PHOTO

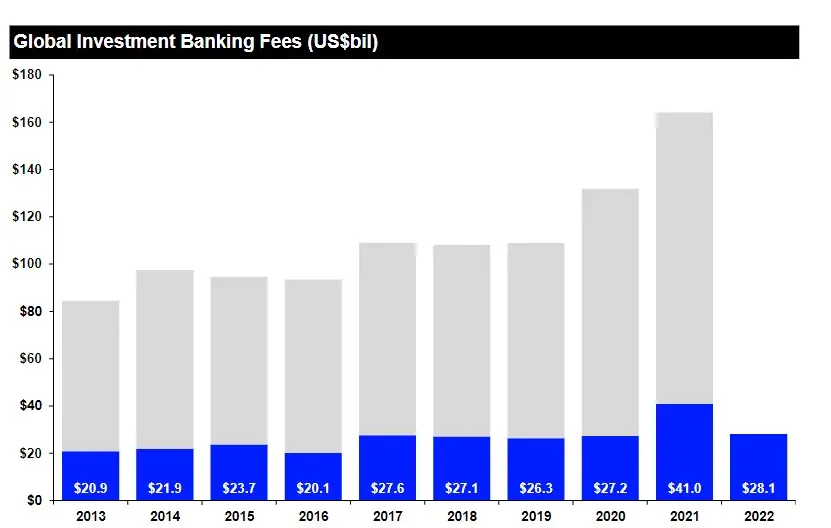

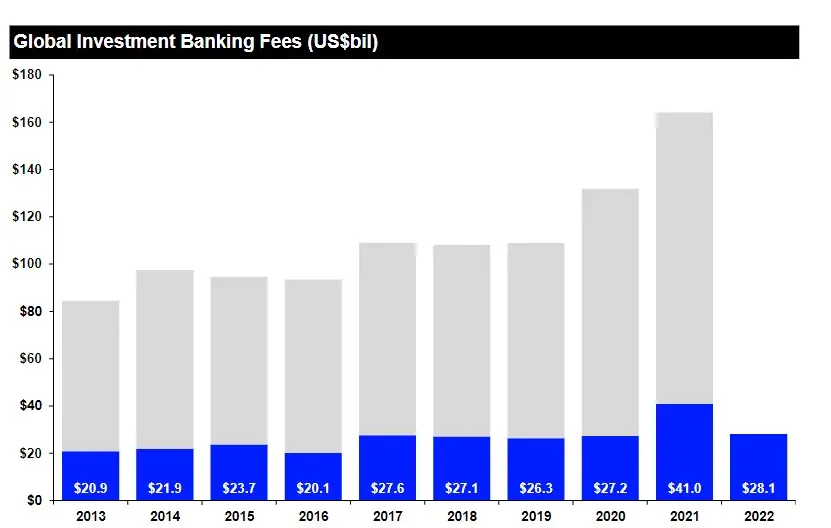

Investment banking fees reached $28.1 billion during the first quarter of 2022, posting a 31% decrease compared to the first quarter of 2021, according to data available with Refinitiv.

This is seen as the slowest opening period for global IB fees since 2020.

Fees during the first quarter of 2022 declined 34% compared to the fourth quarter of last year, which ranked as the largest quarter for fees on record, the global data provider said.

The Americas contributed 49% of all fees generated globally with $13.7 billion, a 39% downtick compared to 2021 levels.

Imputed fees in the EMEA region decreased 29% to $6.3 billion during the first quarter of 2022.

“The environment for deal making saw a number of shifts during the first quarter of 2022, which had a major impact on investment banking fees, including volatile stock markets, rising interest rates, inflation and updated guidance and policies from central banks," said Matthew Toole, Director, Deals Intelligence, Refinitiv.

"Coupled with conflict in Ukraine, the confidence that we saw from corporations to pursue a merger or tap the capital markets over the last few years has largely been put on pause as conditions are re-evaluated,” he added.

Total IB fees in Asia-Pacific and Japan hit $8.0 billion with a 15% decline compared to first quarter 2021 levels.

JP Morgan maintained the top spot for investment banking fees earned during the first quarter of 2022 with $1.9 billion, earning an industry-leading 6.7% share of the market. Goldman Sachs remained in second place with an estimated 6.5% of global wallet share. BofA Securities took the third spot with $1.5 billion in fees, followed by Morgan Stanley and Citi.

Completed M&A advisory fees registered an increase of 8% compared to a year ago with $9.8 billion in fees globally.

With declining number of IPOs, follow-ons and convertibles, ECM underwriting fees totaled $3.5 billion during the first quarter of 2022, a 73% decrease compared to 2021 levels.

DCM underwriting fees decreased 19% compared to the first quarter of 2021, while fees from syndicated lending activity reached US$5.0 billion, a 25% decrease compared to a year ago, Refinitiv said in its review.

(Reporting by Seban Scaria; editing by Daniel Luiz)