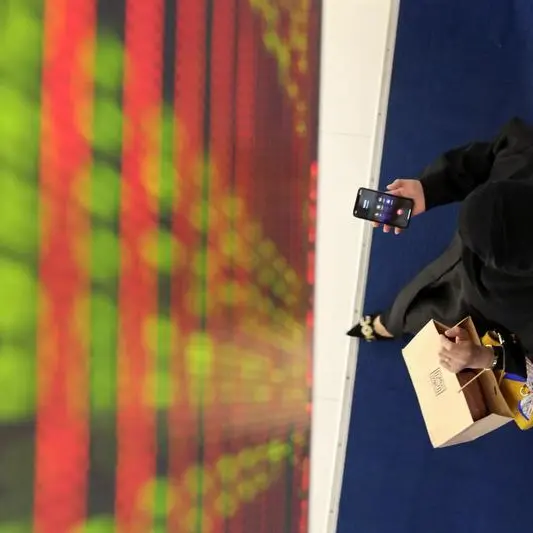

PHOTO

SHANGHAI - China Asset Management Co. (ChinaAMC), the country's biggest provider of exchange-traded funds, said on Monday it launched two flagship ETFs in Thailand, giving Thai investors easy access to a basket of Chinese blue-chip and technology stocks.

The ETF launch comes as China further opens its capital markets to lure global investors. It also signals deepening capital market cooperation between China and Thailand under Beijing's flagship "Belt and Road" infrastructure initiative. "This not only significantly enhances the convenience of cross-border investment but also facilitates a continuous inflow of overseas medium- to long-term capital" into China's stock market, ChinaAMC said in a statement.

The asset manager added that the product launch in Thailand reflected strong local interest in Chinese assets and Chinese technology. The two flagship ETFs - tracking China's blue-chip CSI300 Index and the tech-focused STAR 50 Index respectively - were launched as depository receipts (DRs) on the Stock Exchange of Thailand (SET).

Thai securities firm InnovestX Securities worked with ChinaAMC on the launch, handling the DR issuance and market-making.

The CSI300 Index, regarded by some as a barometer of China's economy, has gained roughly 18% this year, following a 15% rise in 2024.

STAR 50, made up of leading players in Chinese technology from chip-making to biotech and high-end manufacturing, has jumped 36% this year.

The simultaneous launch of the two products allows Thai investors to "trade in real-time during local market hours using baht without overseas accounts, while also benefiting from capital gains tax exemptions," ChinaAMC said, adding it would continue to expand China offerings for international investors. In September, ChinaAMC and U.S. investment adviser Rayliant launched a Nasdaq-listed ETF that channels global money into Chinese companies operating in transformative technologies.

ChinaAMC has also secured a mandate to run a Thai-domiciled fund dedicated to investing in leading Chinese companies with global footprints.

(Reporting by Shanghai Newsroom; Editing by Kate Mayberry)