PHOTO

Middle Eastern stock markets were largely subdued on Tuesday, mirroring global stocks, as mounting concerns about a new strain of coronavirus in China dampened risk appetite.

The death toll from the coronavirus outbreak in China climbed to six On Tuesday as authorities reported a surge in new cases.

The National Health Commission (NHC) put the number of confirmed cases at 291 by the end of Monday, but further information from individual provinces on Tuesday showed a widening geographic spread.

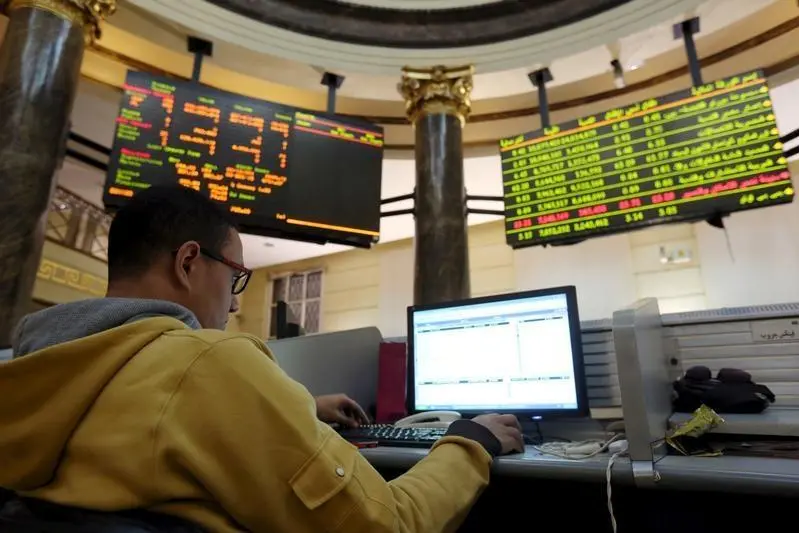

Egypt's blue-chip index fell for a second day, retreating 1%, with 25 of 30 stocks easing on the index.

The country's largest lender, Commercial International Bank, eased by 0.2% and tobacco monopoly Eastern Company lost 1.3%.

Exchange data showed Egyptian investors were net sellers of the stocks.

The Saudi benchmark index dropped 0.3%, with Al Rajhi Bank down 0.5% and Saudi Basic Industries retreating by 1%.

The International Monetary Fund trimmed its forecast for Saudi Arabia's economic growth to 1.9% this year because of oil output cuts agreed with oil exporters, having previously forecast gross domestic product growth of 2.2%.

Riyadh led an agreement last month that committed the OPEC+ group of oil producers to some of the deepest output cuts in a decade to avert oversupply and support prices.

Elsewhere, state-owned oil giant Saudi Aramcoslipped 0.1% to 34.6 riyals ($9.22).

The Abu Dhabi index .ADI lost 0.6%, driven down by a 1.4% fall in the country's largest lender, First Abu Dhabi Bank, and a 0.2% decrease in telecoms company Etisalat .

Qatar's index traded flat as Masraf Al Rayan gained 1.5% after posting a higher annual profit while Qatar Insurance declined by 1.2%.

The Dubai index edged up 0.1%, with its largest lender, Emirates NBD ENBD.DU , adding 0.4% and logistic company Aramex gaining 1.4%.

($1 = 3.7515 riyals)

(Reporting by Ateeq Shariff in Bengaluru Editing by David Goodman) ((AteeqUr.Shariff@thomsonreuters.com; +918067497129;))