier periods.

When placed next to Nvidia’s gain since the start of the year and the drop from its 2025 high, the furious fluctuations surrounding the company’s earnings are a mere blip.

This is not to say that companies’ quarterly earnings are unimportant, and that some type of metric is needed to determine how well a firm performs versus expectations – though the company’s share price will ultimately do that. In short, earnings beats may continue to make for good financial theater, but that’s about it.

(The views expressed here are those of Marty Fridson, the publisher of Income Securities Advisor. He is a past governor of the CFA Institute, consultant to the Federal Reserve Board of Governors, and Special Assistant to the Director for Deferred Compensation, Office of Management and the Budget, The City of New York.)

Enjoying this column? Check out Reuters Open Interest (ROI), your essential new source for global financial commentary. ROI delivers thought-provoking, data-driven analysis of everything from swap rates to soybeans. Markets are moving faster than ever. ROI can help you keep up. Follow ROI on LinkedIn, and X.

(Writing by Mart Fridson; Editing by Anna Szymanski.)