PHOTO

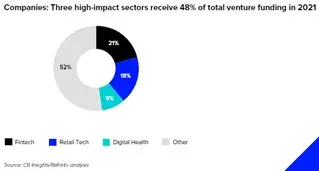

Digitalisation funding is focused around high-impact sectors

Digitalisation is transforming the way the world operates. Industries are either disrupting or being disrupted by the fragmentation of their landscapes and value chains, with new players threatening incumbents in notable ways.

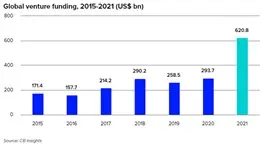

Global venture funding more than doubled in the past year alone, from $293.7 billion in 2020 to $620.8 billion in 2021, according to data from CB Insights.

With abundant VC across sectors, technology continues to be one of the defining stories of our time. Notably, investments in high-impact sectors are fast disrupting the traditional methods of delivering products and services, such as fintech, digital healthcare, and retail tech. These three sectors collectively received almost half (48%) of total venture funding in 2021.

Fragmentation is occurring across the financial services landscape

The rise of digital payments, which has disrupted the traditional ecosystem and opened market entry for local and global players, including for mobile money and e-wallets, remittance and payment aggregation, is illustrative of the sea change that is challenging traditional financial institutions.

Payments are no longer the exclusive domain of pureplay financial services firms, and with the rise of open banking and open finance, this development could be a sign of things to come across other financial services segments as well.

Consumers, especially the younger demographics, are adapting and responding to the proliferation in product choices by becoming savvy bargain hunters. At the same time, they seek out personalised experiences and demand excellent service across all touchpoints of the omnichannel customer journey.

OIC countries lag behind in responding to automation

Most countries that are leading on automation readiness are non-Muslim majority, and the member states of the Organisation of Islamic Cooperation (OIC) are lagging in their uptake of the latest developments to respond to the challenges of automation. The only Muslim-majority country classified as either ‘mature’ or ‘developed’ (the top two categories) on the EIU’s Automation Readiness Index in 2018 (a one-off Index) was the UAE.

The other Muslim countries – Malaysia, Turkey, Saudi Arabia and Indonesia – were listed in the emerging category, and all scored below the global average. These and other global index rankings point towards a similar story: that OIC countries collectively are currently not at the forefront of innovation and disruption, with few exceptions.

More Shariah-compliant VC and PE funding is needed

A growing ecosystem of Islamic economy enablers is helping to foster OIC-based entrepreneurial talents as well as Muslim-led start-ups in non-OIC countries. There is also an increasing number of incubators and accelerators that are helping to enable and enhance OIC entrepreneurial ecosystems. Some examples with a focus on key OIC and Muslim markets include venture capital providers such as Mountain Partners (Malaysia) and UK-based GroundOne Ventures and Bedford Row Capital; incubators and accelerators such as GoodForce Labs (UAE), FIKRA (Malaysia), and Albaraka Garaj (Turkey).

However, given that funding is the most common challenge faced by Islamic fintechs, more Shariah-compliant VC and PE funding is needed globally to help Islamic fintechs and other Shariah-compliant start-ups across a wide variety of sectors to develop initially and eventually scale up into global propositions.

Also, it is important to note that there has not been much activity from several of the incubators and accelerators mentioned above.

For more insights and key findings, read the report.

(Reporting by Tayyab Ahmed; editing by Seban Scaria)