PHOTO

Environmental and social issues are 'very important' for bond issuers and investors worldwide.

Despite the heavy reliance of the Middle East on oil and gas, the region is the strongest to recognise impacts on businesses due to climate change, bringing forth big shifts in capital allocation.

Two thirds of issuers (85 percent in the Middle East) expect to reallocate capital noticeably in the next five years, HSBC said in its Sustainable Financing and Investing Survey 2019 report.

HSBC's global survey of 500 issuers and 500 investors, across Europe, Asia, the Middle East and the Americas, shows around 60 percent of both groups say environmental and social issues are ‘very important’. Three quarters of the rest say they are ‘somewhat important’.

Shifts in capital allocation

Middle Eastern issuers are expecting to change their allocation of capital in response to environmental and social issues.

While 97 percent of the region’s investors and 98 percent of issuers see environmental and social issues as important, 86 percent expect to move capital substantially either from activities challenged by environmental and social issues, or towards activities that promote positive environmental or social outcomes, the report noted.

Middle East insurers are incorporating climate change and sustainability goals into their decision-making and strategies.

Sabrin Rahman, Regional Head of Sustainability for Middle East, North Africa and Turkey at HSBC, said: “The survey demonstrates that issuers in the region are well aware of the impacts of climate change. It shows that issuers and investors are incorporating sustainable-focused targets into their plans, and of particular significance is their enthusiasm for green debt instruments.”

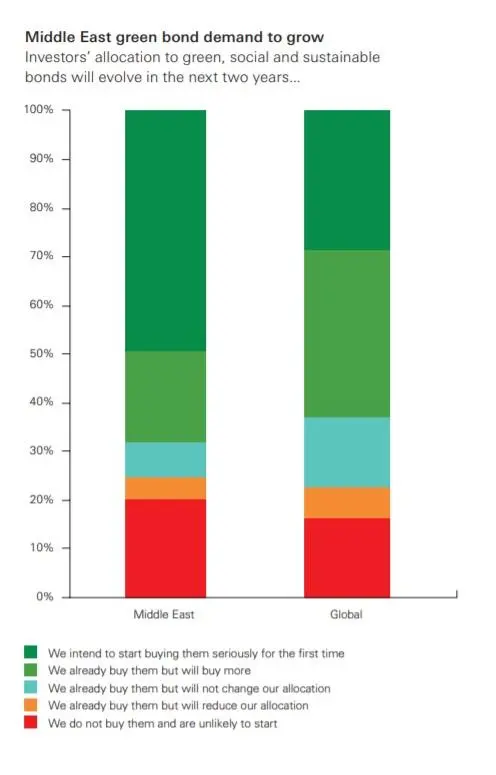

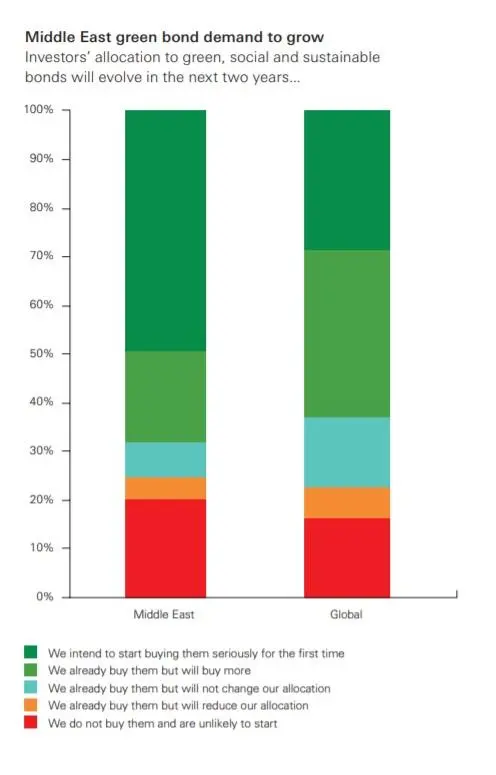

Green bond demand to grow

The report shows that Middle Eastern investors are particularly positive about labelled green, social and sustainable bonds, with a combined 94 per cent of issuers saying the product sounds either ‘very interesting’ or ‘potentially interesting’.

Almost half of investors in the region (49 percent) report that they will start buying these instruments seriously for the first time in the next two years, while a further 19 percent will increase their investments, the report noted.

An unmatched 46 percent and 40 percent judge that they are less risky and produce slightly better returns than ordinary bonds, compared with 39 percent and 35 percent globally.

However, 77 percent of Middle East investor respondents said obstacles are holding them back from pursuing ESG [Environmental, Social and Governance] -based investing more fully.

According to investors, the region’s biggest hurdles are: lack of ESG data comparability between issuers (54 per cent compared to 26 per cent globally); a shortage of expertise or qualified staff (46 per cent compared to 27 per cent globally); and a lack of demand from clients (41 per cent against 20 per cent globally).

(Writing by Seban Scaria, editing by Anoop Menon)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019