In the context of a squeeze on personal disposable income amongst the general population in KSA, a ‘marginal’ price increase on a litre bottle of milk has been met with an organised social media backlash. The “let it go sour” campaign, whereby social media users have been circulating hashtags and photos of a popular yogurt drink plastered with a red X and the phrase “let it go sour”, has negatively impacted a brand that only a few weeks before had achieved the top position in the YouGov BrandIndex KSA rankings for 2017-2018.

BrandIndex, the region’s only daily brand perception tracking study, tracks 16 key metrics for around 500 brands in KSA on a daily basis ranging from brand health to media focussed and lower funnel metrics.

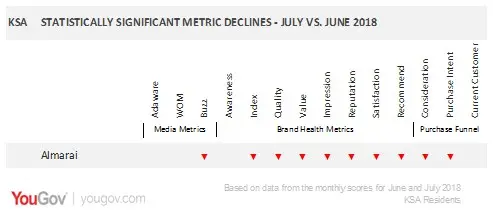

On 10 of these 16 key metrics Almarai have seen a statistically significant decline in scores in July amongst KSA Residents as reported in YouGov’s flagship daily brand perception tracking study.

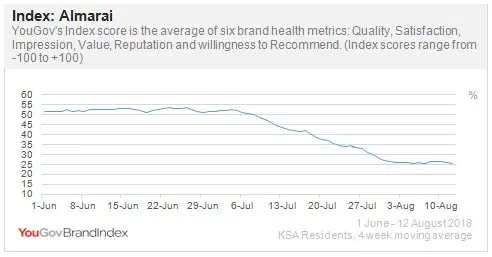

Since the 3rd of July when the “let it go sour” social media campaign started, we have seen Almarai’s Index score decline by over 26 points from a relatively stable score of +52.2 down to +25.5.

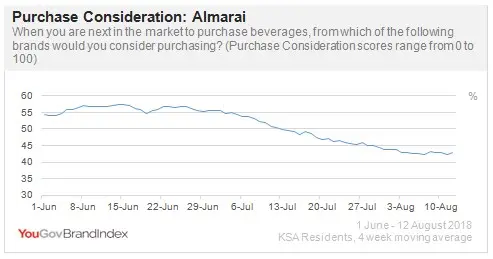

Perceived Value, as a direct result of the price rise has declined from +48.9 on the 3rd of July down to a score of +17.5 a month later, the lowest registered for Almarai since tracking of the brand on BrandIndex began in April 2015. In addition, Sentiment towards the brand (as measured by Buzz) also declined from +42.1 on July 3rd down to +9.0 in the same time frame, indicating what people are hearing about the brand is now much less positive than it has been historically. This has directly impacted Consideration for the brand which declined from 55% of the population previously considering Almarai down to currently 43% of the population.

With Current Customer numbers also registering a decline and an uplift registered in Former Customer numbers in the same time period, all the signs are unfortunately indicating potentially tougher trading times for Almarai.

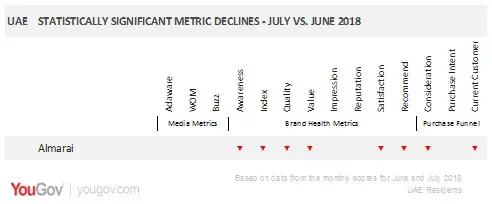

However the hard-hitting news for the brand doesn’t stop there. Despite the boycott and associated social media campaign occurring in Saudi Arabia, the negative perceptions of the brand have also spilled over to UAE residents, with Almarai’s Brand Health Index score declining by 7.1 points in the UAE in July (compared to June). In addition, a further 7 metric scores showed a statistically significant decline this month, impacting Consideration for the brand and also falling customer numbers.

The boycott campaign against Almarai comes hot on the heels of a similar boycott around price hikes suffered by Centrale Danone in Morocco. The impact of that boycott on Danone was significant with reported declines in revenue and market share by up to fifty percent. It remains to be seen if Almarai will suffer a similar drop in KSA or if the recent intervention by the ministry of commerce, which essentially forced the brand to revoke the price increase introduced in early July, stems off any lasting impact on the brand.

-Ends-

YouGov Spokesperson

Scott Booth

Head of Data Products- MENA

Media Enquiries:

Bhawna Singh

Mobile: +919769803043

About BrandIndex

BrandIndex is the authoritative measure of brand perception. Unlike any other brand intelligence service, it continuously measures public perception of thousands of brands across dozens of sectors.

We interview thousands of consumers every day, yielding over 2.5 million interviews a year. BrandIndex operates at national and international levels, allowing you to track brand perception in just one country, compare across multiple countries or monitor a global picture.

About YouGov

YouGov is an international data and analytics group. Our core offering of opinion data is derived from our highly participative panel of 5 million people worldwide. We combine this continuous stream of data with our deep research expertise and broad industry experience into a systematic research and marketing platform.

Our suite of syndicated, proprietary data products include YouGov BrandIndex, the daily brand perception tracker, and market-leading YouGov Omnibus which provides a fast and cost-effective service for obtaining answers to research questions from both national and selected samples.

With 31 offices in 21 countries and panel members in 38 countries, YouGov has one of the world’s top ten international market research networks. For further information visit www.mena.yougov.com

© Press Release 2018Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.