PHOTO

European shares were little changed on the final trading day of 2025, hovering near record highs and set to close out a strong year driven by lower rates, Germany’s fiscal support and rotation away from pricey U.S. tech stocks.

The pan-European STOXX 600 inched 0.1% lower at 592.03 by 08:22 GMT, but remained on track to deliver its strongest annual performance since 2021, with gains of about 16%.

Trading activity remained subdued ahead of the New Year holiday, with markets in Germany, Italy, and Switzerland already closed. Meanwhile, exchanges in France, Spain, and the UK operated on abbreviated schedules for the day. While major regional bourses broadly posted positive returns for the year, Spain's IBEX was set to gain nearly 50% and significantly outpacing its counterparts.

France's CAC 40 was poised for the most modest gains among major European bourses, rising just 10.2%. Political instability, mounting concerns over fiscal debt, and a surge in bond yields all weighed on French market performance.

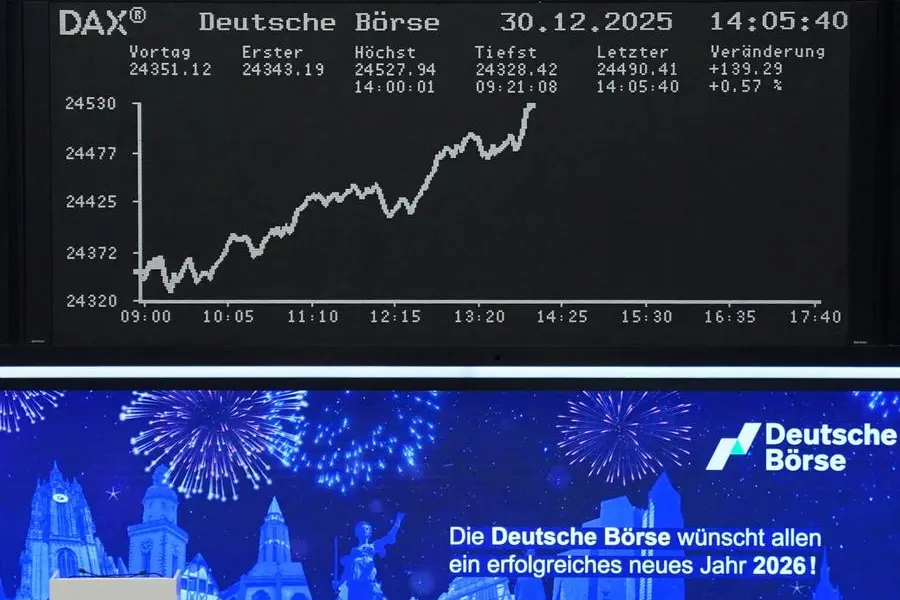

Germany's DAX index was set for 23% advance, benefiting from the government's economic support measures, including fiscal stimulus packages and strategic infrastructure investments.

The UK's FTSE 100 continued its winning streak, on track to climb 22% in 2025 to mark its fifth consecutive year of positive returns.

(Reporting by Ragini Mathur in Bengaluru; Editing by Nivedita Bhattacharjee)